Philippines' Residential Property Market Analysis 2026

The Philippine housing market continues to struggle, constrained by weak demand, rising unsold inventory, and an economy slowed by corruption scandals and frequent typhoons.

This extended overview from the Global Property Guide provides a comprehensive review of the Philippine housing market, highlighting its key characteristics while offering deeper insight into recent developments, underlying market dynamics, and longer-term structural trends.

Table of Contents

- Housing Market Snapshot

- House Price Variations

- Historic Perspective

- Demand Highlights

- Supply Highlights

- Rental Market

- Mortgage Market

- Socio-Economic Context

Housing Market Snapshot

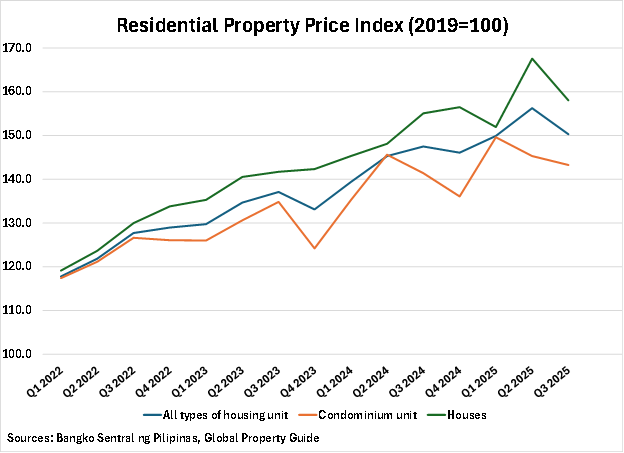

Nationwide, house price growth is decelerating rapidly. In the third quarter of 2025, the nationwide residential real estate price index increased by a miniscule 1.9% from a year earlier, according to figures released by the Bangko Sentral ng Pilipinas (BSP). This is a sharp slowdown from year-on-year price growth of 7.55% in Q2 2025, 7.56% in Q1 2025, 9.77% in Q4 2024, and 7.58% in Q3 2024.

When adjusted for inflation, nationwide residential property prices in Q3 2025 increased only marginally, rising by just 0.15% year-on-year.

Quarterly, the price index actually declined by 3.83% in Q3 2025 (-4.73% inflation-adjusted), in contrast to the quarter-on-quarter increases of 4.25% in Q2 and 2.61% in Q1

Philippines' house price annual change:

Note: Philippines'National House Price Index

Data Source: Bangko Sentral ng Pilipinas.

The residential real estate price index, published every quarter, is based on bank reports on residential real estate loans.

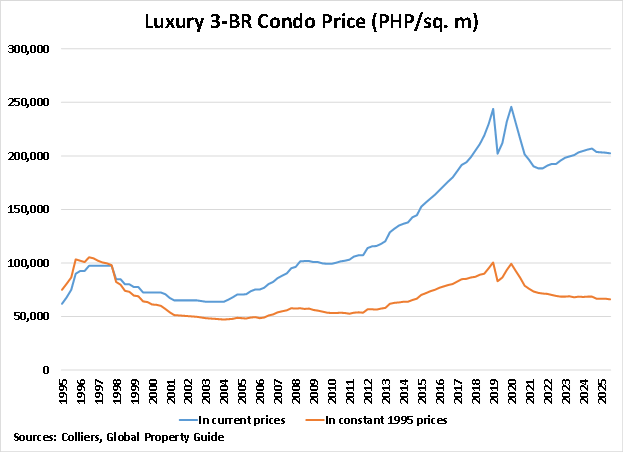

It is supported by a recent report from Colliers International, which showed that the average price of a luxury three-bedroom condominium unit in Metro Manila's central business districts (CBDs) fell by 2.04% to PHP202,590 (US$3,451) per square meter (sqm) in Q3 2025 from the same period last year. It is now the third consecutive quarter of year-on-year price falls and its worst showing since Q1 2022. In real terms, prices of luxury properties in the CBDs were down by 3.71% over the same period.

Quarter-on-quarter, house prices were down slightly by 0.21% in Q3 2025 (-1.14% inflation-adjusted).

The Philippines experienced a house price boom from 2010 to 2018, with house prices in CBDs rising by 125% (77% inflation-adjusted). But with a slowing domestic economy, coupled with the US-China trade war, the housing market slowed sharply in 2019, with house prices rising by a meager 0.9% and falling by 1% when adjusted for inflation. In 2020, the Covid-19 pandemic aggravated the situation, sending the housing market to its knees. Philippine house prices fell by 14.55% (inflation-adjusted) in the third quarter of 2020, and by the end of the year was ranked among the worst-performing housing markets in our Global Residential Real Estate Market Report 2020. Metro Manila CBD house prices plunged by 20.16% (inflation-adjusted).

The housing market started to recover in 2022, with prices increasing by 3.93%, but still declined by 3.82% in real terms due to high inflation. During 2023, prices in the CBDs were up by another 3.98% but remained more or less steady when adjusted for inflation.

However, Metro Manila CBD housing markets noticeably cooled again by the end of 2024, with prices edging up by a negligible 0.12% in nominal terms and falling by 2.7% in real terms.

The housing market is expected to remain subdued in the coming months, with house prices likely to experience minimal to modest declines.

"We project a marginal drop in average prices this year before rising in 2026. The recovery should partly be facilitated by improving take-up for affordable to mid-income condominium units," said the Colliers report.

The housing market's muted activity is largely underpinned by the broader economic slowdown, which continues to weigh on both demand and property prices.

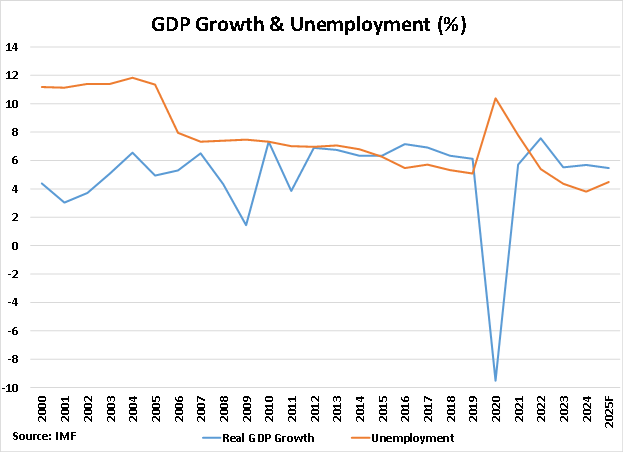

In the third quarter of 2025, the Philippines posted an economic growth of 4% from a year earlier, a slowdown from the 5.5% growth in the previous quarter and the 5.2% expansion in the same period last year. In fact, it was the country's weakest performance since Q1 2021, amid ongoing investigations into government infrastructure spending, particularly flood control projects. Additionally, a series of typhoons further weighed on economic activity.

On a quarterly basis, the economy grew by a meager 0.4% q-o-q in Q3 2025, easing from expansions of 1.5% in Q2 and 1% in Q1. This marked the weakest growth since the contraction in Q2 2020.

As such, the International Monetary Fund (IMF) recently downgraded its economic growth forecast for the Philippines to 5.1% for 2025, from 5.4% previously. Similarly, the World Bank has lowered its 2025 growth forecast for the Philippines to 5.1%, down from its previous estimate of 5.3%, citing sluggish domestic investment, falling business confidence amid a widening corruption scandal, declining foreign direct investment, and the economic impact of recent typhoons.

House Price Variations:

Sharp variations in prices across property types

Residential market trends show notable variation not only by property type but also across different locations, reflecting the diverse demand patterns, supply dynamics, and price movements within the housing sector.

Nationwide:

- For condominium units, prices were up by an average of 1.4% y-o-y in Q3 2025, a slowdown from the prior year's 4.8% growth. Quarter-on-quarter, condo prices in the country fell by 1.4% during the latest quarter.

- For houses, prices rose by 1.9% y-o-y in Q3 2025, a sharp deceleration from the strong growth of 9.4% recorded in Q3 2024. Quarterly, prices were down by 5.7% in Q3 2025.

In the National Capital Region:

- For condominium units, the average price rose by a meager 0.8% in Q3 2025 from a year earlier, following a 5.3% increase in Q3 2024. Quarterly, condo prices were down by 1.4% during the latest quarter.

- For houses, the average price increased by 5.8% in Q3 2025 from a year ago, following a y-o-y growth of 11% in the same period last year. Quarter-on-quarter, house prices were up by 1.1% in Q3 2025.

In areas outside the National Capital Region:

- For condominium units, the average price rose by a modest 3.2% in Q3 2025 from a year ago, following a y-o-y increase of 4% in Q3 2024. Quarter-on-quarter, prices fell slightly by 1.3% in Q3 2025.

- For houses, prices rose by a miniscule 1% y-o-y in Q3 2025, a sharp slowdown from the prior year's 9% growth. Quarterly, house prices were down by 7.1% during the latest quarter.

Historic Perspective:

Real house prices still lag pre-Asian Financial Crisis peaks

Surprisingly, despite so much price appreciation for a decade, the Philippine housing market has still not recovered from the crash after the 1997 Asian Financial Crisis. Between 1997 and 2004, luxury condominium prices dropped 28% (52% inflation-adjusted), in the biggest property crash of all countries affected by the Asian Financial Crisis.

In current price terms, both rental rates and property values are already far above 1997 levels. Yet in 2019, before the new coronavirus outbreak, residential property prices were still about 10% below pre-Asian Financial Crisis levels in real, inflation-adjusted terms.

Worse, the pandemic quickly offset most of the gains in recent years, causing real prices in Q3 2025 to fall back to about 37% below pre-Asian Crisis values.

Demand Highlights:

OFWs remain a key pillar of the housing market

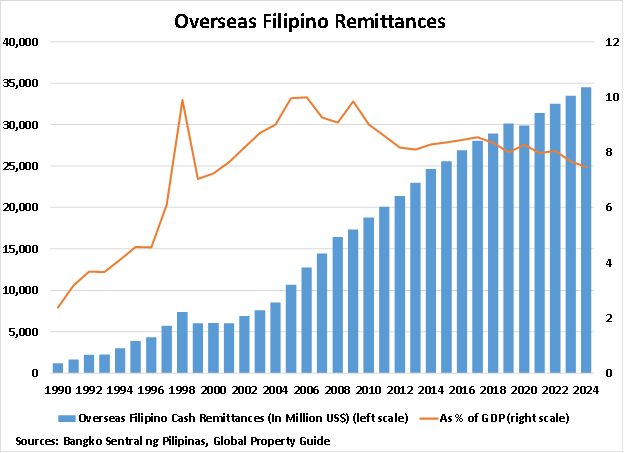

Overseas Filipino communities are consistently targeted by major developers such as Megaworld, DMCI, and Ayala Land, reflecting the strong and enduring role of Overseas Filipino Workers (OFWs) in the domestic housing market. The Philippines is one of the world's largest remittance recipients, with 10.8 million Philippine OFWs living and working in 210 countries and territories worldwide. About 47% of them are permanent migrants, 41% are temporary, and the rest are "irregular migrants".

The top destination countries of registered Filipino emigrants in the past decade included the United States, accounting for 46.78% of the total, followed by Canada (29.79%), Japan (5.45%), Australia (5.08%), Italy (3.05%), New Zealand (2.1%), the United Kingdom (1.34%), South Korea (1.14%), Spain (1.01%), and Germany (0.86%), according to the Commission on Filipino Overseas (CFO).

In 2024, total cash remittances amounted to US$34.49 billion, up by 3% from a year earlier, based on figures released by the BSP. It was equivalent to about 7.5% of GDP last year. Remittances have been rising continuously since 2002, with the exception in 2020 when remittances declined slightly by 0.8% y-o-y, mainly due to the adverse impact of the Covid-19 pandemic.

In the first ten months of 2025, cash remittances increased further by 3.2% to reach US$29.2 billion as compared to the same period last year.

Yet, the rate of growth has noticeably decelerated. From an average annual growth rate of more than 25% in 1990-98, remittance growth slowed to 9% annually in 1999-2008, and further to less than 5% in 2009-2024.

The World Bank believes the slowdown in remittances is due to:

- Stricter implementation of the migrant workers' bill of rights;

- Political uncertainties in host countries; and

- The slowdown in the advanced economies.

It is estimated that 60% of these remittances go directly or indirectly to the real estate sector, according to the World Bank. These OFW remittances power the low-end to mid-range residential property market, housing projects, and mid-scale subdivisions in regions near Metro Manila, such as Cavite, Batangas, and Laguna Provinces.

There are three identifiable segments in Manila's housing market:

- The high end: Local high-earners and expatriates occupy this segment.

- The middle tier: The mid-end condominium sector, with a monthly amortization of around PHP10,500 (US$179), currently requires a disposable income greater than PHP34,962 (US$596) to obtain a housing loan of PHP2 million (US$34,066). This segment has been targeted by many developers and is attractive to overseas foreign workers (OFWs).

- The low end: This is where the mass of the population lives.

We believe that the middle tier is over-supplied. Many of these lower-middle-class condominium developments have low take-up rates.

Supply Highlights:

Condominium supply continues to expand

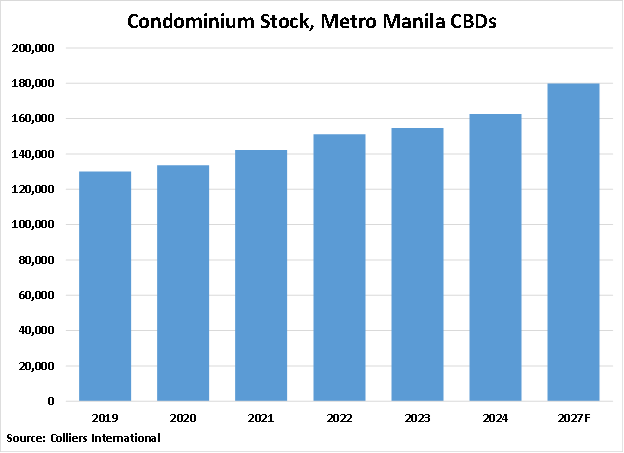

The total condominium stock in Metro Manila's CBDs rose by 5% to reach 162,510 units in 2024 from a year earlier, following annual increases of 2.3% in 2023, 6.3% in 2022, 6.5% in 2021, and 2.6% in 2020, based on figures published by Colliers International.

During 2024, completions in the CBDs totaled 7,810 units, which is equivalent to a strong growth of 120.6% from 3,540 completed units in the prior year. Among the projects completed by end-2024 included Filinvest Land's Belize Oasis in Alabang, Megaworld's Gentry Manor (4 towers), Jinxi Group's Jinxi Seaview City in the Bay Area, and Robinsons Land's Sapphire Bloc East in Ortigas Center, according to Colliers.

In Q3 2025, a total of 1,500 new condominium units were completed. Among the projects completed are Megaworld's Park McKinley West Tower 3 and Uptown Arts Residence in Fort Bonifacio, and Aseana's Midpark Towers in the Bay Area.

For the whole year of 2025, approximately 8,600 condominium units are expected to enter the Metro Manila CBD market, with the Bay Area accounting for more than half of the new supply.

"We anticipate the delivery of 8,600 units for FY 2025, with the Bay Area accounting for almost 60% of new supply," noted the Colliers report. "Colliers expects the Bay Area to be the largest residential hub in Metro Manila by end-2025, accounting for nearly 30% of the condominium stock in the capital region."

Completions averaged around 8,000 units in the past 15 years.

Colliers projects a slowdown in project completions beyond 2025, partly reflecting the more subdued pace of condominium launches in major Metro Manila CBDs over the past three to four years. From 2027 to 2029, average annual deliveries are expected to total around 2,000 units, sharply lower than the roughly 13,000 units delivered each year from 2017 to 2019, when developers accelerated completions to capitalize on strong demand from POGO-related tenants.

The Bay Area will account for about 34% of the expected completions in the next three years, followed by Ortigas Center (20.2%), Alabang (16.1%), Fort Bonifacio (15%), and Makati CBD (14.9%). Rockwell Center and Araneta will see no residential construction activity in the next three years.

Overall, Metro Manila's condominium stock is projected to reach around 179,820 units by end-2027, an increase of 10.7% from 2024.

| METRO MANILA RESIDENTIAL STOCK | |||||

| Location | 2022 | 2023 | 2024 | 2027F | % Change |

| Bay Area | 36,070 | 36,860 | 40,730 | 46,590 | 14.4 |

| Alabang | 5,390 | 5,660 | 6,220 | 9,010 | 44.9 |

| Fort Bonifacio | 41,740 | 42,550 | 43,840 | 46,440 | 5.9 |

| Rockwell Center | 5,830 | 5,830 | 5,880 | 5,880 | 0.0 |

| Ortigas Center | 19,200 | 19,830 | 21,860 | 25,350 | 16.0 |

| Makati CBD | 28,760 | 29,210 | 29,210 | 31,790 | 8.8 |

| Araneta City | 4,550 | 5,140 | 5,140 | 5,140 | 0.0 |

| Others | 9,630 | 9,630 | 9,630 | 9,630 | 0.0 |

| Total | 151,160 | 154,700 | 162,510 | 179,820 | 10.7 |

| Source: Colliers International | |||||

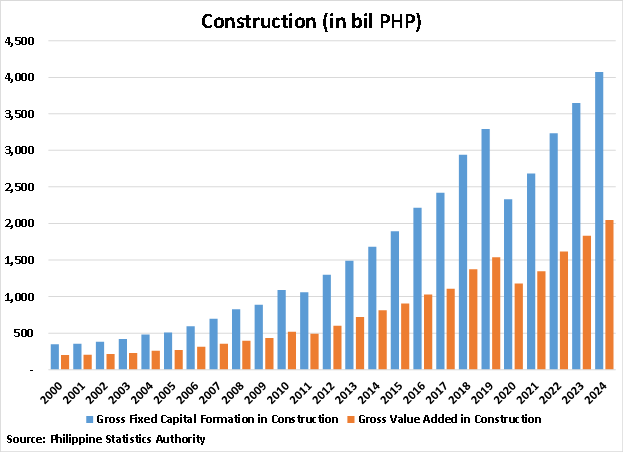

Residential construction activity strengthens

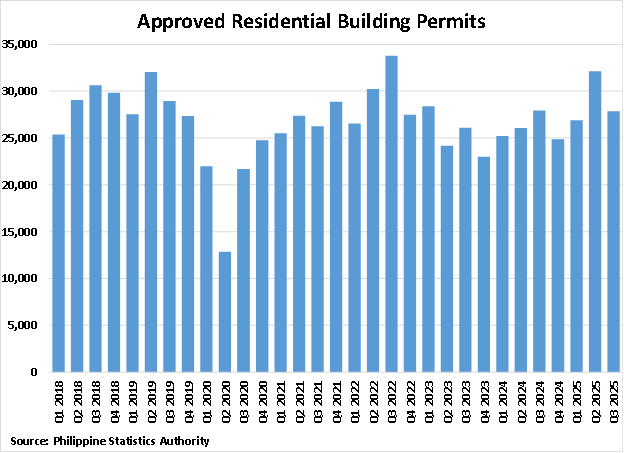

Residential construction activity is improving again, after slowing in 2023. During 2024, the total number of residential building permits issued increased by a modest 3.6% y-o-y to 116,427, following an annual decline of 7.2% in 2023, according to figures released by the Philippine Statistics Authority (PSA).

Similarly, the floor area of residential building permits was up by 8.9% y-o-y to 19.75 million square meters last year, in contrast to the annual contraction of 6% in 2023. Total value also rose strongly by 15.8% to PHP248.65 billion (US$4.24 billion) in 2024, a sharp acceleration from a meager growth of 1.9% in the preceding year.

The upward trend in the residential construction sector continues this year.

- The number of residential building permits rose by 9.7% to 86,919 in the first three quarters of 2025, compared to the previous year. This is far higher than the minuscule year-over-year growth of 0.7% registered in the same period last year.

- The floor area of residential building permits increased strongly by 18.1% y-o-y to 15.11 million sqm in the first three quarters of 2025 - an acceleration from the 2% growth seen in Q1-Q3 2024.

- The total value of residential building permits was up by a huge 18.5% to PHP189.76 billion (US$3.23 billion) in the first three quarters of 2025, as compared to the same period last year. This compares to a year-over-year growth of 12.9% in Q1-Q3 2024.

In September 2025, about 85% of residential constructions in the country were single-type houses.

The average construction cost for a residential unit was PHP15,562 (US$265) per sqm in September 2025. Residential condominium units registered the highest average cost at PHP24,100 (US$410) per sqm. It was followed by single houses, with an average cost of PHP15,060 (US$257) per sqm; apartments with PHP11,805 (US$201) per sqm; duplex/quadruplex with PHP11,269 (US$192) per sqm; and other residential types with PHP8,215 (US$140) per sqm.

New 4PH housing program aims to ease the affordable housing shortage

Nevertheless, the Philippines has a huge housing need at the low end. Nationwide, the country has a housing shortage of approximately 4 million units, according to the Subdivision and Housing Developers Association (SHDA). But other estimates put the housing backlog at a huge 6.5 million units.

Most of this would need to be socialized housing units with a selling price of under PHP450,000 (US$7,665). In Metro Manila, as many as 300,000 households reside in informal and semi-uninhabitable housing units, comprising 8.7% of Metro Manila's total population. These people live in appalling conditions. Many others live in very poor conditions.

To meet the needs of these families, Philippine President Ferdinand Marcos, Jr. launched in September 2022 the current administration's flagship housing program, "Pambansang Pabahay Para sa Pilipino Program" or 4PH, which aims to build a total of 6 million housing units or about 1 million housing units every year until the end of his term in 2028.

Aside from its main goal of providing the Filipino people with decent and affordable housing, the project also aims to generate around 1.7 million jobs every year until 2028.

Construction is now ongoing for 4PH projects in San Fernando City, Pampanga, Davao City, Tagoloan, Misamis Oriental, Tondo, and San Miguel districts in Manila, and Puerto Princesa, Palawan, among others. Additionally, there are over 100 projects in the pipeline, which is projected to build around 415,000 units.

Despite this, the annual target was not met in the past three years of implementation due to several challenges, including typhoons, procedural delays, and other obstacles.

Recently, newly appointed DHSUD Secretary Jose Ramon Aliling has pledged to enhance and expand the 4PH Program, shifting its focus toward horizontal housing developments such as townhouses and single-detached units. Aliling plans to prioritize the release of guidelines and implement rules for horizontal projects, aiming to boost the program's performance. This move signals a strategic shift from the vertical, condominium-style housing favored by his predecessor, Jose Rizalino Acuzar.

Before the introduction of 4PH, the government embarked on the National Shelter Program to provide housing for informal settlers and other families who do not have enough income to rent or buy houses at the prevailing market rates.

Socialized housing units or those which cost less than PHP450,000 (US$7,665) can be purchased with a monthly amortization of PHP2,302 (US$39). The Pag-IBIG Fund (which is the Filipino word for love), the country's state-owned and subsidized housing loan provider, provides a fixed rate of 3% for 30 years for socialized housing units. The problem is that these low-end housing units are usually far from work.

Rental Market:

Residential rental market still weak, vacancy rates remain high

Philippines' rent price index:

Note: Philippines' Rent Price Index, % change 1 yr

Data Source: Philippine Statistics Authority.

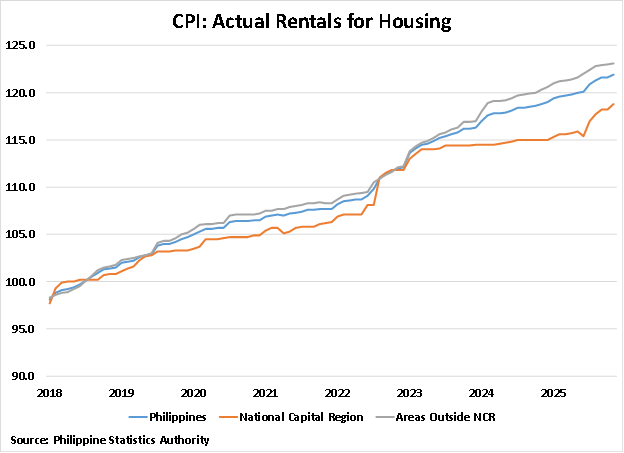

Based on the Consumer Price Index (CPI) published by the PSA, the actual rentals for housing in the Philippines increased by 2.61% in November 2025 from a year earlier.

- In the National Capital Region (NCR), housing rentals were up by 3.3% in November 2025 from the previous year.

- In areas outside the NCR, housing rentals increased by 2.33% y-o-y in November 2025.

However, recent data from Colliers International paint a less optimistic picture, with residential rents across Metro Manila slipping by 0.2% in Q3 2025 compared with the previous period. This followed a meager rent growth of 0.5% in 2024, modest increases of 3.5% in 2023 and 3.9% in 2022, and a cumulative 12% decline in 2020-21.

"We expect a marginal rental correction of 1.2% in 2025, given the elevated vacancy and still substantial number of unsold RFOs," said Colliers.

The lackluster performance of the residential rental market is not surprising given the elevated vacancy registered in Metro Manila CBDs. In Q3 2025, the overall vacancy rate in Metro Manila's secondary market increased by 0.5 percentage points to 25%. By end-2025, the vacancy rate is projected to increase further to an all-time high of 26.5%.

"Colliers forecasts vacancy to reach 26.5% by end-2025, an all-time high. Vacancy in the Bay Area remains above 50% due to a sizable number of units completed before and during the pandemic," noted the Colliers report.

Gross rental yields remain moderately good, but beware of taxes

Rental yield returns in the Philippines are moderately good, at an average of 5.57% in Q3 2025, an increase from 5.12% in Q1 2025, 5.36% in Q3 2024, and 5.19% in Q1 2024, according to a recent research conducted by the Global Property Guide. Usually, smaller properties tend to have higher rental yields, but this is not the case in Manila. Return rates are mostly similar for all apartment sizes.

In Metro Manila, apartments offer gross rental yields ranging from 4.16% to 7.6%, with an average of 5.77%. In Cebu City, rental yields currently range from 4.06% to 6.53%, with a city average of 5.38%.

These yields are before taxes and other expenses. They are for the high-end areas: Taguig City, Pasay City, Pasig City, Makati CBD, Ortigas CBD, Rockwell, The Fort, and Eastwood City.

This does not mean that foreign investors should necessarily rush to invest in Manila, because transaction taxes (known as 'capital gains taxes', but not actually such), and (if observed) official income tax rates applicable to non-resident investors are high.

Mortgage Market:

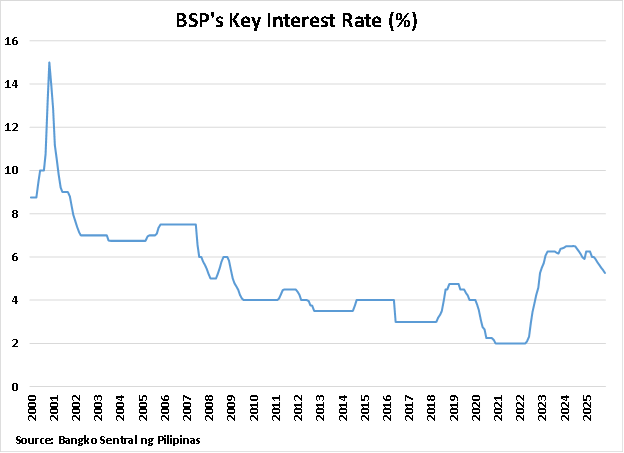

Key interest rates slashed further to buoy economy amid low inflation

In December 2025, the BSP Monetary Board decided to cut its policy rate - the Target Reverse Repurchase (RRP) Rate - by another 25 basis points to 4.50%. The interest rates on the overnight deposit and lending facilities were also reduced to 4.0% and 5.0%, respectively.

The recent move marks the central bank's eighth consecutive rate cut since July 2024, bringing the total cuts to 200 basis points, in an effort to buoy economic activity. Prior to this, the policy rate was raised thirteen times from May 2022 to October 2023, amidst stubbornly high inflation.

"The outlook for inflation continues to be benign, and inflation expectations remain firmly anchored. The inflation forecasts for 2026 and 2027 have risen slightly to 3.2 percent and 3.0 percent, respectively," said the BSP in its December 2025 Monetary Policy press release. "The Monetary Board noted that the outlook for domestic economic growth has weakened further. Overall business sentiment has continued to decline on concerns about governance issues and lingering uncertainty over global trade policy. Nevertheless, domestic demand is expected to rebound slowly as the full impact of monetary policy easing works its way through the economy and as the pace and quality of public spending improves."

"On balance, the Monetary Board sees the monetary policy easing cycle nearing its end. Any additional easing will likely be limited and will be guided by incoming data," added the central bank.

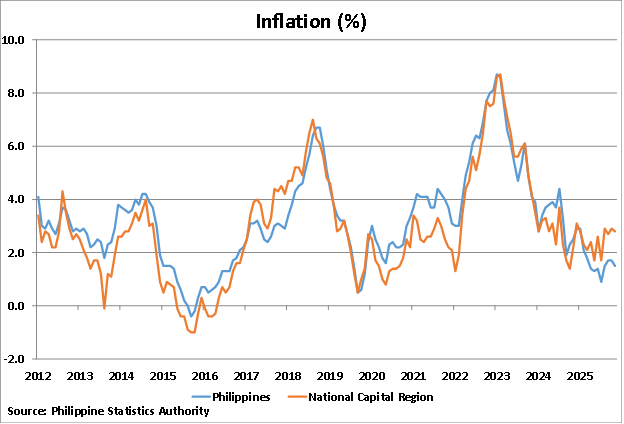

Headline inflation eased to 1.5% in November 2025, slightly down from 1.7% in the previous month and far lower than the 2.5% seen in the same period last year. This is lower than the central bank's target band of 2% to 4%.

Monthly inflation averaged just 2.8% from 2012 to 2021, before accelerating to 5.8% in 2022 and 6% in 2023. With the central bank's efforts, inflation moderated to 3.2% in 2024.

The mortgage market remains underdeveloped

A few major banks in the Philippines offer housing loans. And although loan-to-value ratios of 90% are now in theory being offered and loan tenors can be as long as 30 years, in fact, most loans are short-term. Banks are wary because land titling and registration problems are prevalent, as are lengthy delays in the foreclosure process due to the country's very weak court system.

Therefore, approval of loan applications takes a long time. In addition, interbank collusion prevails: different banks' loans have strangely similar terms and conditions.

Property buyers also face high transaction costs, corruption and red tape, fake land titles, and substandard building practices. Plus, the large informal housing sector and its incentives make it less attractive for low to middle-income families to buy or rent properties.

Because of these factors, the ratio of residential mortgage loans to GDP remains small, at less than 5% of GDP in 2024, a slight increase from 2.4% of GDP in 2012. Most houses in the Philippines are sold for cash or pre-sold, with the developers offering financing.

The size of the residential mortgage market is expected to remain between 4% and 5% of GDP this year.

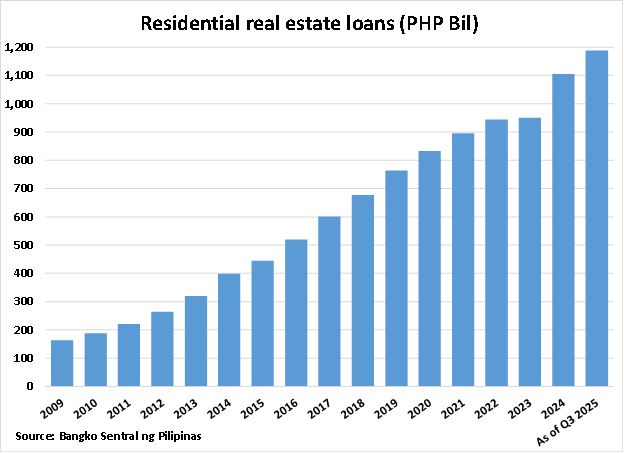

As of Q3 2025, the total outstanding residential real estate loans in the country amounted to PHP1.19 trillion (US$20.23 billion), up strongly by 11.4% from the same period last year, according to figures from the BSP.

From an annual average growth of about 17% from 2010 to 2019, the growth in residential real estate loans decelerated sharply to less than 6% annually from 2020 to 2023. The annual growth of residential real estate loans accelerated again to 16.3% during 2024.

Socio-Economic Context:

Growth Remains Robust, Fiscal Pressures Persist

Philippine peso weakening, inflation still manageable

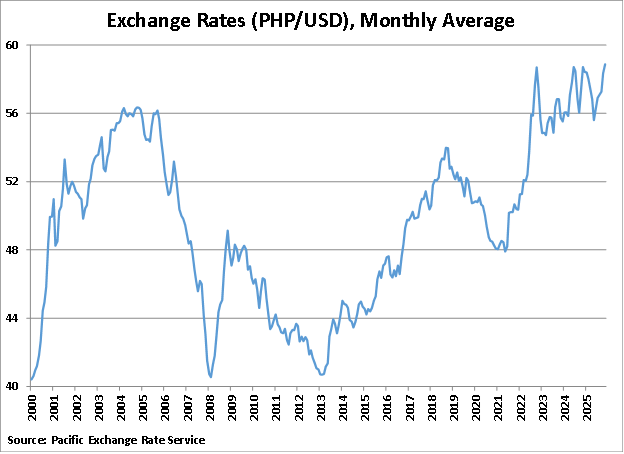

After appreciating by 5.6% in 2020, the Philippine peso depreciated for the second straight year in 2022, reaching PHP58.681 = US$1 in October 2022, amidst aggressive rate hikes delivered by the U.S. Federal Reserve to rein in inflation during the said year.

After regaining some value in early 2023, the local currency depreciated again in the succeeding months. The peso lost about 6.8% of its value against the dollar from PHP54.717 = US$1 in March 2023 to PHP58.707 = US$1 in November 2024.

The peso's movements against the US dollar have been erratic in recent months amid heightened global economic uncertainties and mounting domestic challenges, as the ongoing corruption probes and infrastructure spending controversy continue to erode investor and consumer confidence. In November 2025, the average monthly exchange rate weakened to PHP58.868 per US dollar, marking one of the lowest levels in recent history.

In November 2025, the headline inflation in the country eased to 1.5%, slightly down from 1.7% in the previous month and far lower than the 2.5% recorded in the same period last year, according to the PSA. This is lower than the central bank's target band of 2% to 4%.

In Metro Manila, the headline inflation was higher than the national average, at 2.8% in November 2025.

"Food inflation eased, reflecting slower price increases for vegetables and meat. Meat supply improved after the lifting of the chicken import ban, while vegetable supply stabilized. Rice prices continued to fall in November, though at a slower rate. Meanwhile, electricity rates and domestic prices of selected petroleum products increased, contributing to higher non-food inflation," said the BSP.

"The November inflation outturn continues to indicate a benign inflation environment," added the central bank.

Trade gap, BoP deficit seen narrowing in 2025 before widening in 2026

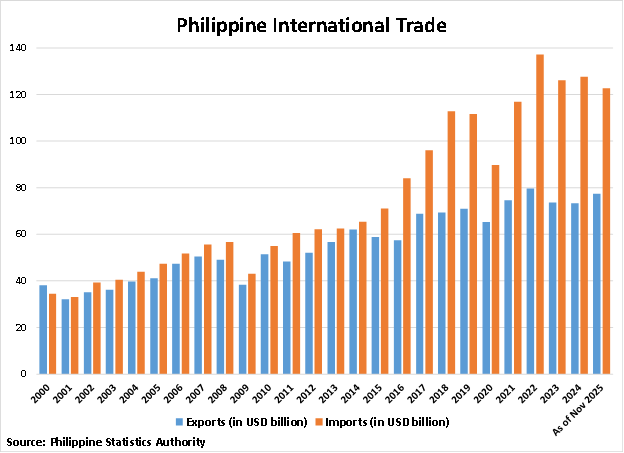

During 2024, the total value of exports fell slightly by 0.5% y-o-y to US$73.29 billion while imports increased by 1.1% to US$127.6 billion, resulting in a trade deficit of US$54.33 billion, according to PSA figures.

In November 2025, the country's trade deficit narrowed by 28.8% to US$3.51 billion as compared to US$4.93 billion in the same month last year, amidst a sustained growth in export sales coupled with softer imports. Over the same period, total exports increased strongly by 21.3% y-o-y to US$6.91 billion while imports declined by 2% to US$10.42 billion. A weaker peso likely contributed to a higher export bill, while global trade uncertainties, partly linked to U.S. tariff policies, further boosted export demand.

For the first eleven months of 2025, Philippine exports reached US$77.39 billion, marking a 14.5% growth from the US$67.6 billion in the previous year. Imports, on the other hand, increased by a modest 4.1% y-o-y to US$122.59 billion in Jan-Nov 2025 as compared to US$117.78 billion in the same period last year. This resulted in a cumulative trade gap of US$45.2 billion in the first eleven months of the year.

China continued to be the leading source of imports for the Philippines in Jan-Nov 2025, accounting for US$35.13 billion (28.7% share of total imports). Other major suppliers included Japan with US$9.77 billion (8% share), South Korea with US$9.53 billion (7.8% share), Indonesia with US$9.42 billion (7.7% share), the United States with US$7.41 billion (6% share), and Thailand with US$7 billion (5.7% share).

The United States emerged as the country's top export destination, receiving US$12.33 billion worth of Filipino export products (15.9% share of total exports) in the first eleven months of 2025. Hong Kong followed closely with US$11.27 billion, equivalent to a 14.6% share. Other top export markets included Japan with US$10.59 billion (13.7% share), China with US$8.51 billion (11% share), the Netherlands with US$3.27 billion (4.2% share), and Singapore with US$3.2 billion (4.1% share).

Electronic products remained the Philippines' leading export category, valued at US$4.19 billion in November 2025, accounting for about 60.7% of total export receipts. The country's other notable exports included coconut oil, mineral products, manufactured goods and machinery, and transport equipment.

The country's balance of payments (BOP) deficit narrowed sharply to US$225 million in November 2025, amidst higher remittance inflows during the holidays, according to the BSP. This is a huge decline from the US$2.28 billion shortfall recorded in the same month last year.

Despite this, the country's cumulative BOP deficit reached US$4.83 billion in the first eleven months of 2025, as compared to the US$2.12 billion surplus a year ago.

"While November's sharp narrowing was helped by seasonal remittance inflows, portfolio adjustments, and some easing in import payments, the year-to-date gap was driven by earlier front-loaded imports of capital goods and energy, a weaker trade balance amid softer global demand, and episodic portfolio outflows during periods of higher US yields and FX (foreign exchange) volatility," said Robert Dan J. Roces, an economist at SM Investments Corp. to BusinessWorld.

For 2025, the BSP now expects the deficit to narrow slightly to US$6.2 billion, equivalent to 1.3% of GDP, from its earlier estimate of US$6.9 billion shortfall or 1.4% of GDP.

The country's BOP deficit is expected to widen in 2026 as external challenges persist. In its latest outlook, the BSP said the BoP deficit is projected to reach US$5.9 billion in 2026, or 1.2% of GDP, wider than the US$3.4 billion deficit (0.6% of GDP) forecast in the previous quarter.

Corruption scandal weighs on the Philippines' economic growth

In the third quarter of 2025, the Philippines posted an economic growth of 4% from a year earlier, a slowdown from the 5.5% growth in the previous quarter and the 5.2% expansion in the same period last year, based on figures from the PSA. In fact, it was the country's weakest performance since Q1 2021, amid ongoing investigations into government infrastructure spending, particularly flood control projects. Additionally, a series of typhoons further weighed on economic activity.

In Q3 2025:

- Household consumption increased by 4.1% y-o-y in Q3 2025, a slowdown from the previous quarter's 5.3% growth.

- Fixed investments barely expanded, registering a minuscule growth of 0.1% y-o-y in Q3 2025, a sharp slowdown from the 3.1% expansion in Q2.

- Government spending grew by 5.8%, following an increase of 8.7% y-o-y in Q2.

- Net trade, on the other hand, contributed positively to the country's overall GDP, with exports increasing by 7% and imports rising by a softer 2.6%.

On a quarterly basis, the economy grew by a meager 0.4% q-o-q in Q3 2025, easing from expansions of 1.5% in Q2 and 1% in Q1. This marked the weakest growth since the contraction in Q2 2020.

The Philippine government expects the economy to grow between 5.5% and 6.5% this year and between 6% and 7% in 2026. However, the International Monetary Fund (IMF) recently downgraded its economic growth forecast for the Philippines to 5.1% for 2025, from 5.4% previously. Similarly, the World Bank has lowered its 2025 growth forecast for the Philippines to 5.1%, down from its previous estimate of 5.3%, citing sluggish domestic investment, falling business confidence amid a widening corruption scandal, declining foreign direct investment, and the economic impact of recent typhoons.

"Growth decelerated in the Philippines, weighed by domestic shocks. Growth in the first three

quarters (Q1-Q3) of 2025 averaged 5 percent, 0.9 percentage points (ppts) lower than Q1-Q3 2024," said the World Bank in its Philippines Economic Update December 2025 Edition. "Private consumption growth was robust in Q1-Q2 but decelerated in the face of typhoons and flooding in Q3. Private and public investment weakened as construction was disrupted by severe weather events, the public works ban preceding mid-term elections, and stronger oversight of infrastructure projects in Q3 amid controversy over governance risks."

This is supported by a recent report by the IMF, which noted that "the balance of risks to the growth outlook is tilted to the downside amid uncertainty from global trade policies, corruption allegations related to flood control projects, and extreme climate events."

Prior to this, the Philippine economy grew by 5.7% during 2024, following annual expansions of 5.5% in 2023, 7.6% in 2022, and 5.7% in 2021 and a pandemic-induced contraction of 9.5% in 2020, buoyed by strong domestic demand, which was evident in higher household consumption and investments.

"While this is below our target, we continue to be one of the fastest-growing economies in both the region and the world. This is despite external and local challenges such as extreme weather events, geopolitical tensions, and subdued global demand," said Finance Secretary Ralph Recto.

Before the pandemic, the Philippine economy had been growing by an average of 6.4% annually from 2010 to 2019.

In 2024, the country's budget deficit narrowed slightly by PHP5.7 billion (US$97.1 million) to PHP1.506 trillion (US$25.65 billion) as revenue growth outpaced spending. As a percent of GDP, the deficit fell to about 5.7% in 2024, down from 6.1% in 2023, 7.3% in 2022, and 8.6% in 2021. However, it remains far above the 3.4% shortfall recorded during the pre-pandemic year of 2019.

The IMF expects the Philippines' shortfall to decline slightly to 5.4% of GDP this year and to 5.2% of GDP in 2026.

The country's national debt ballooned to PHP16.05 trillion (US$273.4 billion) last year, up by 9.8% from the preceding year, according to the Bureau of Treasury.

"The year-on-year (YoY) increase in the debt stock is primarily attributed to the P1.31 trillion net issuance of debt instruments in line with the government's deficit program, as well as the P208.73 billion valuation effect of US dollar strengthening, albeit advantageous third currency movements significantly trimmed the debt total by P80.74 billion," said the Treasury.

As a percentage of GDP, government debt was equivalent to 60.7% in 2024, from 60.1% in 2023, 60.9% in 2022, 60.4% in 2021, and 54.6% in 2020. It was far higher than the pre-pandemic debt levels of below 40% of GDP in 2018 and 2019.

The national government's gross debt is projected to increase to about 62.2% of GDP this year, based on IMF projections.

The labor market seems to be weakening. In October 2025, the nationwide unemployment rate edged higher to 5.0%, from 3.8% in the previous month and 3.9% in the same month last year, based on figures from the PSA. The underemployment rate stood at 12% in October 2025, up from 11.1% in the previous month but slightly lower than the 12.6% recorded a year earlier.

Overall unemployment averaged 6.3% from 2010 to 2019, before increasing to 10.4% in 2020 amidst the Covid-19 pandemic. The jobless rate fell to 7.8% in 2021, 5.4% in 2022, 4.4% in 2023, and finally to a record-low of 3.8% in 2024.

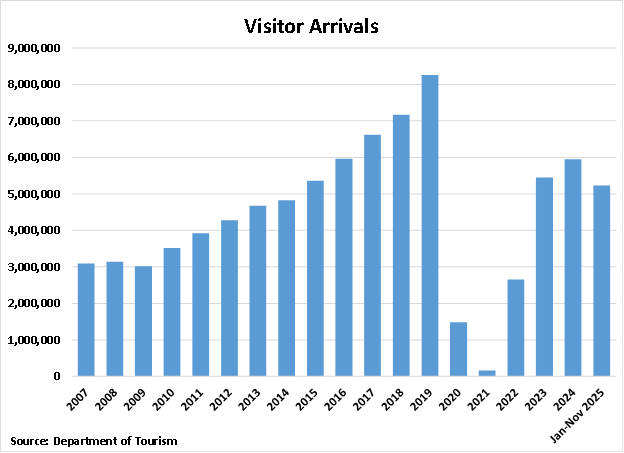

Tourism slowing again

One of the drivers of the country's economy is tourism. During 2024, the total number of international visitor arrivals reached 5.95 million, up by 9.15% from the prior year. Though it was far below the Department of Tourism's target of about 7.7 million tourist arrivals last year. Also, it remains far below the 8.26 million arrivals recorded in 2019 before the Covid-19 pandemic.

The country earned about PHP760.5 billion (US$12.95 billion) from inbound tourism expenditures last year, up by 9.04% from the preceding year and by a huge 26.75% compared to the pre-pandemic year of 2019.

However, tourism seems to be slowing again this year. In the first eleven months of 2025, the number of visitor arrivals fell by 2.16% y-o-y to below 5.24 million, according to figures from the Department of Tourism (DOT). The recent decline in tourist arrivals in the Philippines is mainly due to fewer visitors from key markets like South Korea and China, visa and safety issues, stronger competition from neighboring countries, and infrastructure and promotion challenges.

Accordingly, arrivals from South Korea, the Philippines' top tourism source market, declined sharply by 21% y-o-y to 1.13 million in the first eleven months of 2025. In addition, arrivals from China, another key tourism source market, also declined by 16.5% y-o-y to 248,339 over the same period. These declines were partly offset by continued growth from other major markets: the United States, currently the second-largest source, rose 6.57% y-o-y to 894,835 arrivals through November; Japan, in third place, increased 15.36% y-o-y to 406,794; and Australia, fourth, grew by 16.17% to 268,892.

Despite the challenges encountered this year, the DOT remains optimistic about the outlook for 2026, as the Philippines is set to host the ASEAN Tourism Forum (ATF) in Cebu from January 26 to 29, alongside the meeting of ASEAN tourism ministers.

Sources:

- Property prices show modest growth in Q3 2025 (Bangko Sentral ng Pilipinas): https://www.bsp.gov.ph/

- Colliers Quarterly | Property Market Reports - Residential | Q3 2025 | Philippines (Colliers International): https://www.colliers.com/

- Compendium of CFO Statistics (Commission on Filipino Overseas): https://cfo.gov.ph/

- Overseas Filipino Cash Remittances (Bangko Sentral ng Pilipinas): https://www.bsp.gov.ph/

- Personal Remittances Reach a Record High of US$3.7 Billion in December 2024; Full-Year Level of US$38.3 Billion Highest to Date (Bangko Sentral ng Pilipinas): https://www.bsp.gov.ph/

- Construction Statistics from Approved Building Permits Philippines 2024 (Philippine Statistics Authority): https://psa.gov.ph/

- Construction Statistics from Approved Building Permits October 2025 (Philippine Statistics Authority): https://psa.gov.ph/

- Housing Poverty in the Philippines (Habitat for Humanity): https://www.habitatforhumanity.org.uk/

- Pambansang Pabahay Para sa Pilipino (4PH) (Department of Human Settlements and Urban Development): https://dhsud.gov.ph/

- SHFC breaks ground for two Pambansang Pabahay projects in Quezon City (Manila Bulletin): https://mb.com.ph/

- New DHSUD chief vows improved, expanded 4PH program (MSN): https://www.msn.com/

- Gross rental yields in the Philippines: Manila and Cebu (Global Property Guide): https://www.globalpropertyguide.com/

- Selected Domestic Interest Rates (Bangko Sentral ng Pilipinas): https://www.bsp.gov.ph/

- Monetary Board reduces target RRP rate by 25 basis points (Bangko Sentral ng Pilipinas): https://www.bsp.gov.ph/

- Target reverse repurchase (RRP) rate (Bangko Sentral ng Pilipinas): https://www.bsp.gov.ph/

- Real Estate Exposure (Bangko Sentral ng Pilipinas): https://www.bsp.gov.ph/

- November inflation slows down to 1.5 percent (Bangko Sentral ng Pilipinas): https://www.bsp.gov.ph/

- Summary Inflation Report Consumer Price Index (2018=100): November 2025 (Philippine Statistics Authority): https://psa.gov.ph/

- Trade deficit narrows despite higher November trade flows (Business Mirror): https://businessmirror.com.ph/

- Philippine trade deficit shrank by 29% in November (Inquirer.net): https://business.inquirer.net/

- BOP posts US$225 million deficit in November 2025, GIR rise to US$111.3 billion (Bangko Sentral ng Pilipinas): https://www.bsp.gov.ph/.

- BSP warns of wider BOP deficit in 2026 (Philippine Star): https://www.philstar.com/

- BoP deficit sharply narrows in Nov. (Business World): https://www.bworldonline.com/

- PH economy maintained steady growth in 2024 despite challenges; outlook for 2025 remains bullish, driven by lower inflation, higher consumption, and investments (Department of Finance): https://www.dof.gov.ph/

- Philippines GDP Growth Rate (Trading Economics): https://tradingeconomics.com/

- IMF Executive Board Concludes 2025 Article IV Consultation with the Philippines (International Monetary Fund): https://www.imf.org/

- BSP: Economy to recover in 2026 (Philippine Star): https://www.philstar.com/

- World Bank trims growth forecasts for the Philippines (Inquirer.net): https://business.inquirer.net/

- IMF lowers Philippine growth forecasts for 2025 and 2026 (Business World): https://www.bworldonline.com/

- Philippines Economic Update December 2025 Edition (The World Bank): https://documents1.worldbank.org/

- Government revenue hits 27-year high, budget deficit improves in 2024 (Manila Bulletin): https://mb.com.ph/

- Philippines ends 2024 with P16.05T sovereign debt (GMA News Online): https://www.gmanetwork.com/

- The number of employed persons in October 2025 increased to 48.62 million Filipinos 15 years old and over (Philippine Statistics Authority): https://psa.gov.ph/

- Tourism arrivals increased in 2024 - DoT (Daily Tribune): https://tribune.net.ph/

- Foreign tourist arrivals to the Philippines down 3% between January and November amid signs of improvement from China (AIG): https://asgam.com/

- Tourism Demand Statistics (Department of Tourism): https://www.tourism.gov.ph/

- Tourism (Philippine Statistics Authority): https://openstat.psa.gov.ph/

- PH ready to shape future of reg'l tourism as ASEAN hosting nears - DOT (Philippine News Agency): https://www.pna.gov.ph/