Egypt Residential Property Market Analysis 2025

Egypt’s housing market remains on an upward trajectory, propelled by strong demand and reinforced by a series of significant economic reforms, most notably repeated currency devaluations and the recent easing of restrictions on foreign land ownership.

This extended overview from the Global Property Guide covers key aspects of Egypt's housing market and takes a closer look at its most recent developments and long-term trends.

Table of Contents

- Housing Market Snapshot

- Historic Perspective

- House Price Variations

- Demand Highlights

- Supply Highlights

- Rental Market

- Mortgage Market

- Socio-Economic Context

Housing Market Snapshot

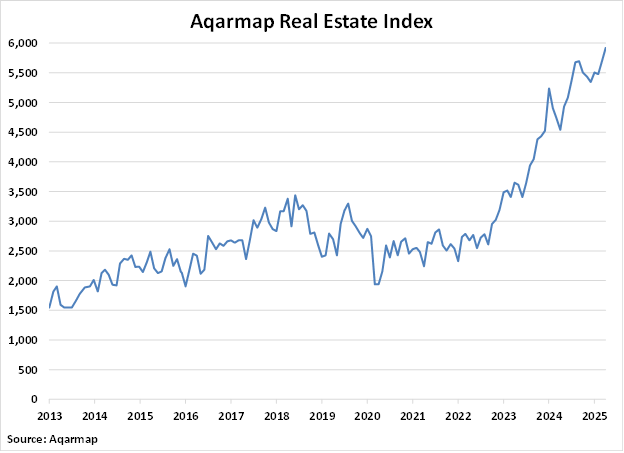

In April 2025, the nationwide real estate price index surged by 30.4% from a year earlier, higher than the year-on-year price growth of 24.4% recorded in the same period last year, based on figures from Egypt's leading real estate portal, Aqarmap. When adjusted for inflation, real estate prices rose by a more moderate 14.5% over the same period, amidst persistently high inflation.

In the three months to April 2025, real estate prices increased 7.5% (3% inflation-adjusted).

Real estate prices were up by 18.2% during 2024 (but down by 4.8% in real terms), following annual growth of 41.9% in 2023, 25.4% in 2022, and 3.6% in 2021 and a y-o-y decline of 9.6% in 2020.

Egypt's house price annual change:

Data Source: Aqarmap Real Estate Index.

The outlook for Egypt's housing market remains positive, underpinned by strong and sustained demand.

"The residential market is expected to remain resilient, driven by robust local and foreign demand and improving economic conditions," said JLL MENA. "That said, rising living costs have shifted preferences towards smaller, budget-friendly, finished units within mixed-use developments offering 'live-work-play' environments. Developers who adapt to these changing demands by phasing out larger master plans and replacing shell-and-core villas with fitted townhouses and apartments are likely to outperform. This flexibility in product offerings, coupled with amenity-rich developments and ample open spaces, will be key to success in Cairo's evolving residential landscape."

President Abdel Fattah el-Sisi recently removed the last restrictions on foreign ownership of land and property in Egypt, in an effort to buoy the housing market. He also allowed the government, the biggest landowner in Egypt, to use its land for public-private partnership schemes. These improvements, together with the fundamentally strong local demand, are now beginning to boost the housing market and the overall economy in general.

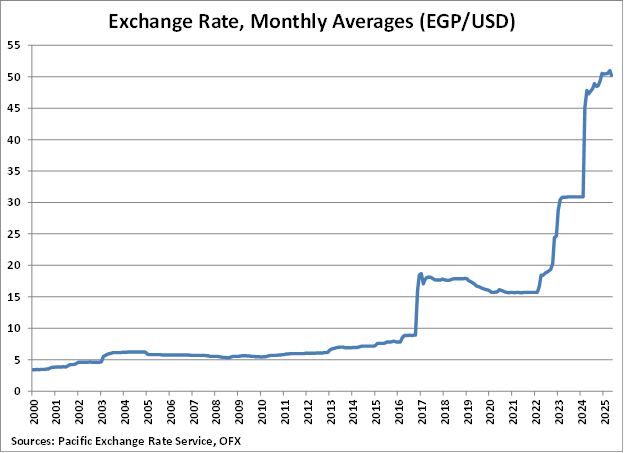

In November 2016, Egypt floated the Egyptian pound (EGP), causing a dramatic depreciation against major currencies, making real estate more attractive from the perspective of the wealthy Egyptians. If he lives abroad, Egyptian property is much less expensive because of the currency depreciation. In fact, in 2022, Egypt devalued its domestic currency twice, with a pledge to adopt a flexible exchange-rate policy, eventually helping the country clinch a US$3 billion loan from the International Monetary Fund (IMF).

In January 2023, the central bank devalued the domestic currency for the third time, resulting in a loss of approximately 40% of its value. Then, in early March 2024, the country devalued its domestic currency again by more than 38% to pave the way for billions more in loans from the IMF. As a result, the average exchange rate reached EGP50.23 per USD 1 in May 2025 - a more than 82% cumulative decline from its value of EGP 8.88 per USD 1 before the decision to float the currency in 2016.

There is a huge, real demand for housing in Egypt, as the country's population increases by 2.5 million annually, and there are about one million marriages taking place every year.

There is also increasing foreign demand in the country. Foreigners can buy property in Egypt under Law No. 230 of 1996. However, foreigners cannot buy more than two pieces of real estate, which cannot exceed 4,000 square meters (sq. m.), and their purpose must be for a family member to live in the property. If registered, the property cannot be sold or rented for five years.

In addition, the government implemented other reforms recently:

- A value-added tax (VAT) was introduced.

- Egypt's Investment Law was amended to attract more foreign investors.

- Fuel and electricity subsidies have been continuously reduced since 2014, as part of the government's goal of reducing spending.

- The price of sugar was raised by 40%.

- The CBE has abolished a 'priority list' for imports.

- The time and day limits during which banks are allowed to execute foreign currency exchanges have been extended.

Other initiatives included the launch of several mega-projects to boost economic growth, including the expansion of the Suez Canal and the construction of a new capital city.

"The implementation of structural reforms, supported by the IMF program, and the shift to a durably flexible exchange rate regime are expected to relieve the pressure on external financing and accelerate reforms," said the European Bank for Reconstruction and Development (EBRD).

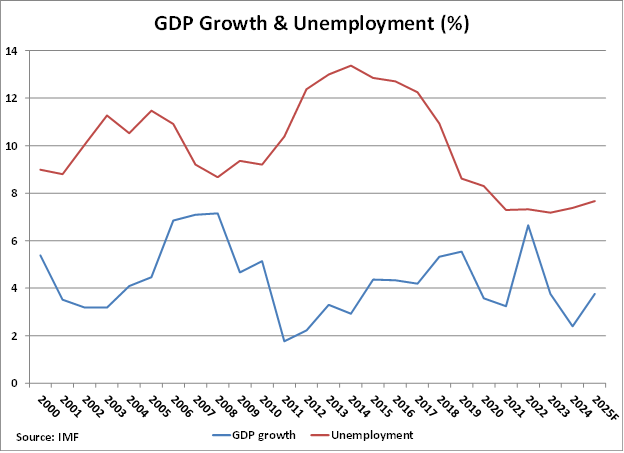

Egypt has successfully weathered the adverse impact of the Covid-19 pandemic, with its real GDP rising by 3.5% in 2020 and by another 3.3% in 2021. In fact, Egypt was the only nation in the MENA that avoided negative GDP growth during the onset of the pandemic. The economy expanded by a healthy 4.3%, on average, in the past decade, as various economic reforms have successfully buoyed business investment and private consumption in the country.

After growing by 6.7% in 2022, Egypt's economic growth moderated to 3.8% in 2023. Then in 2024, economic growth slowed further to 2.4%, due to disruptions from the Gaza conflict, a sharp drop in Suez Canal revenues, declining oil and gas output, and high inflation caused by currency depreciation and subsidy cuts. Austerity measures tied to IMF reforms also contributed to the slowdown.

Historic Perspective:

Egypt's housing cycle

Egypt has seen erratic house price movements in the past years, buffeted by economic and political events.

Property prices in Egypt rose by 13.7% (4.5% in real terms) in 2005 but fell by 0.4% (-4.4% in real terms) in 2006 and by another 0.6% (-10.4% in real terms) in 2007, according to the 2008 Egypt Housing Survey conducted by Bearing Point Inc, which had a cross-Egypt sample. House prices fell further in 2008, due to the global financial crisis. In fact, by end-2009, house prices in the secondary market had fallen by about 37%, in real terms, according to local real estate analysts.

Egypt's housing market recovered strongly in early 2010, mainly due to robust economic growth, rising by about 10% in 2010. For a long time, the housing market was stable in real terms, with the nationwide real estate price index rising by 9% (-3.5% in real terms) in 2013 and by another 11.4% (2.6% in real terms) in 2014, according to the Aqarmap Real Estate Index.

The housing market weakened again in 2015, with house prices falling by 4.7% (-14.2% in real terms), amidst political uncertainty and civil unrest. But the property market bounced back immediately, with house prices rising by 24.7% (1.2% in real terms) in 2016.

In 2017, house prices rose by 7.9% in nominal terms, but actually fell by 11.5% when adjusted for inflation. The wide difference between the nominal and real figures was mainly due to extraordinarily high inflation during the period, after the government floated the Egyptian pound (EGP) in November 2016, causing a dramatic depreciation against major currencies. Other economic reforms, such as the reduction of fuel subsidies, have also broadly impacted households' purchasing power in recent years, causing a temporary fall in real estate demand.

These have been compounded by the Covid-19 pandemic, with house prices falling by almost 10% during 2020 (-14.4% in real terms). With things slowly going back to normal, the Egyptian housing market is now showing huge improvements. House prices rose by a modest 3.6% (-2.2% in real terms) in 2021 before accelerating in 2022 by 25.4% (3.4% in real terms). In 2023, house prices surged by 41.9% (6.1% in real terms) from a year earlier.

During 2024, nominal house prices increased by 18.2% but actually declined by 4.8% when adjusted for inflation.

House Price Variations:

Local house price variations

Properties closer to central Cairo typically command higher prices per square meter. However, residential property prices in upscale gated communities and the New Administrative Capital are quickly closing the gap.

Leading the list of Egypt's priciest property locations are the New Administrative Capital, Dokki, El Sheikh Zayed, Zamalek, and New Cairo's Fifth Settlement areas, favored for their modern infrastructure, amenities, and premium lifestyle offerings.

In New Cairo, where the affluent district of Fifth Settlement is located, the average price of apartments rose by 14.4% y-o-y to EGP23,800 (US$479) per sqm in June 2025 while villa prices fell by a modest 4.9% to an average of EGP21,450 (US$432) per sqm, based on figures from Aqarmap.

On the 6th of October, in one of the largest industrial zones in Egypt, apartment prices rose strongly by 29.6% y-o-y to an average of EGP19,250 (US$387) per sqm in June 2025, while villa prices were up slightly by 2% to EGP23,050 (US$464) per sqm.

In Nasr City, Cairo's biggest neighborhood, the average apartment price surged by 52.3% to EGP21,100 (US$425) per sqm in June 2025 from a year earlier, while the average villa price was also up by a huge 58.5% to EGP21,950 (US$442) per sqm.

In El Maadi, a posh suburban district south of Cairo, the average apartment price increased nearly 34% y-o-y to EGP21,950 (US$442) per sqm in June 2025, while villa prices rose slightly by 0.9% y-o-y to EGP21,400 (US$431) per sqm.

In El Sheikh Zayed City, an upscale integrated city known for its quietness, green areas, and moderate temperatures, apartment prices increased strongly by 19.4% y-o-y to an average of EGP24,900 (US$501) per sqm in June 2025 and villa prices rose by 11.2% to EGP24,400 (US$491) per sqm.

In El Zamalek, an affluent district of western Cairo surrounding the northern portion of Gezira Island in the Nile River, the average apartment price stood at EGP24,100 (US$485) per sqm in June 2025, down slightly by 2.8% from a year earlier, according to Aqarmap.

| AVERAGE RESIDENTIAL PROPERTY PRICES IN GREATER CAIRO (IN SQM), JUNE 2025 | ||||

| Apartments | Villas | |||

| EGP | USD | EGP | USD | |

| New Cairo - 5th Settlement | 23,800 | 479 | 21,450 | 432 |

| 6th of October | 19,250 | 387 | 23,050 | 464 |

| El Sheikh Zayed | 24,900 | 501 | 24,400 | 491 |

| Heliopolis - Masr El Gedida | 20,850 | 420 | 21,000 | 423 |

| Nasr City | 21,100 | 425 | 21,950 | 442 |

| El Maadi | 21,950 | 442 | 21,400 | 431 |

| El Oubour | 18,600 | 374 | 20,450 | 411 |

| Faisal | 9,550 | 192 | 11,400 | 229 |

| El Zamalek | 24,100 | 485 | - | - |

| El Mohandeseen | 23,050 | 464 | 26,850 | 540 |

| Dokki | 25,600 | 515 | 25,300 | 509 |

| El Haram | 10,000 | 201 | 12,750 | 257 |

| Giza | 8,750 | 176 | 12,950 | 261 |

| Mokattam | 17,250 | 347 | 17,600 | 354 |

| Helwan | 9,150 | 184 | 12,000 | 241 |

| Ain Shams | 9,150 | 184 | 22,950 | 462 |

| Badr | 9,450 | 190 | 18,750 | 377 |

| Garden City | 21,350 | 430 | - | - |

| Downtown - West El Bald | 15,100 | 304 | - | - |

| El Zaytun | 14,200 | 286 | 23,150 | 466 |

| Hadayek El Koba | 13,200 | 266 | - | - |

| Hadayek El Ahram | 15,300 | 308 | 17,000 | 342 |

| Shoubra | 14,150 | 285 | - | - |

| Imbaba | 9,300 | 187 | - | - |

| El Agouza | 19,600 | 394 | - | - |

| Manial | 23,350 | 470 | - | - |

| El Abbasiya | 16,100 | 324 | - | - |

| 15th of May | 10,800 | 217 | 23,900 | 481 |

| El Nozha | 15,150 | 305 | - | - |

| El Sayyeda Zeinab | 11,100 | 223 | - | - |

| El Khalifah | 7,250 | 146 | - | - |

| El Omraneya | 8,350 | 168 | - | - |

| New Heliopolis | 16,450 | 331 | 20,800 | 419 |

| New Administrative Capital | 27,600 | 555 | 23,850 | 480 |

| El Shorouk City | 18,400 | 370 | 23,100 | 465 |

| Sources: Aqarmap, Global Property Guide | ||||

There are also numerous investment locations outside Greater Cairo.

On the North Coast, which covers entirely the northern territory of Egypt along the Mediterranean Sea, the average price of apartments was EGP26,100 (US$525) per sqm in June 2025, down slightly by 1.1% from a year earlier. In contrast, the average villa price increased by 15.8% y-o-y to EGP20,200 (US$406) per sqm over the same period.

Alexandria, one of Egypt's largest cities, a principal seaport, and a major industrial hub, offers a wide range of residential properties. Currently, the average apartment price is EGP7,300 (US$147) per sqm, down by 16.1% from a year ago. On the other hand, villas have an average price of EGP13,850 (US$279) per sqm, an increase of 16.4% from the prior year. Alexandria is best known for the Lighthouse of Alexandria (Pharos), one of the Seven Wonders of the Ancient World.

In Ain El Sokhna, a seaside city lying on the western shore of the Red Sea's Gulf of Suez, the average apartment price rose by 2.4% y-o-y to EGP21,700 (US$437) per sqm in June 2025, while villa prices were up by 8.8% to EGP19,850 (US$399) per sqm.

Demand Highlights:

The ambitious 'New Administrative Capital'

The Cairo metropolitan area is now nearing 20 million people, making it one of the most congested cities in the world. In fact, traffic costs amounted to about 4% of Egypt's entire GDP, according to World Bank estimates.

To address these problems, the Egyptian government has been building a new administrative and financial capital since 2015. Originally dubbed "Cairo Capital" and "global city for Egypt's future", the New Administrative Capital will address crowding, pollution, and rising house prices in Cairo. The city will be developed in phases over 40 years, according to the then-housing minister, Mostapha Madbouly.

The new capital, which is located about 40 km east of Cairo, is being built on 69,000 hectares - about two times the size of Cairo.

The new capital could house up to 7 million people, with the initial plans including 21 residential districts housing 1.1 million residential units, 40,000 hotel rooms, 663 healthcare facilities, 1.8 million sq. m. of residential space, and 1,250 mosques and churches. The plan also includes a new presidential palace, a new parliament building, new buildings for various government administrations, and an area dedicated to foreign embassies.

Phase 1 has an estimated cost of about US$45 billion.

Plans for Phase II were initially slated to begin in 2024, but the planned expansion of an additional 40,000 feddans has been postponed to 2026.

Over 30 skyscrapers are currently under construction, including the Iconic Tower, which is poised to become the tallest skyscraper in both Egypt and Africa.

Misr Stadium, the largest in the region, is now operational, with the stadium having opened in early 2024.

The new capital city is envisioned as a "Smart City" which will "take advantage of the sustainable technologies of today as well as be adaptable to future technologies," according to Cairo Capital's website.

Since 2023, various ministries and government entities have been relocated to the new capital city.

On April 2, 2024, President Abdel Fattah al-Sisi was sworn in for a third consecutive term, marking the official inauguration of the New Administrative Capital as Egypt's new seat of government.

Currently, however, residential property prices in the New Administrative Capital have risen to levels that are out of reach for mid-level employees with an annual average income of just US$4,800. As such, most employees opted to commute from Cairo using the Light Rail Transit system or other nearby cities.

Investment hotspots

Buying opportunities in Egypt - and particularly the newly built opportunities - can be conceptually divided into three areas: Cairo, the Red Sea, and the Mediterranean Coast.

Emaar's Uptown Cairo

Constructed by the developer EmaarMisr, the EGP 12 billion (US$241.4 million) Uptown Cairo offers several residential villages, a golf course, malls, sports, and leisure facilities, as well as a business park. This is the first wholly foreign-owned developer to enter the Egyptian market.

In June 2025, apartment prices plummeted by 35.8% y-o-y to an average of EGP17,100 (US$344) per sqm, based on figures from Aqarmap. In contrast, villa prices nearly tripled y-o-y in June 2025, to reach an average of EGP22,500 (US$453) per sqm.

Katameya Heights

The super-luxurious Katameya Heights launched prior to Uptown Cairo, covering an area of about 1.5 million sqm. Katameya Heights, introduced in 1997, was purely local. Formerly a stretch of desert, Katameya Heights is now a large suburban area with large houses and has attracted enormous interest. The resort offers a marvelous clubhouse, a beautifully designed golf course, and luxurious villas.

In June 2025, the average apartment price in Katameya Heights stood at EGP22,800 (US$459) per sqm, up by 9.4% from a year earlier, according to Aqarmap. Likewise, villa prices also increased by a huge 58.6% y-o-y to an average of EGP24,350 (US$490) per sqm over the same period.

Rehab City

Rehab City, a real estate development located in New Cairo, is being developed by Talaat Moustafa Group (TMG). The development is located on the Cairo-Suez road. It offers many shopping malls and a cinema complex. Rehab City is preferred by many upper-middle-class locals.

In June 2025, the average apartment price plunged by 42% y-o-y to EGP15,650 (US$315) per sqm, while the average villa price was down by 13.3% y-o-y to EGP24,050 (US$484) per sqm, based on figures from Aqarmap.

Madinaty

With a total budget of EGP 60 billion (US$1.21 billion), Madinaty is considered one of the biggest and most expensive real estate developments in New Cairo. Developed by Talaat Moustafa Group (TMG), it includes 80,000 residential villas, townhouses, and apartments. There are also recreational and commercial areas, schools, medical facilities, and hotels. Madinaty is adjacent to El Shrouq City.

Construction began in July 2006 and stopped for 7 years while the developer was in prison, accused of murdering his mistress.

In June 2025, the average apartment price dropped 17.3% y-o-y to EGP22,250 (US$448) per sqm while the average villa price surged by 32.1% y-o-y to EGP21,000 (US$423) per sqm, according to figures from Aqarmap.

New Cairo City

Emaar Misr is also building a 5,000-home 3.8 m sq. m. project in New Cairo City. The development is considered a new extension to Cairo, the capital. New Cairo City, when completed, is expected to feature several villages offering gated villas, townhouses, and high-rise apartments.

Mivida is an EGP6 billion (US$120.7 million) flagship residential development project by Emaar Misr located in the fifth district of New Cairo City. The 3.8 million sqm development features 5,000 apartments, townhouses, and villas. In June 2025, apartment prices fell by 5% y-o-y to an average of EGP16,950 (US$341) per sqm. In contrast, villa prices were up by 20.4% y-o-y to an average of EGP18,600 (US$374) per sqm over the same period.

Hurghada

Hurghada is the most popular seaside resort in Egypt, though it is overcrowded and now slightly seedy. Hurghada has an international airport with direct flights to major European countries, as well as flights to Cairo. The city is divided into three parts: Downtown (the old part), Sekalla (the city center), and El Memsha (the modern part).

In June 2025, apartment prices averaged EGP24,550 (US$494) per sqm, down by 2.4% from a year earlier. In contrast, villa prices rose by 10.8% y-o-y to an average of EGP14,900 (US$300) per sqm.

Sharm el-Sheikh

Sharm el-Sheikh is now the country's most luxurious and attractive resort, newer and more upscale than Hurghada, and is host to 5-star hotels and international conferences. Sharm has a vibrant nightlife and boasts many nightclubs, the longest continuous bar in the Middle East, and a marina that can handle private yachts and sailboats. Zoning laws limit building heights, which have prevented the surroundings' natural beauty from being spoiled by high rises.

Sharm's development has been led by tourism, though hotels such as the Ritz-Carlton have sold private villas. New residential developments tend to follow this hotel-based pattern, such as the Sierra Resort Nabq Bay, the Laguna Vista Residence in Nabq Bay, the Carlton Resort, and Hadava. Fully residential is Montazah in Ras Nasranr.

Though residential property prices have been falling recently. In June 2025, the average apartment price in Sharm el Sheikh fell by 8% y-o-y to EGP23,650 (US$476) per sqm while villa prices plummeted by 53.8% to an average of EGP6,750 (US$136) per sqm.

Gamsha Bay

In Gamsha Bay, 60 kilometers north of Hurghada, a 320 million sq. m. tourism and housing project is being developed by Damac, which developed the Dubai Towers and will be completed over 10 years. The development has a total budget of EGP2.9 billion (US$58.4 million).

Sahl Hasheesh

Eighteen kilometers south of Hurghada lies Sahl Hasheesh Bay, where a purpose-built resort flanking 12.5 kilometers of sandy beach was built. Covering 32 million square metres by the time it was completed in 2014. Sahl Hasheesh has 20 5-star hotels and 8 golf courses. The Egyptian Resorts Company (ERC) owns exclusive development rights.

Port Ghalib

Much further south, near Marsah Alam, two and a half hours from Luxor, the Port Ghalib project is being developed by the Al Kharafi Group of Kuwait along 18 kilometers of shoreline. It opened in November 2007. Marsah Alam has a newly-built international airport, an international convention center, a man-made lagoon, and a multiplicity of sports facilities. The Port Ghalib marina is now classed as an official new Port of Entry to Egypt.

3. Mediterranean Coast

Marassi

The Marassi resort, which costs around EGP9.92 billion (US$200 million), is being developed by Emaar. It is located on a 7-km coastline at Sidi Abdel Rahman on the Mediterranean near El Alamein. Marassi Resort will offer up to 3,000 hotel rooms, luxury villas, chalets, a marina, an 18-hole golf course, and healthcare facilities. Currently, a three-bedroom chalet in Marassi costs around EGP7 million (US$140,800) to EGP35 million (US$704,200), based on Property Finder listings.

Almaza Bay

Travco, the main German tour, launched Almaza Bayat Marsa Matruh in 2014, located on the Mediterranean between Alexandria and Libya. The Almaza Bay Resort has a total area of 5 million sqm and boasts about 2.5 km of flawless beachfront in one of the most pristine beaches in the world. According to Travco's official website, Almaza Bay features almost 2,000 residential units, an active marina, a retail urban center, food & beverage and outdoor dining, a sporting club, and several open space activities.

Apartment prices in Almaza Bay start from EGP2.9 million (US$58,350) and can reach up to EGP4.3 million (US$86,500). On the other hand, townhouses and villas are sold from EGP7 million (US$140,800) to EGP10 million (US$201,200). Units that are located directly at the beach are priced as high as EGP40 million (US$804,800).

The three major developments in Almaza Bay include the Jaz Almaza Beach Resort, Jaz Crystal Resort, and Jaz Oriental Resort.

Supply Highlights:

Residential construction activity continues to increase

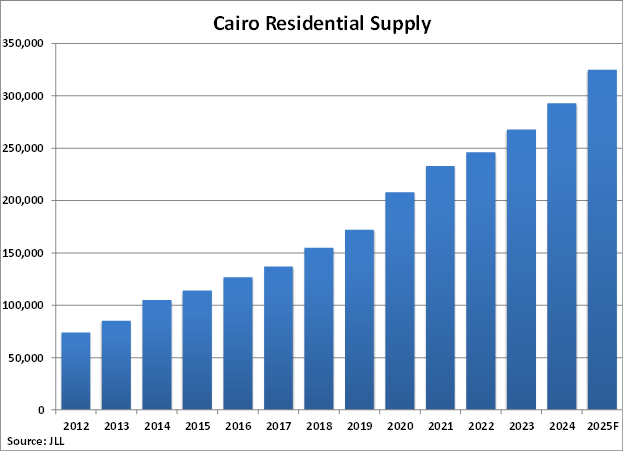

In 2024, about 24,000 new residential units were completed in Cairo, up from 23,000 units in 2023 and 18,000 units two years ago, according to JLL, amidst continued strong demand despite high residential prices. This brought the total stock in Cairo to about 293,000 units by end-2024.

"Despite the economic turbulence and policy tightening, Egypt's real estate market is on an upward trajectory. The reduction in inflationary pressures, coupled with rising foreign investment and improved stability of the Egyptian pound, is reigniting investor interest," said Aymsan Sami, Country Head of JLL Egypt.

Residential construction is expected to continue to strengthen this year. For the full year of 2025, more than 32,000 additional units are scheduled for completion in the capital city, according to JLL.

"Egypt's construction market has shown remarkable resilience amid global challenges. While geopolitical tensions and economic uncertainties have impacted the sector, national projects and growing foreign investments are creating significant opportunities for developers. Strategic partnerships and innovative solutions will be essential to overcoming challenges such as rising material costs and supply chain disruptions," stated Ahmed Hemmat, Head of Projects and Development Services for JLL in Egypt.

However, investments in the lower segments of the market remain weak. The country's major developers tend to cater exclusively to the upper middle and upper classes due to the absence of efficient mortgage law.

Approximately 50% of the population is classified as lower income, and around 37% of urban space in Egypt consists of informal settlements, while "unsafe slums" are roughly 1% of urban areas, according to Sherif El-Gohary of the Ministry of Urban Renewal and Informal Settlements.

Affordability remains a big issue for the poor

With a population of about 107.3 million in 2024, Egypt needs around 175,000 to 200,000 additional housing units each year and has a housing shortage of about 3 million. While there are approximately 5.6 million vacant units nationwide, most of these are beyond the means of the low and middle-income classes.

In response, President El-Sisi spearheaded the construction of one million housing units for low-income youth. The US$40 billion project was a collaboration with Arabtec Holding, a UAE company. Called "For the Youth", the project planned to house low-income people in 13 cities across the country. However, after the project broke down, Egypt pursued its own housing program with local banks and the World Bank, providing homes to 241,517 families. The government also launched the Long Live Egypt Fund, a charitable fund to serve the poor and young Egyptians in housing and health. However, they are still inadequate to solve the country's housing shortage and affordability problem.

About 44.4% of Egypt's housing stock is occupied by owners, while about 35.7% of the housing stock is rented. Other tenure types are gifts, in-kind privileges (14.1%), and public housing (5.5%).

Low-income housing, usually priced around US$14,000 per unit, remains unaffordable, and most developers do not supply houses to this income group.

The price of the cheapest social housing units has risen, on average, by about 15% to 20% annually over the past decade, while average incomes only increased by 1% per year over the same period.

Rental Market:

The rental market remains resilient, with surging rents

Rents for high-end residential properties in Cairo, which are sometimes paid in US dollars, continue to rise rapidly, supported by strong demand.

In the 6th of October district, apartment rentals soared by a whopping 90.2% y-o-y in Q1 2025, following annual growth of more than 100% in 2024, 25% in 2023, 9% in 2022, 2% in 2021, and 8% in 2020, according to JLL MENA. In New Cairo, rentals for apartments also skyrocketed by 88.2% in Q1 2025 from a year earlier, after increases of 108% in 2024, 30% in 2023, 3% in 2022, 1% in 2021, and 5% in 2020.

"An emerging trend reveals prospective home buyers opting to rent in upscale neighbourhoods, in order to elevate their living standards, where such areas are often beyond their purchasing power," said the JLL report.

"This shift is incentivising property owners to lease rather than dispose of their residential units. Consequently, the rental market has gained appeal for both tenants pursuing better living standards and landlords aiming to maximise returns on their real estate investments," added the JLL report.

Expats looking for apartments prefer direct methods rather than using realtors. One of the most popular methods is going to the American University in Cairo to look for apartment ads. Another one is going directly to the residential building of choice and asking the bawab or doorman for vacancies.

Good rental yields

The average gross rental yield in Egypt stands at 6.77% in Q2 2025, higher than the 5.52% recorded in Q1 2024, according to the Global Property Guide.

In major areas:

- In Cairo, the gross rental yield is currently at par with the national average, at 6.77%. Though there are wide variations within the capital city. The average rental yield of two-bedroom apartments in New Cairo is at 7.06%; in the 6th of October, at 5.33%; in Mohandessin, at 13.33%; in Sheikh Zayed, at 5.5%; and, in Heliopolis-Masr El Gedida, at 4.93%.

- In Alexandria, apartments offer gross rental yields ranging from 3.8% to 6.7%, with a city average of 5.06%.

- In Hurghada, gross rental yields for apartments range from 5.86% to 8.08%, with a city average of 7.29%.

Mortgage Market:

Key interest rates slashed further, as inflation remains manageable

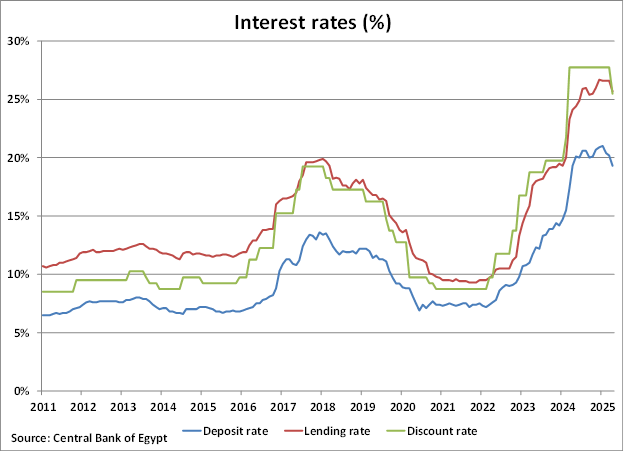

In May 2025, the Monetary Policy Committee of the Central Bank of Egypt (CBE) decided to implement a 100 basis point reduction in its key interest rates. The overnight deposit rate has been lowered to 24%, the overnight lending rate to 25%, and the rate of the main operation to 24.5%. Additionally, the discount rate has been cut by 100 basis points to 24.5%.

"Domestically, the CBE nowcast for Q1 2025 suggests a sustained recovery in economic activity, with real GDP growth projected at around 5.0 percent compared to 4.3 percent in Q4 2024. Output gap estimates indicate that real GDP remains below potential, despite a continued increase in economic activity, indicating that demand-side inflationary pressures will remain subdued. This aligns with the expected disinflation path in the short term, and is supported by the current monetary stance," said the central bank in its MPC Press Release in May 2025.

"Regarding annual inflation, it decelerated significantly in Q1 2025 due to muted inflationary pressures, monetary tightening, favorable base effects, and the fading impact of previous shocks," added the central bank.

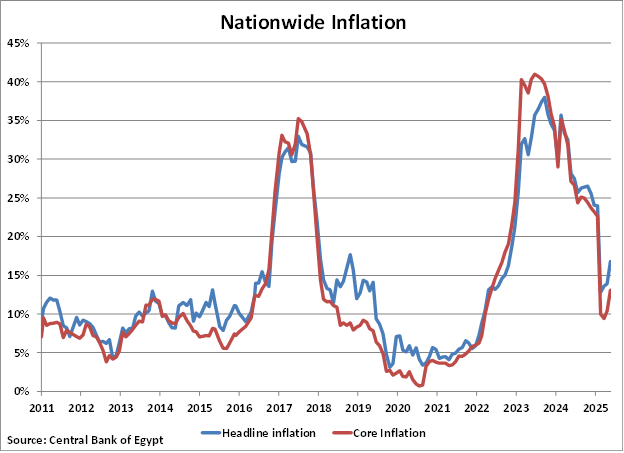

In May 2025, the country's headline inflation was 16.8%, sharply down from 28.15% in the previous year, based on figures from CAPMAS. Likewise, core inflation also declined to 13.1% in May 2025, from 27.13% seen in the preceding year. Despite the sharp deceleration in recent months, inflation remains far above the central bank's target of 7% with a two-percentage-point tolerance band.

The government's finance program boosts mortgage market growth

The Egyptian mortgage market dates back to 2001 when Presidential Decree No. 277 created the Mortgage Finance Authority (MFA). But currently, Egypt's mortgage market is equivalent to less than 1% of the country's GDP, according to Mona El-Baradei of the Egyptian Banking Institute.

However, the mortgage market is now expected to grow rapidly due to government initiatives. The number of mortgage finance companies (MPC) operating in Egypt increased from only 2 in 2005 to 27 recently. These include Sakan, Al-Qula, EHFC, Egyptian Housing Finance Co., EMRC, Amlak, Al-Tayasor, Tamweel, Tamweel Emirates, Naeem, Al-Ahly, Arab African International, Al-Ahly United, and El Masreyin, according to the Egyptian Financial Supervisory Authority (EFSA).

To address the housing shortage, the Central Bank of Egypt (CBE) launched a mortgage finance program in 2014 to finance low-income housing projects, allocating EGP 20 billion (US$402.4 million) to banks in the form of deposits to benefit low-income citizens.

In February 2016, the program was expanded to increase the number of beneficiaries and to add a new segment of low-income citizens at a lower interest rate of 5%. In addition, above-middle-income citizens were also included at an interest rate of 10.5%.

Earlier in 2016, the CBE allocated EGP500 million (US$10.1 million) to mortgage companies for the first tranche of the program. Moreover, 14 banks provided EGP 5 billion (US$100.6 million) to finance 62,000 housing units as part of the program, according to Mai Abdel Hamid, the head of the Mortgage Finance Fund.

In March 2020, the World Bank approved a loan for Egypt's Mortgage Finance Fund worth US$500 million to finance the country's social housing programs.

To help struggling borrowers during the onset of the Covid-19 pandemic, the government temporarily reduced interest rates from its mortgage finance program and ordered MPCs to provide a six-month grace period to any client on request.

Then in 2021, President Abdel Fattah al-Sisi directed the CBE to launch a new mortgage funding program for low- and middle-income individuals with long-term loans of up to 30 years and with low and simplified interest rates not exceeding 3%.

As of April 2025, the total funds disbursed reached around EGP84.64 billion (US$1.7 billion), benefiting 630,015 low-income individuals. Of which, the contribution of 22 banks that participated in the government's mortgage finance program for low-income housing amounted to EGP82.13 billion (US$1.65 billion) for 610,201 customers - a contribution of about 97% of the entire initiative, according to the Social Housing and Mortgage Finance Fund.

The 10 banks with the biggest contribution by April 2025 included:

- National Bank of Egypt (NBE): EGP20.4 billion (US$410.4 million) equivalent to 24.1% share, benefitting 159,522 individuals

- Banque Misr: EGP19.39 billion (US$390.1 million) equivalent to 22.9% share, benefitting 146,347 customers

- Banque du Caire: EGP9.12 billion (US$183.6 million), representing about 10.8% share, benefitting 61,094 individuals

- Housing and Development Bank (HDB): EGP 7.92 billion (US$159.4 million) or 9.4% share, benefitting 76,081 customers

- QNB Alahli: EGP5.8 billion (US$116.7 million) for 32,665 customers, accounting for about 6.9% share

- Commercial International Bank (CIB): EGP5 billion (US$100.7 million) for 30,606 clients, capturing around 5.9% market share

- United Bank: EGP2.19 billion (US$44 million) equivalent to 2.6% share, benefitting 15,236 individuals

- Industrial Development Bank: EGP2.03 billion (US$40.8 million) equivalent to 2.4% share, benefitting 17,929 individuals

- Bank NXT: EGP1.79 billion (US$35.9 million) for 10,269 clients, capturing 2.1% market share

- Arab African International Bank: EGP1.41 billion (US$28.4 million) provided to 11,056 clients, representing 1.7% market share

Socio-Economic Context:

The Sisi regime and army rule

Previous President Mohammed Morsi succeeded Hosni Mubarak in June 2012 but was ousted by a military coup on July 3, 2013. Current president Abdel Fattah al-Sisi, the ex-general who led the coup, has launched a crackdown on Muslim Brotherhood supporters and cemented army rule.

Among the thousands of Muslim Brotherhood sympathizers in jail are dozens, if not hundreds, of secular activists jailed for their political activities. Meanwhile, a growing number of liberals have left the country to go abroad, since no opposition is allowed, and any opposition, even a humorous comment, can result in immediate arrest and long prison terms. Authorities have also ordered travel bans and asset freezes against prominent human rights organizations.

Under the Sisi regime, the commercial reach of the military has greatly expanded. The army is all over the place. More than 50 hotels are run by the army, their profits never declared; new petrol station licenses go exclusively to Wataneya, an army-controlled company, with soldiers manning the petrol pumps; pasta is sold by Macarona Queen, an army company; a cement complex in the city of Beni Suef, considered the largest in the Middle East, is owned by El-Areesh Cement Co for Cement, which is controlled by the armed forces; mineral water is sold by Safi, an army-controlled company; all the major toll roads are run by the military; an army department called the Engineering Department of the Armed Forces buys houses and lands for commercial purposes, again wholly exempt from any audit or taxation.

All these companies are run by military men, in military uniform, with conscript soldiers often doing the menial work. Unsurprisingly, some claim that the military's commercial reach expanded rapidly in recent years, now constituting around 20% to 25% of GDP.

Military-controlled projects are mostly built by the Engineering Department of the Armed Forces - building civil and military infrastructure, bridges, schools, tourist projects, the development of all sports activities, plus low-income housing projects, and urbanistic projects.

The army is happy to sell land to foreign companies, such as the French supermarket chain Carrefour. However, foreign enterprises become involved at their own risk, always open to the likelihood of being squeezed into a situation where the army makes the law.

In May 2017, Sisi approved a new law that aims to regulate non-governmental organizations (NGOs) in Egypt. The law makes it impossible for NGOs to function independently, as it strictly controls the funding of NGOs and gives the government the authority to monitor and challenge their day-to-day activities.

Despite these abuses, the sycophantic press daily sings the praises of the regime.

In March 2018, Sisi won a second term against a sole minor opposition candidate. More serious challengers, including human rights lawyer Khalid Ali and former PM Ahmad Shafiq, withdrew from the race, and former armed forces chief of staff Sami Anan was arrested. Then, during the 2020 parliamentary elections, Egypt's Mostaqbal Watn Party, which is a strong supporter of Sisi, secured nearly 55% of the contested seats.

However, the Covid-19 pandemic exposed the chronic weaknesses of Egypt's underfunded public health system, which Sisi pledged to reform at the start of his presidency. Health budgets rose in recent years but remain far below Sisi's targeted spending of 3% of GDP. In fact, in 2019, the healthcare budget was just around 1.3% to 1.8% of GDP.

To fight the pandemic, the government increased its allocated spending for health care by 46% y-o-y to EGP 258 billion (US$ 5.2 billion) in its 2020/2021 budget. Then, in the 2021/2022 budget, the government allocated about EGP 109 billion (US$2.2 billion) to the health sector.

An ambitious new health insurance system is on the way, which promises to revolutionize public health care and make it accessible to the poor. Its implementation was initially expected to take up to 15 years, but Sisi has reduced this period to 10 years.

On April 2, 2024, Sisi was inaugurated for a third six-year term following his re-election in December 2023, where he secured 90% of the vote. Egypt's struggling economy and the war in Gaza were key electoral issues.

Egypt's economy growing modestly, labor market continues to improve

Egypt has successfully weathered the adverse impact of the Covid-19 pandemic, with its real GDP rising by 3.5% in 2020 and by another 3.3% in 2021. In fact, Egypt was the only nation in the MENA that avoided negative GDP growth during the onset of the pandemic. The economy expanded by a healthy 4.3%, on average, in the past decade, as various economic reforms have successfully buoyed business investment and private consumption in the country.

After growing by 6.7% in 2022, Egypt's economic growth moderated to 3.8% in 2023. Then in 2024, economic growth slowed further to 2.4%, due to disruptions from the Gaza conflict, a sharp drop in Suez Canal revenues, declining oil and gas output, and high inflation caused by currency depreciation and subsidy cuts. Austerity measures tied to IMF reforms also contributed to the slowdown.

The International Monetary Fund (IMF) projects Egypt's economy to grow by a modest 3.8% this year and by another 4.3% in 2026. This is in line with the World Bank's forecast, which projects Egypt's real GDP growth at 3.8% for the current fiscal year, with a further acceleration to 4.2% in the following year. Egypt's continued economic growth will be supported by an increase in private consumption and a boost in private sector investment, partly linked to a major investment agreement with the UAE.

Egypt's budget deficit stood at about 7.3% of GDP in 2024, from 7.1% of GDP in 2023, 6.1% in 2022, 7.2% in 2021, and 7% in 2020, according to the Ministry of Finance.

The Egyptian government has approved a budget amounting to EGP 4.6 trillion (US$91 billion) for FY2025- 26, an increase of 18% from the previous fiscal year. It expects revenues of around EGP 3.1 trillion (US$61.3 billion), up by 19% from the earlier fiscal year, with a projected deficit of EGP 1.5 trillion (US$29.7 billion).

Public debt is projected to fall to 82.9% of GDP compared to the current year's anticipated 92%.

The labour market continues to improve. In Q1 2025, the nationwide unemployment rate declined to 6.3%, from 6.4% in the previous quarter and 6.7% in the same period last year, according to CAPMAS. In fact, it was the country's lowest jobless rate recorded in recent history.

Egypt's unemployment rate averaged 10.1% from 2000 to 2024, according to the IMF.

In May 2025, the headline inflation was 16.8%, up from 13.9% in the previous month but sharply down from 28.15% in the previous year, based on figures from CAPMAS. Despite the sharp deceleration in recent months, inflation remains far above the central bank's target of 7% with a two-percentage-point tolerance band. Headline inflation had been extraordinarily high in the past three years, reaching a record high of 38% in September 2023, mainly due to a weaker Egyptian pound after a series of devaluations in recent years.

Core inflation stood at 13.1% in May 2025, up from 10.4% a month earlier but still far higher than the 27.13% seen in the preceding year.

Sources:

- Egypt Real Estate Demand Index (Aqarmap): https://index.aqarmap.com/

- Egypt's residential sector leads 2024 project awards, valued at $2.4bn: JLL (Daily News Egypt): https://www.dailynewsegypt.com/

- Cairo Market Dynamics, Q1 2025 (JLL MENA): https://www.jll-mena.com/

- Why Egypt's President Sisi is rushing to embrace the nation's youth (The Christian Science Monitor): https://www.csmonitor.com/

- Almaza Bay: New Phases at One of North Coast's Most Sophisticated Resorts (Property Finder): https://www.propertyfinder.eg/

- Monthly Interest Rates (Central Bank of Egypt): https://www.cbe.org.eg/

- Discount Rates (Central Bank of Egypt): https://www.cbe.org.eg/

- Egypt - Inclusive Housing Finance Program-for-Results - Additional Financing (World Bank): https://www.worldbank.org/

- Egypt: 22 banks offer $1.75bln in mortgage finance for low-income housing in February 2023 (Zawya): https://www.zawya.com/

- Banks inject EGP 82.1bn into low-income mortgage initiative until April 2025 (Daily News Egypt): https://www.dailynewsegypt.com/

- Mortgage finance in Egypt reaches USD 1.60 billion, benefiting 617,500 citizens (Global Business Outlook): https://globalbusinessoutlook.com/

- Gross rental yields in Egypt: Cairo and 2 other cities (Global Property Guide): https://www.globalpropertyguide.com/

- MPC decides to cut key policy rates by 100 basis points (Central Bank of Egypt): https://www.cbe.org.eg/

- So why is Egypt building a new capital city right next to Cairo? (City Monitor): https://www.citymonitor.ai/

- Egypt country profile (BBC News): https://www.bbc.com/

- Gov't spending on health hits EGP 572 billion in 8 years (State Information Service): https://sis.gov.eg/

- Egypt to implement healthcare system nationwide within 10 years: Finance minister (Ahram Online): https://english.ahram.org.eg/

- The road to Universal Health Coverage in Egypt: New expectations and hopes (International Health Policies): https://www.internationalhealthpolicies.org/

- IMF Executive Board Completes the Fourth Review of the Extended Fund Facility Arrangement for Egypt, Approves the Request for an Arrangement Under the Resilience and Sustainability Facility, and Concludes the 2025 Article IV Consultation (International Monetary Fund): https://www.imf.org/

- World Bank revises Egypt's economic forecast, expects modest recovery in coming 2 years (Egypt Today): https://www.egypttoday.com/

- World Bank raises forecast for Egypt's FY2024/25 GDP growth by 0.3% (Zawya): https://www.zawya.com/

- Egypt Government Budget (Trading Economics): https://tradingeconomics.com/

- Egypt Approves Budget for FY2025-26 Amidst IMF Pressure (Middle East Briefing): https://www.middleeastbriefing.com/.

- Egypt Unemployment Rate (Trading Economics): https://tradingeconomics.com/

- Inflation Rates Historical Data (Central Bank of Egypt): https://www.cbe.org.eg/