Hong Kong's Residential Property Market Analysis 2025

Hong Kong’s residential property prices are showing signs of stabilization amid strengthening demand and a pickup in residential construction activity. This follows the removal of market-cooling measures, a gradual decline in interest rates, and improving economic conditions.

This extended overview from the Global Property Guide provides a comprehensive assessment of Hong Kong’s housing market, examining its key characteristics while offering a closer look at recent developments and longer-term structural trends shaping the sector.

Table of Contents

- Housing Market Snapshot

- Historic Perspective

- Demand Highlights

- Supply Highlights

- Rental Market

- Mortgage Market

- Socio-Economic Context

Housing Market Snapshot

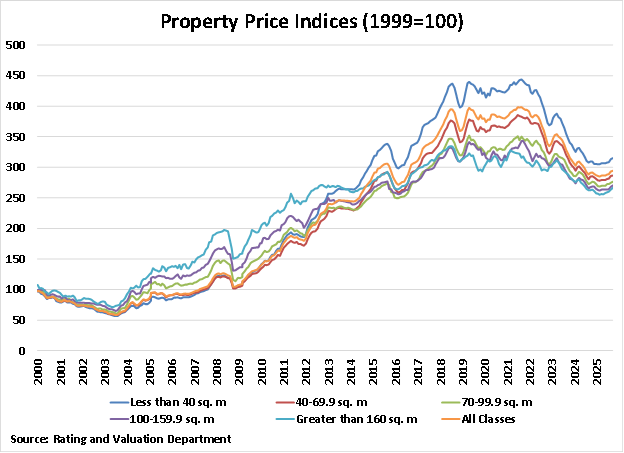

Hong Kong's residential property price index increased slightly by 1.13% in October 2025 as compared to the same period last year, a sharp improvement from the year-on-year decline of 9.63% in October 2024, according to data released by the Rating and Valuation Department (RVD). It is now the second consecutive month of year-on-year price increase after falling continuously from February 2022 to August 2025.

However, when adjusted for inflation, the price index fell slightly by 0.1% y-o-y in October 2025.

In the three months of October 2025, house prices in Hong Kong were up by 2.15% (1.69% inflation-adjusted).

Hong Kong's house price annual change:

Note: Hong Kong's National House Price Index

Data Source: The Rating and Valuation Department (RVD).

Variations in price movements per property size and region:

- Apartments smaller than 40 sq. m: the prices fell slightly by 0.6% y-o-y in October 2025, to an average of HK$131,305 (US$16,885) per square meter (sqm). It is a deceleration from the year-over-year price fall of 7.8% in October 2024.

- 40-69.9 sq. m. apartments: prices were down by 2.2% y-o-y to an average of HK$132,729 (US$17,069) per sqm in October 2025. It is an improvement from the 12.7% y-o-y contraction seen in October 2024.

- 70-99.9 sq. m. apartments: prices were up by 9.4% in October 2025 from the same period last year, to reach an average of HK$171,697 (US$22,080) per sqm. It was a sharp turnaround from the prior year's 9.8% price fall.

- 100-159.9 sq. m. apartments: prices fell by a modest 4.8% y-o-y to an average of HK$197,080 (US$25,344) per sqm in October 2025. It was compared to the strong growth of 20.6% recorded in the same period last year.

- Apartments with sizes bigger than 160 sq. m: prices dropped by a huge 21.5% y-o-y to HK$210,509 (US$27,071) per sqm in October 2025. This is in contrast to the y-o-y price increase of 14.3% seen in October 2024.

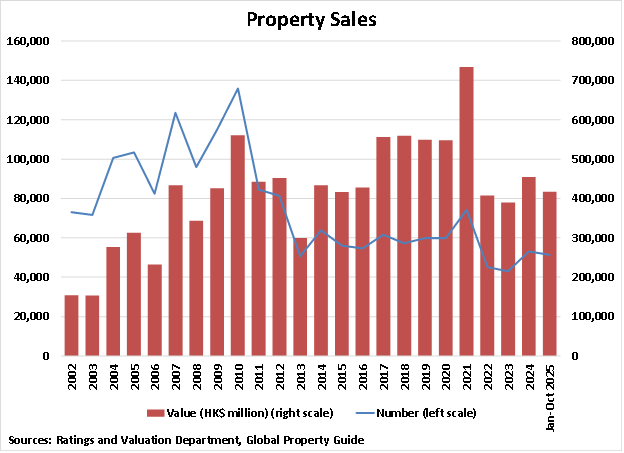

Demand continues to strengthen, buoyed by declining interest rates and the removal of housing market restrictions. In the first ten months of 2025, the total number of property transactions - including primary and secondary sales - rose by a huge 20.3% y-o-y to 51,361 units, following a strong growth of 23.5% in 2024 and annual declines of 4.5% in 2023 and 39.4% in 2022, based on figures released by RVD. Likewise, total sales volume increased by 14.4% y-o-y to HK$416.94 billion (US$53.62 billion) in Jan-Oct 2025, after rising by 16.7% in 2024 and falling by 4.5% in 2023 and 44.4% in 2022.

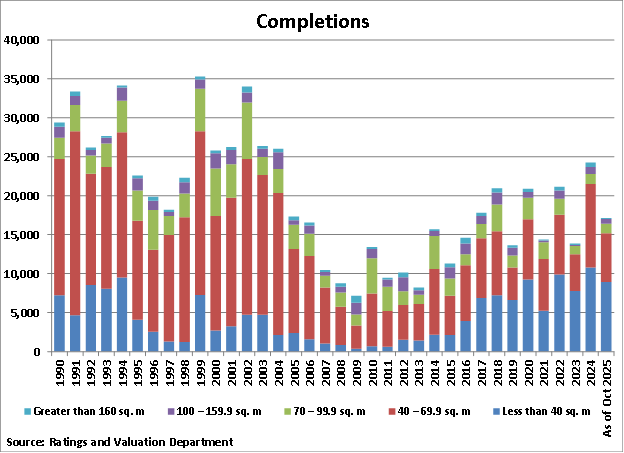

As such, residential construction activity is now increasing. During 2024, residential completions soared by 75.1% y-o-y to 24,261, a sharp improvement from an annual decline of 34.6% in 2023, according to figures released by RVD. Then, in the first ten months of 2025, there were 17,174 dwelling units completed in Hong Kong. About 52% of these are properties with an area of 40 sq. m. and below.

Despite this, Hong Kong continues to suffer a chronic housing shortage - a problem that has dragged on for over two decades.

| AVERAGE HOUSE PRICES, OCTOBER 2025 | ||||||

| Property size | Average prices (per sqm) | Year-on-year change | ||||

| Hong Kong | Kowloon | New Territories | Hong Kong | Kowloon | New Territories | |

| HKD (USD) | HKD (USD) | HKD (USD) | % | % | % | |

| Less than 40 sqm | 131,305 ($16,885) |

118,374 ($15,223) |

109,384 ($14,066) |

-0.6 | 2.9 | -1.9 |

| 40 sqm - 69.9 sqm | 132,729 ($17,069) |

123,852 ($15,927) |

105,977 ($13,628) |

-2.2 | -1.9 | -3.0 |

| 70 sqm - 99.9 sqm | 171,697 ($22,080) |

149,679 ($19,248) |

117,074 ($15,055) |

9.4 | -3.1 | -0.6 |

| 100 sqm - 159.9 sqm | 197,080 ($25,344) |

171,940 ($22,111) |

106,459 ($13,690) |

-4.8 | -0.7 | -5.2 |

| Greater than 160 sqm | 210,509 ($27,071) |

224,714 ($28,898) |

103,323 ($13,287) |

-21.5 | -13.0 | 0.8 |

| Sources: Rating and Valuation Department (RVD), Global Property Guide | ||||||

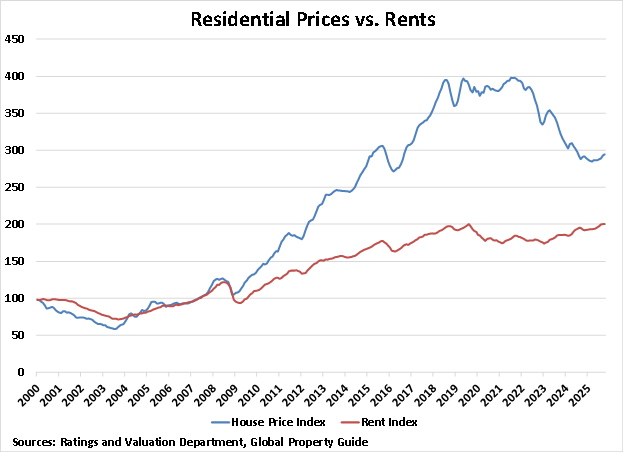

From 2008 to 2013, Hong Kong's dwelling prices skyrocketed by 134% (95.7% inflation-adjusted), driven by a flood of money in the wake of the global financial crisis.

The market slowed in the first half of 2014, but bounced back in the second half, with prices rising by 13.6% in Q4 2014, 19.6% in Q1 2015, 20.4% in Q2 2015, and 15% in Q3 2015.

After a brief housing market slowdown, house prices surged again by 41.5% (35.5% inflation-adjusted) from H2 2016 to H1 2018.

The housing market slowed from the end of 2018 until the first half of 2019 due to macroeconomic uncertainties and social unrest. After a short-lived recovery in the second half of 2019, the housing market struggled again in 2020 due to pandemic-related travel restrictions and lockdown measures imposed worldwide. Then in 2022, things got worse, with house prices plunging by 15% (-16.7 inflation-adjusted), following a modest increase of 3.7% in 2021 and a meager growth of 0.2% in 2020.

The housing market remained depressed in the succeeding two years, with house prices falling further by 7% (-9.2% inflation-adjusted) in 2023 and by another 7.1% (-8.4% inflation-adjusted) in 2024.

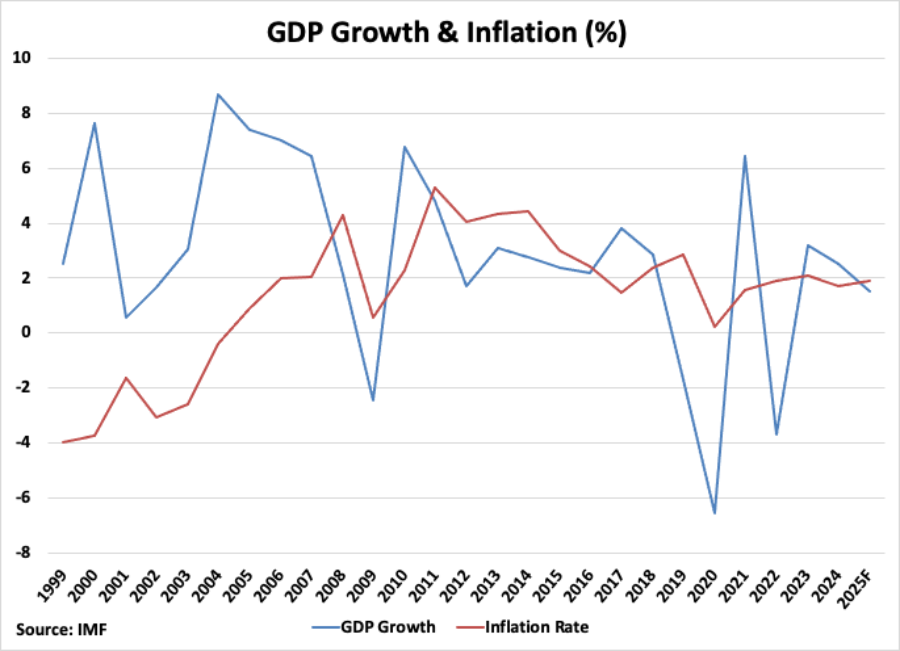

Overall, Hong Kong's service-oriented economy grew by a modest 2.5% in 2024 from a year earlier, following an expansion of 3.2% in 2023 and a contraction of 3.7% in 2022. To boost economic activity, the HK government unveiled a number of measures in the past two years, including offering cash handouts to residents, cutting the salaries tax, and attracting more workers and foreign investments.

In the third quarter of 2025, the HK economy expanded by 3.8% from a year earlier, following year-on-year growth of 3.1% in Q2 2025, 3% in Q1 2025, 2.5% in Q4 2024, and 1.9% in Q3 2024, underpinned by a sustained surge in exports and ongoing expansion in domestic demand. According to data released by the government. It is now the eleventh consecutive quarter of year-on-year growth.

On a seasonally adjusted quarter-on-quarter basis, real GDP expanded by 0.7% in Q3 2025, an improvement from a meager growth of 0.4% in the previous quarter and a contraction of 0.1% in the same period last year.

With improved performance, the HK government has recently revised its forecast for real GDP growth upwards to 3.2% for the whole year of 2025, from its earlier projection of 2% to 3%.

Historic Perspective:

Hong Kong still most unaffordable, but bubble risks ease

Hong Kong's housing boom in the past decades has been propelled by a combination of stringent government regulations on development, historically low interest rates, and currency stability, while the supply of land, which the government controls, continues to diminish.

Hong Kong's currency peg to the dollar kept borrowing costs near record lows, fueling continued property demand.

| HOUSE PRICE INDEX, Y-O-Y CHANGE (%) | ||

| Year | Nominal | Inflation-adjusted |

| 2009 | 28.5% | 26.5% |

| 2010 | 21.0% | 17.7% |

| 2011 | 11.1% | 5.1% |

| 2012 | 25.7% | 21.2% |

| 2013 | 7.7% | 3.3% |

| 2014 | 13.6% | 8.2% |

| 2015 | 2.4% | 0.1% |

| 2016 | 7.9% | 6.6% |

| 2017 | 14.7% | 12.8% |

| 2018 | 1.9% | -0.6% |

| 2019 | 5.5% | 2.6% |

| 2020 | 0.2% | 1.1% |

| 2021 | 3.7% | 1.3% |

| 2022 | -15.0% | -16.7% |

| 2023 | -7.0% | -9.2% |

| 2024 | -7.1% | -8.4% |

| Sources: Rating and Valuation Department, Global Property Guide | ||

Despite improved affordability because of the recent decline in house prices, Hong Kong's property market remains the world's most unaffordable for the fourteenth year in a row, according to the Demographia International Housing Affordability Survey 2025. Average home prices were 14.4 times the gross annual median household income in 2024, down from 16.7 times in 2023, 18.8 times in 2022, and 20.7 times three years ago. In fact, it is now at its lowest level since 2016.

"Hong Kong has been the least affordable market in Demographia International Housing Affordability for the past 14 years since its inclusion. However, in recent years, there have been material improvements. The 2024 Hong Kong median multiple of 14.4 improved from 16.7 in 2023. This is an even greater improvement than Hong Kong's pre-pandemic 20.8 in 2019," said the Demographia report.

"China's central government has given Hong Kong a clear responsibility to improve housing affordability and increase house sizes, which are among the smallest in the world."

Similarly, in Mercer's 2024 Cost of Living Survey, Hong Kong was ranked as the world's most expensive city for expatriates to live in, followed by Singapore, Zurich, and Geneva.

Likewise, the 2025 UBS Global Real Estate Bubble Index ranked Hong Kong as the least affordable city, with approximately 14 years of income needed to purchase a 60 sqm apartment. However, the study noted that Hong Kong, along with Toronto, recorded the largest declines in bubble-risk scores, now falling into low bubble-risk territory due to recent sharp declines in house prices.

"Sales activity has picked up, supported by changes to mortgage insurance, property stamp duty easing, lower rates, and most importantly, lower home prices. Real home prices started to stabilize after falling nearly 28% below 2021 levels, matching those last seen in 2011 in inflation-adjusted terms," said the UBS report. "While financing costs are expected to ease further, following the trend of US rates, prices are likely to be flat to slightly negative as high inventories weigh on the outlook. The lower prices have improved the relative affordability compared to the last peak."

Demand Highlights:

Property demand strengthening

In the first ten months of 2025, the total number of property transactions - including primary and secondary sales - rose by a huge 20.3% y-o-y to 51,361 units, following a strong growth of 23.5% in 2024 and annual declines of 4.5% in 2023 and 39.4% in 2022, based on figures released by RVD. Likewise, total sales volume increased by 14.4% y-o-y to HK$416.94 billion (US$53.62 billion) in Jan-Oct 2025, after rising by 16.7% in 2024 and falling by 4.5% in 2023 and 44.4% in 2022.

As a result of the government lifting all market cooling measures earlier last year, Mainland Chinese homebuyers flocked to the Hong Kong property market in recent months, driving transaction levels to increase again.

Though there were wide variations in sales movements in the primary and secondary markets in the first ten months of 2025:

- Primary market property sales were up strongly by 25.5% y-o-y to 16,979 units, following a spectacular growth of 57.3% in 2024, a modest increase of 4.2% in 2023 and a huge contraction of 41.6% in 2022, based on data from RVD. Likewise, total transaction values increased by 17.8% y-o-y to HK$178 billion (US$22.89 billion), following annual growth of 51.3% in 2024 and 16.3% in 2023 and a huge fall of 52.5% three years ago.

- Secondary market property sales were up by 17.9% y-o-y to 34,382 units in Jan-Oct 2025, following an annual growth of 12.2% in 2024 and declines of 7.2% in 2023 and 38.7% in 2022. Similarly, transaction values increased by 12% y-o-y to HK$238.94 billion (US$30.73 billion), following annual contractions of 0.1% in 2024, 12.2% in 2023, and 40.8% three years ago.

This is in line with the recent figures released by the Land Registry, which showed that a total of 71,703 properties changed hands in Hong Kong in the first eleven months of 2025, up strongly by 14.8% compared to the same period last year. This following an annual growth of 17.1% in the whole year of 2024 and a decline of 2.7% in 2023. Similarly, the total value of property transactions increased by 11.8% y-o-y to HK$549.24 billion (US$70.63 billion) over the same period, following a full year growth of 11.8% in 2024 and a contraction of 13.8% in 2023.

Demand for residential property in Hong Kong is expected to strengthen further in the coming months, supported by lower interest rates and a gradual improvement in economic conditions.

Property market restrictions relaxed

Effective 17 September 2025, the government revised the New Capital Investment Entrant Scheme (New CIES), lowering the minimum residential property price eligible for investment from HK$50 million (US$6.43 million) to HK$30 million (US$3.86 million) and raising the maximum property investment that could count toward the scheme from HK$10 million (US$1.28 million) to HK$15 million (US$1.93 million). The changes aim to attract more high-net-worth investors and enhance liquidity in the housing market.

Also in May 2025, the Stamp Duty (Amendment) Bill 2025 was enacted, which effectively increases the maximum property value subject to stamp duty of HK$100 (US$13) from HK$3 million (US$385,792) to HK$4 million (US$514,389). This change, part of the 2025-26 Budget, helps make buying lower-value properties easier. The adjustment applies to transactions executed on or after February 26, 2025.

"Based on property transaction data of 2024-25, we estimate that the measure will benefit approximately 15 per cent of property transactions, with government revenue reduced by about $400 million annually," said a government spokesperson.

In October 2024, with effects extending into 2025, the Hong Kong Monetary Authority (HKMA) relaxed mortgage lending rules by removing most countercyclical macroprudential measures. The changes effectively standardized the maximum loan-to-value ratio at 70% and raised the debt-servicing ratio cap to 50% for most residential mortgages, easing financing conditions and supporting housing demand amid a prolonged market downturn.

Earlier, Hong Kong removed all extra stamp duties in February 2024 to revive the struggling housing market, following pressure to lift long-standing housing market cooling measures, according to finance chief Paul Chan.

The decade-old property cooling measures have been lifted, including the Buyer's Stamp Duty targeting non-permanent residents, the New Residential Stamp Duty for second-time buyers, and the Special Stamp Duty aimed at homeowners who sold their property within two years.

"After prudent consideration of the overall current situation, we decide to cancel all demand side management measures for residential properties with immediate effect, that is, no Special Stamp Duty, Buyer's Stamp Duty, or New Residential Stamp Duty needs to be paid for any residential property transactions starting from today," said Chan. "We consider that the relevant measures are no longer necessary amidst the current economic and market conditions."

In October 2023, Chief Executive John Lee announced a partial easing of extra stamp duties - the first time that the property cooling measures were relaxed in over a decade. Among the property market curbs relaxed:

-

The Buyer's Stamp Duty (BSD) and the New Residential Stamp Duty (NRSD) were halved from 15% to 7.5%.

- The Special Stamp Duty (SSD) - equivalent to 10% of the property price - that was previously imposed on transactions involving property held for less than three years will now only apply to transactions for property held for less than two years.

- All stamp duties on property purchases by newly-arrived foreign talents in Hong Kong are suspended, but it is subject to the new residents obtaining permanent residency.

- Stamp duties paid by second-home buyers and non-locals were also halved from a maximum of 30% to 15%.

Also in September 2022, the HKMA relaxed its stress-test requirements for new mortgage borrowers by 100 basis points, effectively making the test easier to pass. The recent move came amidst falling property demand, after homebuyers saw their purchasing power fall by HK$1 million (US$128,597) since January 2022, following increases in both HIBOR and banks' prime rates.

Several rounds of market-cooling measures

Before the recent relaxation of property curbs, the HK government implemented several rounds of housing market-cooling measures in the past years to reduce speculative buying and regulate house price growth.

To discourage developers from hoarding, in June 2018, Carrie Lam introduced a vacancy tax on unsold homes that are not leased or have remained unoccupied six months after receiving an occupation permit. The tax rate is two times the rental income or 5% of the home's value.

Aside from the tax, the government also allocated nine plots of land, including three in the prime Kai Tak district, for public housing.

In addition, the HKMA imposed new restrictions on bank lending to property developers in May 2017, restricting loans to property developers to a maximum of 40% of a site's value, replacing the earlier limit of 50%. Also, the number of loans allowed for residential property with a value less than HK$10 million (US$1.28 million) was reduced from 60% to 50%, and those with a value exceeding HK$10 million (US$1.28 million) were also cut from 50% to 40%.

In addition, a 30-person Land Supply Task Force was set up to consider long-term solutions to Hong Kong's housing crisis, given the outcry about 'coffin homes'.

In recent years, Hong Kong's government has leaned against property price rises:

- In November 2010, the government imposed a 'flip tax' of 15% on properties resold within six months (though in May 2014 the rule was somewhat relaxed), and doubled stamp duties to 8.5% on properties worth HK$20 million (US$2.55 million) or more.

- On October 26, 2012, the government imposed a 15% extra tax on property purchases made by foreigners.

- In February 2013, the government doubled the stamp duty on all property transactions worth more than HK$2 million (US$257,195), though again, this measure ended in May 2014.

- In April 2013, the Residential Properties (First-hand Sales) Ordinance to shield buyers from dishonest sales practices came into full effect.

- In February 2015, the government required buyers of self-used residential properties valued under HK$7 million (US$900,181) to make larger down payments.

- In November 2016, the government raised stamp duties for all property transactions to 15%, except for first-time homebuyers who are charged just 4.25%. However, house price rises continued to accelerate, amidst a surge in the number of multiple home purchases on one single transaction as investors take advantage of lower tax rates.

- To close the loophole, the government also announced that first-time homebuyers acquiring more than one property in a single contract will be charged the same 15% stamp duty that applies to purchases of a second property starting April 2017.

Supply Highlights:

Residential construction activity increasing

Residential completions soared by 75.1% y-o-y to 24,261 in 2024, a sharp improvement from an annual decline of 34.6% in 2023, according to figures released by RVD.

The New Territories and Kowloon accounted for 48% and 45% of the total completions, respectively. The remaining 7% were from Hong Kong Island. More specifically, the largest share came from Kowloon City at 33%, followed by Yuen Long and Tuen Mun at 17% each.

By property class:

- Class A completions (properties with an area of 40 sqm and below) surged by 38.3% y-o-y to 10,794 units, following a contraction of 21% in the preceding year.

- Class B completions (40 to 69.9 sqm) rose by a whopping 129.4% y-o-y to 10,705 units last year, in contrast to an annual fall of 39.1% in 2023.

- Class C completions (70 to 99.9 sqm) increased by 21.1% y-o-y to 1,284 units last year, in stark contrast to the 48.2% fall recorded in 2022.

- Class D completions (100 to 159.9 sqm) increased by nearly six times from 157 units to 913 units in 2024, a sharp turnaround from an annual decline of 85.1% in the prior year.

- Class E completions (160 sqm and above) rose by about 3.5 times from 162 units a year earlier to 565 units in 2024, in contrast to a decline of 68.9% in 2023.

Then, in the first ten months of 2025, there were 17,174 dwelling units completed in Hong Kong. About 52% of these are properties with an area of 40 sq. m. and below.

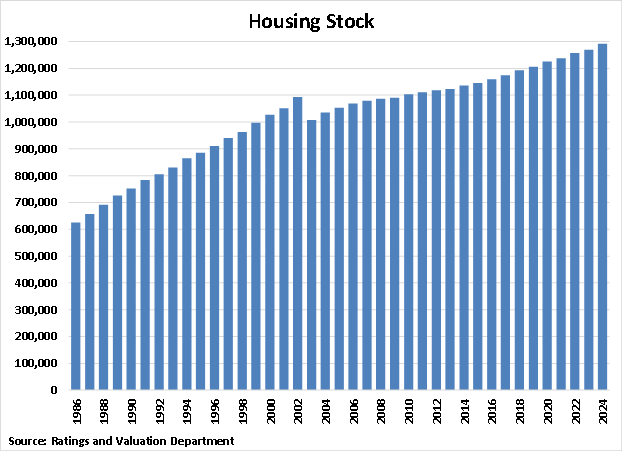

The stock of flats in Hong Kong totaled 3,056,000 units in 2024, up by 0.9% from the 3,027,000 units in the prior year and by 6.5% from 2,870,000 units in 2019, according to the Housing in Figures 2025 report released by the Housing Bureau. Of these, 1,320,000 units are public permanent housing, while the remaining 1,736,000 units are private housing.

Tackling Hong Kong's longstanding housing shortage

Increasing supply is the key. "We are looking at a shortfall of at least 1,200 hectares of land to meet our future supply and demand, and this is not taking into account extra land needed to improve the living space of each individual," said Task Force on Land Supply chairman Stanley Wong Yuen-fai.

The government recently unveiled Hong Kong's first major reclamation project since 2003, at an estimated cost of HK$20.5 billion (US$2.64 billion). Scheduled for completion by 2030, it will reclaim 130 hectares off northern Lantau and extend Tung Chung's new town to provide 49,000 flats for 144,000 people, plus 870,000 sqm of commercial floor area.

"It will greatly help solve the current shortage of housing," said Financial Secretary Paul Chan. Besides this, the government's 10-year housing strategy aims to provide land for 28,000 public flats annually, alongside 18,000 private homes.

Following Chinese President Xi Jinping's call on Hong Kong to provide "more decent" homes for the poor, the HK government has recently unveiled a HK$26.4 billion (US$3.39 billion) light housing project that plans to build about 30,000 temporary apartments over the next five years. This will give people an option to move out of cramped quarters, like the city's infamous "coffin homes", while waiting for public housing. However, the new scheme has faced public backlash because of its high cost, and it is seen as merely a band-aid solution to the city's festering housing crisis.

In September 2025, the HK government released its Long Term Housing Strategy (LTHS) Annual Progress Report 2025, setting its 10-year supply target at 420,000 units. The estimate closely aligns with the projected gross housing demand of 419,100 units over the same timeframe. This goal includes a target of 294,000 units for public housing and 126,000 units for private housing.

"Since the LTHS annual update in 2018, we have revised the public/private split of the new housing supply from 60:40 to 70:30. Balancing the Government's commitment to substantially increase the public housing supply to meet the social demand and the demand for private housing, the Government will maintain the public/private split of the new housing supply of 70:30 for the next 10-year period from 2026-27 to 2035-36. Accordingly, out of the total housing supply target of 420 000 units, the public housing supply target will be 294 000 units and the private housing supply target will be 126 000 units," a spokesman for the Housing Bureau said.

"In the LTHS Annual Progress Report 2024, we announced that the public housing supply would be planned with a gradual move towards a 60:40 ratio between public rental housing (PRH)/Green Form Subsidised Home Ownership Scheme (GSH) units and other subsidised sale flats (SSF). To increase home ownership opportunities for citizens, the Government will continue to advance in this direction in the next decade. Correspondingly, the public housing supply target of 294 000 units will comprise 176 000 PRH/GSH units and 118 000 other SSF units," added the spokesman.

At the same time, the Housing Bureau has unveiled four key directions for future housing policy:

- Encourage citizens to move up the housing ladder.

- Optimize the use of existing public housing resources.

- Further enhance construction cost-effectiveness and ensure the smooth implementation of public housing programmes.

- Implement the regulatory regime on Basic Housing Units.

Some development projects are also underway that could dramatically increase the city's housing stock.

"Two major projects could add substantially to Hong Kong's housing stock. The "Northern Metropolis," virtually adjacent to neighboring Shenzhen, would add more than 900,000 new housing units over the next two decades, with a target of more than 40% to be completed by 2032," said the 2025 edition of the Demographia International Housing Affordability report. "Another project, Lantau Vision Tomorrow, would add more than 200,000 new housing units on reclaimed islands near Hong Kong International Airport. This significant addition of housing units could moderate Hong Kong's still-high housing costs."

The total housing stock stood at 1,291,956 units in 2024, up by only 1.7% from the previous year, according to the RVD.

By property class:

- Class A (properties with an area of 40 sqm and below): 419,027 units, up by 2.4% from a year earlier

- Class B (40 to 69.9 sqm): 617,894 units, up by 1.6% from a year ago

- Class C (70 to 99.9 sqm): 155,088 units, up by a meager 0.6% y-o-y

- Class D (100 to 159.9 sqm): 70,982 units, up by 1.4% from a year ago

- Class E (160 sq. m. and above): 28,965 units, up by 1.6% from the previous year

Rental Market:

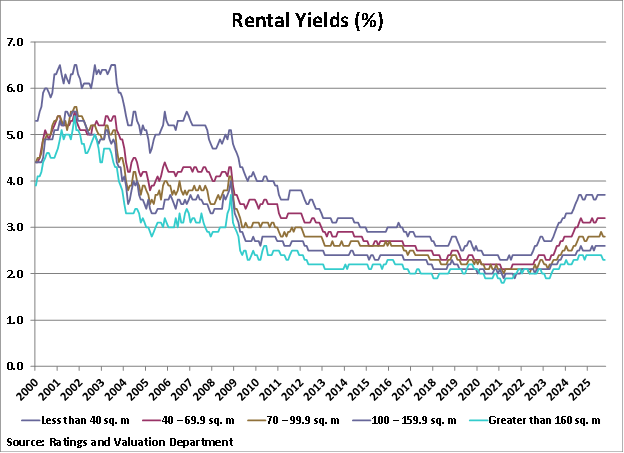

Rental yields gradually increasing, but still low by international standards

While Hong Kong's rental yields are gradually rising, they remain extremely low by international standards, which can be attributed to the surge in property prices in the past decade. Hong Kong is not a 'typical' market. It is a place where the rich choose to park assets in the form of apartments, as part of a diversified asset-safeguard strategy, like Monaco and Singapore. Such markets typically have lower rental yields than more 'normal' housing markets.

Rental yields in Hong Kong in October 2025:

- Property Class A (properties with an area of 40 sq. m. and below) rental yields were 3.7%, up from 3.6% a year ago and 3.1% two years earlier, according to figures from RVD.

- Property Class B (40 to 69.9 sq. m.) rental yields stood at 3.2%, up from 3.1% in the previous year and 2.7% two years ago.

- Property Class C (70 to 99.9 sq. m.) rental yields averaged 2.8%, unchanged from the previous year but higher than the 2.4% recorded two years ago.

- Property Class D (100 to 159.9 sq. m.) rental yields averaged 2.6%, up from 2.5% in October 2024 and from 2.3% in October 2023.

- Property Class E (160 sq. m. and above) rental yields were 2.3%, slightly down from 2.4% in the previous year but up from 2.2% two years ago.

This is supported by the recent research conducted by the Global Property Guide, which showed that the average gross rental yield in Hong Kong stood at 3.9% in Q2 2025, up from 3.88% in Q4 2024, 3.52% in Q3 2024, 3.54% in Q2 2024, and 3.39% in Q1 2024.

By major areas:

- In New Territories, gross rental yields for apartments ranged from 2.69% to 4.56% in Q2 2025, with a city average of 3.72%.

- In Kowloon, apartments offer gross rental yields between 2.49% and 4.89%, with a city average of 4.13%.

- In Hong Kong Island, gross rental yields ranged from 3.61% to 4.35% in Q2 2025, with an average of 3.9%.

- In the Outlying Islands, gross rental yields ranged from 3.66% to 4.01% in Q2 2025, with a city average of 3.84%.

Residential rental rates movements

Rental rates in Hong Kong are on the rise overall, though the pace of growth differs significantly depending on the property's location and size.

Hong Kong's rent price index:

Note: Hong Kong's Rent Price Index, % change 1 yr

Data Source: Rating and Valuation Department.

In October 2025:

- Rents for apartments smaller than 40 sqm were up by 2.5% from a year earlier, to an average of HK$ 497 (US$ 64) per sqm per month.

- Rents for 40-69.9 sqm apartments rose by 6% y-o-y, to an average of HK$ 426 (US$ 55) per sqm per month.

- Rents for 70-99.9 sqm apartments rose by 1.8% y-o-y, to an average of HK$ 449 (US$ 58) per sqm per month.

- Rents for 100-159.9 sqm apartments increased by 4.8% y-o-y, to an average of HK$ 455 (US$ 59) per sqm per month.

- Rents for apartments larger than 160 sqm were up strongly by 11% y-o-y, to reach an average of HK$ 484 (US$62) per sqm per month.

| AVERAGE RENTS, OCTOBER 2025 | ||||||

| Property size | Average rents (per sqm) | Year-on-year change | ||||

| Hong Kong | Kowloon | New Territories | Hong Kong | Kowloon | New Territories | |

| HKD (USD) | HKD (USD) | HKD (USD) | % | % | % | |

| Less than 40 sqm | 497 ($64) | 474 ($61) | 335 ($43) | 2.5 | 5.8 | 3.7 |

| 40 sqm - 69.9 sqm | 426 ($55) | 379 ($49) | 285 ($37) | 6.0 | 4.1 | 5.6 |

| 70 sqm - 99.9 sqm | 449 ($58) | 414 ($53) | 290 ($37) | 1.8 | 13.1 | 3.2 |

| 100 sqm - 159.9 sqm | 455 ($59) | 364 ($47) | 245 ($32) | 4.8 | -0.3 | 1.7 |

| Greater than 160 sqm | 484 ($62) | 424 ($55) | 221 ($28) | 11.0 | -2.8 | -10.2 |

| Sources: Ratings and Valuation Department (RVD), Global Property Guide | ||||||

Mortgage Market:

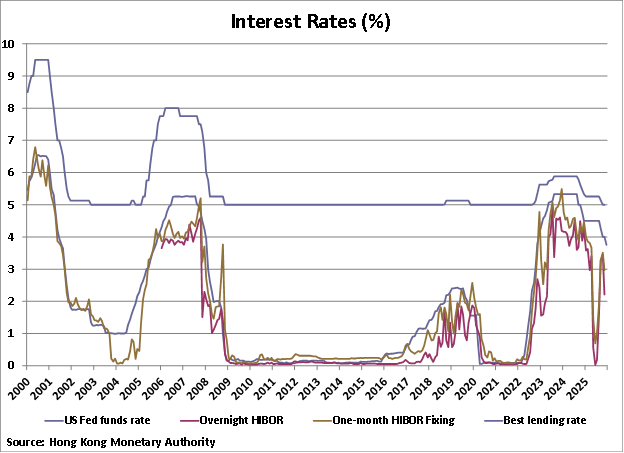

Interest rates declining

In its December 2025 meeting, the HKMA reduced its base rate to 4.00%, following the U.S. Federal Reserve's decision to cut its fed funds rate by 25 basis points to 3.75%. It is now the Fed's third consecutive rate cut in the past four months.

The HKMA moves in lockstep with the Fed, giving the local currency's peg to the US dollar.

"Following the 25-basis-point downward adjustment in the target range for the US federal funds rate on 10 December (US time), 50 basis points above the lower end of the prevailing target range for the US federal funds rate is 4.00%, while the average of the five-day moving averages of the overnight and one-month HIBORs is 2.39%. The Base Rate is therefore set at 4.00% according to the pre-set formula," said the HKMA.

The recent move came after HKMA Chief Executive Eddie Yue noted that Hong Kong's residential property market has shown signs of stabilization, although the commercial real estate sector remains under pressure.

Hong Kong's currency has been pegged at around HK$7.8 per U.S. dollar since October 1983, so when the US Federal Reserve interest rates move, so do Hong Kong's interest rates.

Prior to this, the base rate was cut five times from September 2024 to October 2025, after it was kept unchanged at 5.75% from July 2023 to August 2024, as inflationary pressures eased.

As such, major banks' best lending rates have been continuously declining in Hong Kong. In December 2025, HSBC Holdings PLC announced that its best lending rate remains unchanged at 5.00%. The bank's best lending rate was last changed in October 2025, when it was cut by 12.5 basis points.

Hang Seng Bank and Bank of China (Hong Kong) also maintained their Hong Kong dollar prime lending rate at 5.00% in December 2025. Other major lenders, including Standard Chartered, Bank of East Asia, and Shanghai Commercial Bank, kept their lending rate at 5.25% over the same period.

Fixed-rate mortgage scheme converted from pilot to permanent program

At the height of the Covid-19 pandemic, the Hong Kong Mortgage Corporation Limited (HKMC) introduced a pilot scheme for fixed-rate mortgages for 10, 15, and 20 years to reduce homebuyers' risks from interest rate volatility, thereby improving the banking sector's long-run stability. The maximum loan amount for residential mortgages under the scheme is HK$10 million (US$1.28 million). At the end of the fixed-rate period, the borrower has the option to re-fix the mortgage rate or convert it to a floating-rate loan.

In October 2021, HKMC announced that the scheme would be converted from a pilot program into a permanent offering starting from November 1, 2021.

"Proposed in the 2020-21 Budget, the Fixed-rate Mortgage Scheme has approved loans totaling around HK$400 million in the past year and a half. This reflects a certain market demand for fixed-rate mortgage products," said Financial Secretary Paul Chan. "The scheme has filled a market gap, and its permanent offer will continue to provide an alternative financing option to homebuyers for mitigating their risks arising from interest rate volatility, thereby enhancing banking stability in the long run."

The fixed interest rates per annum under the scheme, which was maintained until January 2022, were as follows:

| FIXED-RATE MORTGAGE PILOT SCHEME | |||

| Fixed-rate period | Gross Mortgage Rate (GMR) | Full/Partial Prepayment Penalty (% of the Prepaid Amount) | |

| Fixed interest rate | GMR after the fixed-rate period | ||

| 10-year | 1.99% | The then prevailing fixed mortgage rate or Hong Kong Prime Rate minus 2.35% | 1st year: 3% 2nd year: 2% 3rd year: 1% |

| 15-year | 2.09% | ||

| 20-year | 2.19% | ||

| Source: HKMC | |||

After that, the new rates are announced monthly. Currently, the new fixed interest rates are as follows, based on the HKMC website:

- For 10-year mortgage loans: 4.00%

- For 15-year mortgage loans: 4.15%

- For 20-year mortgage loans: 4.30%

The application period is from November 6, 2025, until further notice. The drawdown period is within two months upon receipt of the application by the bank.

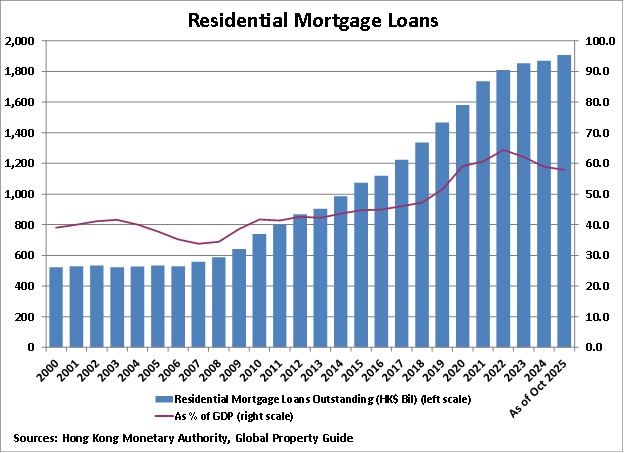

New mortgage lending rising strongly

New residential mortgage loans approved rose sharply by 52.7% to 6,305 in October 2025, as compared to 4,130 in the same period last year, according to HKMA figures. Likewise, the value of newly approved residential mortgage loans soared by 65.2% y-o-y to HK$31.34 billion (US$4.03 billion) in October 2025.

The secondary market accounted for about a 54.9% share of all new mortgage loans approved during the period. The primary market and refinancing accounted for 35.3% and 9.8%, respectively.

As such, the value of mortgage loans outstanding increased by 1.8% to HK$ 1.91 trillion (US$245.29 billion) in October 2025 from a year earlier, following growth of 0.8% in 2024, 2.5% in 2023, 4.2% in 2022, 9.8% in 2021, 7.8% in 2020, and 9.8% in 2019, based on figures from the HKMA.

The average loan-to-value (LTV) ratio of newly approved loans stood at 61.5% in October 2025, down from 62.2% in the previous month but higher than the 60.5% recorded a year earlier.

Over the same period, the mortgage delinquency ratio remained low at about 0.09% to 0.13%, while the rescheduled loan ratio was unchanged at 0.00%.

Though relative to GDP, the size of the mortgage market continues to shrink. This suggests that the economy is expanding at a faster pace than the mortgage sector. During 2024, the mortgage market was equivalent to about 58.9% of GDP, down from around 62.2% in 2023 and 64.4% in 2022 but still far higher than the 43.6% a decade ago.

Socio-Economic Context:

Economic outlook improving

Hong Kong's service-oriented economy grew by a modest 2.5% in 2024 from a year earlier, following an expansion of 3.2% in 2023 and a contraction of 3.7% in 2022. To boost economic activity, the HK government unveiled a number of measures in the past two years, including offering cash handouts to residents, cutting the salaries tax, and attracting more workers and foreign investments.

In the third quarter of 2025, the HK economy expanded by 3.8% from a year earlier, following year-on-year growth of 3.1% in Q2 2025, 3% in Q1 2025, 2.5% in Q4 2024, and 1.9% in Q3 2024, underpinned by a sustained surge in exports and ongoing expansion in domestic demand. according to data released by the government. It is now the eleventh consecutive quarter of year-on-year growth.

In Q3 2025:

- Private consumption increased by 2.1%, an improvement from the previous quarter's 1.9% growth.

- Government spending rose by 1.9%, slightly down from the previous quarter's 2.5% expansion.

- Overall investment climbed by 4.3%, an acceleration from a 1.9% increase in the previous quarter.

- Goods exports grew by 12.1%, driven by strong demand for electronics and easing US-China trade tensions, while services exports rose 6.1% on higher inbound tourism and solid financial market activity. Imports increased more slowly, with goods up 11.7% and services up 2.6%.

On a seasonally adjusted quarter-on-quarter basis, real GDP expanded by 0.7% in Q3 2025, an improvement from a meager growth of 0.4% in the previous quarter and a contraction of 0.1% in the same period last year.

"The Hong Kong economy staged a robust performance in the third quarter of 2025, driven by a continued surge in exports and sustained expansion in domestic demand. Real GDP grew by 3.8% over a year earlier in the third quarter, picking up visibly from the 3.1% growth in the preceding quarter," said the HK government.

With improved performance, the HK government has recently revised its forecast for real GDP growth upwards to 3.2% for the whole year of 2025, from its earlier projection of 2% to 3%.

"Looking ahead, the Hong Kong economy should see further solid growth for the rest of 2025. Sustained moderate growth of the global economy in the near term, coupled with easing China-US trade tensions of late and persistent demand for electronics-related products, should lend support to Hong Kong's exports of goods. Continued increases in inbound tourism and vibrant financial market activities should provide further impetus to exports of services," said the HK government.

"Domestically, the renewed US interest rate cuts since September are conducive to asset market sentiment. The Government's various measures to develop the economy and diversify markets will also provide support," added the HK government.

The HK economy suffered greatly for most of 2019 from social unrest as well as the US-China trade tensions, and for the whole year of 2020 from the COVID-19 pandemic. In 2020, real GDP contracted by about 6.5% from a year earlier, following a decline of 1.7% in 2019. When the first COVID-19 case was detected in January 2020, the HK government immediately rolled out social distancing measures and travel restrictions, putting further strain on the already ailing economy.

Prior to these, the HK economy had been growing by an annual average of 3.8% from 2000 to 2018.

Inflationary pressures remain manageable. In November 2025, overall inflation was 1.2%, unchanged from the previous month but still slightly down from 1.4% a year earlier, according to the Census and Statistics Department. Faster increases in food and transport prices, together with a smaller decline in clothing and footwear costs, were counterbalanced by slower price growth in miscellaneous services and a further decrease in electricity, gas, and water prices.

As a result, the HK government recently revised down its 2025 forecasts for underlying and headline inflation to 1.2% and 1.5%, respectively, from earlier projections of around 1.5% and 1.8%.

"Looking ahead, overall inflation should remain modest in the near term, as cost pressures on the domestic and external fronts are still broadly in check," said the statistics authority.

Hong Kong's inflation rate averaged 3.3% from 2010 to 2019 before slowing sharply to 0.25% in 2020. Then inflation rose again to 1.6% in 2021, 1.9% in 2022, and 2.1% in 2023. Inflation eased to 1.7% in 2024.

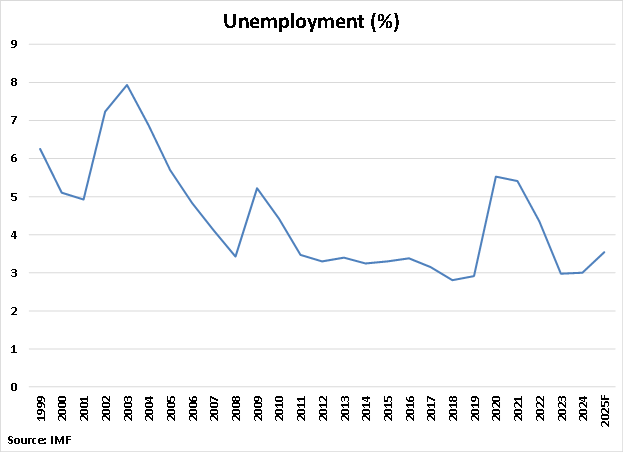

The labor market is weakening. In the three months ending November 2025, the seasonally-adjusted unemployment rate stood at 3.8%, unchanged from the previous period but higher than the 3.1% recorded in the same period last year, based on figures from the Census and Statistics Department. It remains the second-highest level seen in over three years.

The total number of unemployed persons reached 144,400 in the September-November 2025 period, down by approximately 5,200 from 149,600 in August-October 2025. The number of underemployed persons during the latest period was 60,900, almost at par with the previous period.

Tourism sector shows continued improvement

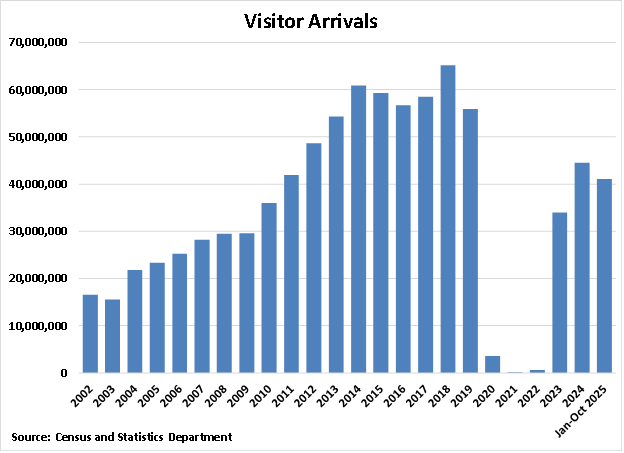

Tourism continues to recover. During 2024, the total number of visitor arrivals in Hong Kong reached 44.5 million people, up by a huge 30.9% from the prior year, according to figures from the Hong Kong Tourism Board (HKTB). Around 76.5% of the total arrivals came from Mainland China.

Despite the recent surge, the figures remained about 32% lower compared to the record-high 65.1 million arrivals registered in 2018.

In the first ten months of 2025, visitor arrivals rose further by 11.9% to almost 41.1 million people as compared to the same period last year.

Visitors from Mainland China, who accounted for 76.6% of total arrivals in Jan-Oct 2025, increased strongly by 10.8% y-o-y to more than 31.4 million people.

In September 2025, the average hotel room occupancy rate stood at 83%, down from 90% in the previous month but slightly up from 81% in the same period last year, according to the Culture, Sports and Tourism Bureau.

Tourist arrivals averaged about 56 million people annually from 2011 to 2019. However, tourism became almost nonexistent in the following three years due to pandemic-related travel restrictions. Arrivals dropped to 3.57 million people in 2020, and then to just 91,398 people in 2021 and 604,564 people in 2022. In 2023, the tourism sector showed considerable improvements, registering visitor arrivals of 34 million people. The tourism sector has been continuously improving since.

Sources:

- Property Market Statistics (Rating and Valuation Department): https://www.rvd.gov.hk/

- Demographia International Housing Affordability 2025 Edition (Chapman University): https://www.chapman.edu/

- Cost of Living City Ranking 2024 (Mercer): https://www.mercer.com/

- UBS Global Real Estate Bubble Index 2025: Dubai and Madrid with the strongest bubble risk increase (UBS): https://www.ubs.com/

- Countercyclical macroprudential measures for property mortgage loans (Info.gov.hk): https://www.info.gov.hk/

- New measures with effect from 17 September 2025 (New Capital Investment Entrant Scheme Office): https://www.newcies.gov.hk/

- LegCo passes stamp duty bill to ease burden on HK low-end home buyers (China Daily): https://www.chinadailyhk.com/

- Government welcomes passage of Stamp Duty (Amendment) Bill 2025 (The Government of the Hong Kong Special Administrative Region): https://www.info.gov.hk/

- Hong Kong Budget 2024: Extra stamp duties axed in bid to revive housing market (Hong Kong Free Press): https://hongkongfp.com/

- Scrapping Hong Kong property curbs will not lead to an overheated market or encourage speculation, the government says (South China Morning Post): https://www.scmp.com/

- Hong Kong slashes stamp duties, easing property curbs for the first time in over 10 years (CNBC): https://www.cnbc.com/

- How Hong Kong homebuyers have seen their purchasing power shrink by HK$1 million since January (South China Morning Post): https://www.scmp.com/

- Hong Kong in Figures 2025 (Census and Statistics Department): https://www.censtatd.gov.hk/

- Hong Kong Steps Up Efforts to Fix Housing Crisis After Xi Push (Bloomberg): https://www.bloomberg.com/

- Government releases Long Term Housing Strategy Annual Progress Report 2025 (Government of the Hong Kong Special Administrative Region): https://www.info.gov.hk/

- Housing strategy report updated (News.gov.hk): https://www.news.gov.hk/

- Gross rental yields in Hong Kong: Kowloon and 3 other areas (Global Property Guide): https://www.globalpropertyguide.com/

- Adjustment of Base Rate (Hong Kong Monetary Authority): https://www.hkma.gov.hk/

- HSBC maintains its best lending rate at 5.00 per cent in Hong Kong (HSBC): https://www.about.hsbc.com.hk/

- Six major Hong Kong banks keep prime rates unchanged despite HKMA base rate cut (South China Morning Post): https://www.scmp.com/

- Permanent Offer of Fixed-rate Mortgage Scheme (Hong Kong Monetary Authority): https://www.hkma.gov.hk/

- Fixed Rate Mortgage Scheme (Hong Kong Mortgage Corporation): https://www.hkmc.com.hk/

- Residential Mortgage Survey Results for October 2025 (Hong Kong Monetary Authority): https://www.hkma.gov.hk/

- Monthly Statistical Bulletin (December 2025 - Issue No. 376) (Hong Kong Monetary Authority): https://www.hkma.gov.hk/

- Hong Kong Prime Lending Rate (Trading Economics): https://tradingeconomics.com/

- Unemployment and underemployment statistics for September - November 2025 [16 Dec 2025] (Census and Statistics Department): https://www.censtatd.gov.hk/

- Table 510-60001: Consumer Price Indices (October 2019 - September 2020 = 100) (Census and Statistics Department): https://www.censtatd.gov.hk/

- Latest Developments Gross Domestic Product and its major components (The Government of the Hong Kong Special Administrative Region): https://www.hkeconomy.gov.hk/

- Economy rises 3.8% in Q3 (News.gov.hk): https://www.news.gov.hk/

- Economic performance in the third quarter of 2025 and latest GDP and price forecasts for 2025 (The Government of the Hong Kong Special Administrative Region): https://www.info.gov.hk/

- Tourism (Census and Statistics Department): https://www.censtatd.gov.hk/

- Table 650-80001: Visitor arrivals by nationality/region (Census and Statistics Department): https://www.censtatd.gov.hk/

- Hotel room occupancy rate (Data.gov.hk): https://data.gov.hk/