Property Investment in Colombia: Foreigner’s Guide (2025)

Colombia’s expanding economy, burgeoning tourism industry, and ongoing infrastructure upgrades have made the country one of Latin America’s top foreign real estate investment destinations. Colombia’s major metropolitan areas offer a mix of modern amenities, beautiful scenery, and mild temperatures – all at relatively low property prices and rising rental yields. Additionally, foreigners are given the same property ownership rights as citizens, making Colombia an increasingly popular choice for international investors.

This newly updated 2025 edition guide will take you through the basic steps and important things to consider when buying property in Colombia as a first-time foreign buyer.

12 Things to Know Before Buying a Property in Colombia

- Can Foreigners Buy Property in Colombia

- Best Cities and Regions to Invest

- Square Meter / Square Foot Prices

- Median Asking Prices

- Rental Yields and Rents

- Market Performance (Past and Present)

- Landlord and Tenant Laws

- Property Related Taxes

- Buying (and Selling) Costs

- Short-Term Rental Regulations

- Mortgage and Financing Options

- How to buy property in Colombia: step-by-step

1) Can Foreigners Buy Property in Colombia?

Yes, Colombia’s government provides foreign investors with the same property purchasing rights as residents, making it easier to buy Colombian property compared to some other countries.

Investors do not have to be Colombian citizens, but they will likely need to get a Colombian Tax ID to buy property and pay property taxes.

Colombia also offers a Golden Visa (Visa M) to some qualifying real estate investors who purchase property worth at least 350 times the current minimum wage (around $120,000 USD as of August 1, 2025). The Golden Visa offers several enhanced benefits for those looking to permanently work or reside in Colombia.

2) Best Regions and Cities to Invest

The following cities in Colombia offer diverse real estate opportunities, ranging from cosmopolitan urban living and luxury developments to cultural hubs and innovation-driven centers, each aligned with different investor profiles and lifestyle preferences.

Bogotá

As the capital and economic center of Colombia, Bogotá is the country’s most important real estate market. Neighborhoods like Chapinero, Usaquén, and Chicó are highly sought after for their combination of business activity, cultural vibrancy, and upscale housing. The city’s strong rental demand, international presence, and role as a financial hub make it an attractive destination for both residential and commercial investors.

Medellín

Known for its transformation into one of Latin America’s most innovative cities, Medellín has become a key spot for property investment. Areas such as El Poblado and Laureles attract both locals and international buyers due to their modern infrastructure, lifestyle amenities, and mountain views. The city’s focus on technology, entrepreneurship, and urban planning adds long-term value for investors seeking growth potential.

Cartagena

As Colombia’s most iconic coastal city, Cartagena offers a unique blend of colonial charm and luxury beachfront developments. The historic walled city and neighborhoods like Bocagrande and Manga are popular for high-end residential and vacation properties. Strong tourism and a growing demand for short-term rentals make Cartagena particularly appealing to investors focused on hospitality and holiday housing.

Cali

Renowned as Colombia’s cultural and entertainment capital, Cali presents an emerging market for real estate investment. Districts such as Ciudad Jardín and Granada are known for their residential appeal, nightlife, and dining options. With its expanding middle class and increasing business activity, Cali offers opportunities for long-term investors seeking both rental yields and capital appreciation.

Barranquilla

Situated on the Caribbean coast, Barranquilla has become an economic hub for trade, logistics, and industry. The city’s growing middle-class population and expanding infrastructure projects support a rising demand for modern housing. Areas like Alto Prado and Villa Santos are popular among professionals and families, making Barranquilla a city with strong potential for both residential and commercial investment.

3) Square Meter / Square Foot Prices

Colombia’s square meter prices are some of the lowest in Latin America and have been slowly dropping over the past several months. The following prices are as of Q1 2025:

- Medellin - $1,582 per m²

- Bogotá - $1,653 per m²

4) Median Asking Prices

Colombia’s median asking prices for a one-bedroom apartment are moderate compared to other Latin American countries. Average costs by area are as follows as of July 2025:

- Medellin - $128,000

- Cartagena- $109,000

- Santa Marta - $103,000

- Bogotá - $84,000

- Pereira - $76,000

- Cali - $71,000

- Barranquilla - $68,000

- Bello - $47,000

5) Rental Yields and Rents

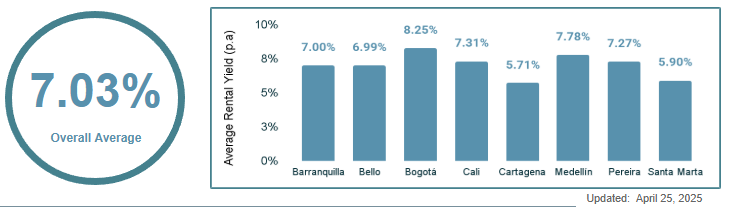

Colombia has some of the highest rental yields in Latin America, especially in Bogotá, which is a major financial, cultural, and economic hub.

In most areas across the country, rentals with more bedrooms have higher yields than studio or one-bedroom properties. For example, in April 2025, Bogotá’s one-bedroom apartments averaged 7.19% yields while 4+ bedroom apartments yielded an average of 9.32%. The highest average yield was in Cali (all locations), where three-bedrooms averaged 9.94%, but one-bedrooms were only at 4.84%.

As of April 2025, rental yields for one-bedroom properties in Colombia’s major cities were approximately as follows:

- Bogotá - 7.19%

- Medellin - 6.67%

- Cali - 4.84%

- Barranquilla - 6.82%

- Cartagena - 7.50%

- Pereira - 6.00%

- Bello - 6.60%

- Santa Marta - 6.05%

Colombia's rent price index:

Data Source: OECD.

6) Market Performance (Past and Present)

From 2005 through 2015, Colombia’s housing market experienced rapid growth thanks to a rising economy, increased urban development, and increased government housing programs – especially in major cities like Bogotá, Medellín, and Cali. Demand for new construction surged after banks made it easier to obtain mortgages, and low-to-middle income subsidies were introduced. These combined factors drew foreign investors, and property prices steadily increased.

From the mid-2000s through the mid-2010s, Colombia’s housing market saw rapid growth fueled by a rising economy, expanding urban development, and supportive government housing programs – especially in major cities like Bogotá, Medellín, and Cali. Demand for new construction surged after banks made mortgages more accessible and low-to-middle-income subsidies were introduced. These factors attracted foreign investors, driving steady property price increases. By the late 2010s, however, oversupply in some markets began to slow growth, particularly in larger urban centers.

The COVID-19 pandemic caused the market to temporarily slow down. In 2022, Colombia began offering a digital nomad visa (“Visa V Nómadas Digitales”), allowing remote workers to live in the country for up to two years without having to work for a Colombian company. The influx of remote workers has led to increased rental demand and higher rental rates.

Today’s Colombian market has not only rebounded, but now offers some of the highest rental yields in Latin America – especially in big cities like Bogotá and Cali.

Colombia's house price annual change:

Data Source: Banco de la Republica Colombia.

7) Landlord and Tenant Laws

Columbia’s laws between landlords and tenants are judged by the Global Property Guide to be pro-tenant. Columbian laws provide strong protections for tenants, especially related to lease terms and eviction policies.

Two important laws state that rental rates cannot be higher than 1% of the property’s commercial value, and security deposit requirements are not allowed. However, landlords do have rights when it comes to breach of contract and non-payment.

8) Property Related Taxes

Colombia’s tax system is complex.

Foreigners are taxed on all income earned within Colombia, and married couples are taxed separately. Tax brackets are measured in Tax Units (TU), which are adjusted annually. TUs are based on a sliding scale ranging from 0% to 39%. Rental income is taxed at a flat 39%.

A 3.5% withholding tax is also applied to rental income as an advanced payment, but can often be credited back against annual tax liability, which equates to income minus relevant expenses.

Capital gains taxes on real estate vary by the holding period. Property that is held for over two years is taxed at a flat 10% rate. Foreign-owned properties that are sold within two years, however, are taxed at 35%. In either case, acquisition costs, ownership transfer fees, and improvements can be deducted from the selling price.

Colombia’s Industry and Commerce Tax applies to any gross income generated by activities connected to real estate. Tax rates vary by the municipality and type of business, typically ranging from 0.2% to 1.38%. This tax can be deducted from income taxes.

Individuals whose wealth is over a certain amount are also subject to an annual wealth tax.

Corporations are taxed at a flat 35% rate.

9) Buying (and Selling) Costs

Colombia’s transaction costs are some of the lowest in Latin America. On top of the purchase price, buyers should expect to pay up to an additional 2.15% (not counting travel expenses) and sellers up to 4%.

Here's a full breakdown:

| Transaction Costs | ||

| Who Pays? | ||

| Property Transfer Tax | 0.50% - 1.00% | buyer |

| Legal Fees | 0.50% - 1.00% | buyer |

| Notary Fees | 0.15% | buyer |

| Real Estate Agent Fee | 3.00% - 4.00% (+16% VAT) | seller |

| Costs Paid by Buyer | 1.15% - 2.15% | |

| Costs Paid by Seller | 3.00% - 4.00% | |

| ROUNDTRIP TRANSACTION COSTS | 4.15% - 6.15% | |

| Source: Global Property Guide, PWC | ||

10) Short-Term Rental Regulations

Short-term rentals are allowed in Colombia, but they are regulated.

All short-term rental properties must be registered in Colombia’s National Tourism Register (Registro Nacional de Turismo [RNT]). Registration is done online – taking about five days for approval – and must be renewed every year.

Additionally, records of all short-term rental guests must be documented in Colombia’s Tarjeta de Registro de Alojamiento (Accommodation Registration Card). This helps local authorities keep up with renters and ensure they are complying with tourist regulations.

For condominium rentals less than 30 days, the property’s deed must explicitly state that short-term rentals are allowed.

11) Mortgage and Financing Options

Although some Colombian banks will not offer mortgages to non-resident foreigners, others will – especially those with good credit, strong financial standing, and a large down payment. Most banks require a higher down payment for foreign buyers – averaging 30% to 40% of the property’s value, with loan terms up to 20 years.

In some situations, property developers have special in-house financing programs for foreigners. These options often have higher interest rates but less stringent requirements. The terms are significantly shorter, often five years or less.

12) How to Buy Property in Colombia: Step-by-Step

- Open a Colombian Bank Account: A Colombian bank account is usually required when applying for a mortgage from a Colombian bank or when transferring a large amount of money for a property purchase. To deter money laundering, many banks do not allow wire transfers for the first six months. For that reason, those seriously considering purchasing property in Colombia may want to open an account even before searching for property.

- Research Pricing, Rental Yields, and Market Trends: Colombia’s average property prices are lower than many parts of Latin America, and its yields are higher – making it an attractive market for investors. In many areas, larger, multi-bedroom properties produce higher yields, likely due to higher demands for long-term shared living spaces. As international tourism in Colombia has skyrocketed, the need for short-term rentals has also increased significantly and is expected to continue growing at 6.12% annually.

- Research and Find Property: When searching for property, online real estate sites such as FincaRaíz (Colombia’s largest listing platform), Metrocuadrado, and Properati can help get you started. Colombia does not require working with a real estate professional, but it’s highly recommended. Because real estate agents and attorneys do not have to undergo the same level of training and licensing required in some more developed countries, working with vetted, reputable professionals is essential. Talk to your agent about varying local neighborhoods, as crime rates, amenities, and expat communities can vary significantly, even from block to block.

- Hire a Bilingual Real Estate Attorney: This is imperative, especially as Colombia’s title histories can be incomplete or inaccurate, and issues like unpaid debts can transfer with the property.

Paperwork will likely be in Spanish, so if you do not speak the language fluently, it’s critical to have a reputable attorney who can help you navigate through the legal system, review contracts, and perform due diligence. - Verify Property Title and History: Your attorney will request the property’s Certificado de Tradición y Libertad from the local registry. This title document discloses the ownership history, any existing liens, mortgages, legal disputes, or other red flags. Title searches are especially important in Colombia, where regulations are less diligent than in many other countries. Colombia’s antiquated title system is decentralized and inconsistent, which can make it harder to get reliable records, especially outside of urban areas. Colombia’s decentralized system relies on notaries and registries, which are often not digitized, so each record must be carefully reviewed.

- Get a Colombian Tax ID: You must have a Colombian tax identification number (NIT) before you can purchase property. Your NIT is required for registering the property in your name and for paying taxes. The NIT can take anywhere from a few days to a few weeks to receive.

- Make an Offer and Sign a Promissory Contract: Once an offer is made and accepted, both parties sign the Contrato de Promesa de Compraventa. This promissory contract outlines the terms of the sale and sets a timeline for completion. Contracts also usually have a clause stating the sale is conditional on the property being free of title or other liability issues, which are somewhat common in Colombia.

- Conduct Due Diligence: Your attorney or notary will continue the due diligence process to ensure that there are no ownership disputes, check for liens or other obstacles, and make sure the title is clear and can be legally transferred. Rushing this step can lead to major legal and financial problems. In addition to a thorough title search, your real estate attorney will verify other important factors like property tax payment history, unpaid utilities, zoning regulations, and other encumbrances.

- Transfer Funds: Colombia requires bringing funds from another country through an authorized foreign exchange agent.

- Sign the Final Purchase Contract: The property transfer officially takes place at a notary’s office, where both parties sign the deed and pay any applicable taxes or other fees.

- Register the Property with the Local Registry: The deed must be submitted to the local Office of Public Instruments (Oficina de Registro de Instrumentos Públicos) before the sale is official. Registration typically takes one to two weeks.

Timeline: Expect 2 to 6+ months.

Need Help?

Buying property in a foreign country can feel overwhelming, but we're here to help.

At Global Property Guide, we offer:

- Data-backed insights on property prices, rental yields, and taxes

- Country-specific legal and tax guidance through our partner network

- Pre-screened investment properties, including income-generating Airbnb units

- 1-on-1 consultations with real estate experts focused on international buyers

- Step-by-step buyer support, from due diligence to closing

Whether you're looking for your first investment in Colombia or expanding your international portfolio, we can help you make smart, secure decisions.

Contact our team or book a free consultation to get started.