New Zealand Residential Real Estate Market Analysis 2025

After a downturn, housing prices in New Zealand are now showing signs of stabilization. This recovery is supported by lower borrowing costs and gradually improving consumer confidence, while rental inflation slows against the backdrop of falling net migration.

This extended overview from Global Property Guide covers key aspects of New Zealand’s housing market and takes a closer look at its most recent developments and long-term trends.

Table of Contents

- Housing Market Snapshot

- Historic Perspective

- Demand Highlights

- Supply Highlights

- Rental Market

- Mortgage Market

- Socio-Economic Context

Housing Market Snapshot

After a sharp boom during the COVID-19 pandemic and a subsequent downturn, residential property prices in New Zealand are showing signs of stabilization. This recovery is being supported by easing borrowing costs and gradually improving consumer confidence. As of Q1 2025, the House Price Index (HPI) reported by the Reserve Bank of New Zealand (RBNZ) remained in negative territory, recording a 1.82% year-on-year drop. However, the pace of decline has moderated compared to the most recent market trough.

According to the Real Estate Institute of New Zealand (REINZ), the median national house price in June 2025 stood at NZD 770,000 (USD 464,087), remaining flat in year-on-year terms. Excluding Auckland, the median price rose by 1.7% to NZD 691,500 (USD 416,774), while Auckland's median price fell 3.4% over the year to NZD 990,000 (USD 596,683).

New Zealand's house price annual change:

Data Source: Reserve Bank of New Zealand.

Regional disparities persisted, with ten of the sixteen regions reporting an annual increase in median house prices. The most pronounced growth was recorded in West Coast, where prices surged 35.5% year-on-year from NZD 310,000 (USD 186,840) to NZD 420,000 (USD 253,138). Southland reached a new record, with its median house price climbing to NZD 502,500 (USD 302,862) - the first regional record high since January.

"We're seeing a market that is steady on the surface but with some movement underneath at a regional level. The unchanged national median price suggests stability, yet this reflects contrasting regional dynamics, with some areas experiencing renewed growth year-on-year," said REINZ Chief Executive Lizzy Ryley.

Median house price, by region:

| Region | Median House Price, June 2025, NZD |

Median House Price, June 2025, USD |

YoY, % |

| Northland | NZD 635,000 | USD 382,721 | 0.8% |

| Auckland | NZD 990,000 | USD 596,683 | -3.4% |

| Waikato | NZD 735,000 | USD 442,992 | 3.5% |

| Bay of Plenty | NZD 822,000 | USD 495,428 | 5.1% |

| Gisborne | NZD 587,000 | USD 353,791 | -4.6% |

| Hawke's Bay | NZD 700,000 | USD 421,897 | 5.7% |

| Taranaki | NZD 620,000 | USD 373,680 | -0.8% |

| Manawatū-Whanganui | NZD 530,000 | USD 319,436 | -2.3% |

| Wellington | NZD 760,000 | USD 458,060 | -4.4% |

| Tasman | NZD 739,000 | USD 445,403 | 2.3% |

| Nelson | NZD 700,000 | USD 421,897 | 8.0% |

| Marlborough | NZD 750,000 | USD 452,033 | 21.0% |

| West Coast | NZD 420,000 | USD 253,138 | 35.5% |

| Canterbury | NZD 675,000 | USD 406,829 | -2.2% |

| Otago | NZD 720,000 | USD 433,951 | 15.0% |

| Southland | NZD 502,500 | USD 302,862 | 14.5% |

| New Zealand | NZD 770,000 | USD 464,087 | 0.0% |

| Note: Exchange rate as of June 2025, NZD 1 = USD 0.60271. | |||

| Data Source: Stats NZ. | |||

Looking ahead, New Zealand house prices are projected to rise steadily through 2027. A Reuters poll of 14 property analysts indicates an expected 3.8% increase in average home prices in 2025, below the 5.0% forecast reported in the February edition of the same poll. Further increases of 6.0% and 5.1% are forecast for 2026 and 2027, respectively, with anticipated monetary policy easing expected to bolster market confidence.

"There's a lot of uncertainty out there at the moment. Buyers are still a little bit more hesitant than we thought. The rebound, although it started, is not quite as strong as we had hoped for," said Jarrod Kerr, Chief Economist at Kiwibank, in an interview with Reuters. "We are pushing back our expectations for the recovery more into 2026. It's not that the story's changed, it's just that the story is being delayed."

Affordability remains a key structural challenge within New Zealand's housing market. According to the 2025 edition of the Demographia International Housing Affordability report by Chapman University, Auckland remains classified as a "severely unaffordable" market despite modest improvements in recent years. Reuters estimates suggest that nationwide home prices are approximately six times the average household income, leaving homeownership out of reach for many first-time buyers.

Nonetheless, improving borrowing conditions and stabilizing supply are creating a more favorable outlook. Nine out of eleven analysts surveyed by Reuters believe that purchasing conditions for first-time buyers will improve over the next year, while two expect conditions to worsen. "It's still difficult to get onto the housing ladder. But it was practically impossible by the end of 2021, where house prices went up 50% in two years from levels that people generally agreed were too high to start with," noted Sharon Zollner, Chief Economist at ANZ. "We haven't solved our housing affordability problem but it is easier than it was, so some first home buyers are taking advantage of this opportunity. But New Zealand house prices are still very expensive in an international comparison relative to incomes and rents."

Historic Perspective:

From Homeownership to Investment Asset - the Financialization of Housing

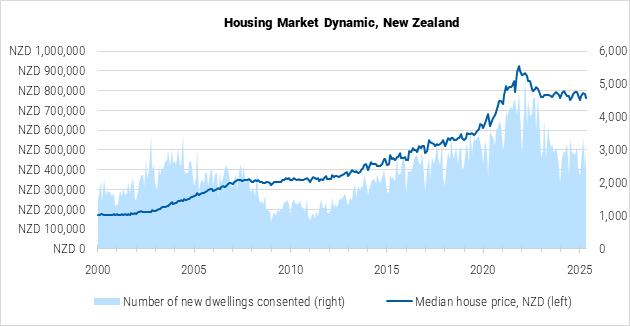

Over the past 25 years, New Zealand's residential property market has undergone exceptional growth, with the national median house price rising from approximately NZD 170,000 (USD 102,461) in 2000 to NZD 770,000 (USD 464,087) by mid-2025 - a more than fourfold increase. Over the same period, the population grew from 3.88 million to about 5.3 million, a demand surge that was not matched by a corresponding increase in construction, intensifying supply-side pressures.

Policy reforms in the 1990s had enduring effects. The Housing Restructuring and Tenancy Matters Act 1992 reduced direct state support for home ownership, encouraging greater reliance on market-based housing finance. During the global property boom preceding the Global Financial Crisis (GFC), capital increasingly flowed into housing markets, accelerating the financialization of property, from a place to live to a vehicle for investment.

Major economic disruptions further constrained supply and affordability. The 2007-2009 GFC curtailed access to credit and delayed new developments, while the 2011 Christchurch earthquakes and the COVID‑19 pandemic introduced additional supply shocks and delays. Throughout this period, interest rates remained structurally lower than in prior decades, allowing households to take on more debt, even as wage growth consistently lagged behind property price appreciation.

These trends have widened wealth disparities and intensified concerns about intergenerational equity. Home ownership has become increasingly unattainable for many younger New Zealanders, while property has continued to serve as a dominant investment channel. This dynamic has contributed to growing perceptions that wealth accumulation is increasingly tied to land ownership.

A range of policy interventions have been introduced over the years, including tighter loan-to-value (LVR) restrictions, the bright-line test on capital gains, limits on foreign ownership, and initiatives to fast-track urban development. However, these efforts have delivered only modest improvements, as the fundamental imbalances between supply and demand remain unresolved.

Experts broadly agree that meaningful progress requires long-term, bipartisan planning and a revitalized public sector role in housing. Reforms to planning and zoning regulations, improved construction sector productivity, and the promotion of a wider mix of housing tenures will be essential to restoring affordability and accessibility across New Zealand's housing market.

25-year housing market dynamic (median house price vs number of new dwellings consented), New Zealand:

Data Sources: Stats NZ, REINZ.

Demand Highlights:

Confidence Returns Amid Lower Interest Rates and Gradual Recovery

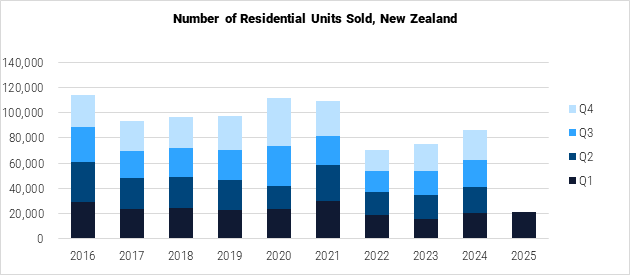

According to the latest data from the RBNZ, a total of 21,108 residential property sales were registered across the country in the first quarter of 2025. This represents a 3.01% increase compared to the same period in 2024 and marks the eighth consecutive quarter of positive growth since Q1 2023. "Clearly confidence levels are growing, no doubt reflecting the falls in mortgage rates," commented CoreLogic NZ Chief Property Economist Kelvin Davidson.

Data Source: Stats NZ.

More recent figures from REINZ further confirm the sustained momentum in the housing market. In June 2025, the number of properties sold nationwide rose by 20.3% year-on-year, increasing from 4,877 to 5,865. At the regional level, Gisborne recorded the largest annual increase at 70.0%, with sales rising from 20 to 34. Strong growth was also observed in Southland (+34.9%), Bay of Plenty (+33.3%), and Marlborough (+32.7%).

On a quarterly basis, REINZ data shows that 19,986 residential units changed hands between April and June, reflecting a 15.35% increase from the same period in 2024. While this annual growth appears significant, it is measured against a relatively low base year, when transaction volumes were well below historical norms. "The market isn't booming, but clearly a bit more confidence is returning," experts from Cotality commented.

Residential sales, by region:

| Residential Sales, Jun 2025 |

YoY, % (Jun 2025 vs Jun 2024) |

Residential Sales, Apr-Jun 2025 |

YoY, % (Apr-Jun 2025 vs Apr-Jun 2024) |

|

| Auckland Region | 1,774 | 17.80% | 6,010 | 12.55% |

| Rest of the country | 4,091 | 21.36% | 13,976 | 16.59% |

| New Zealand | 5,865 | 20.26% | 19,986 | 15.35% |

| Data Sources: Global Property Guide, based on monthly figures from REINZ. | ||||

Looking ahead, demand expectations remain broadly optimistic. According to the latest CBRE survey of property valuation professionals conducted in mid-June 2025, all respondents anticipate that demand will either remain stable or increase over the next 12 months, with falling interest rates cited as a key driver of market recovery. However, compared to the previous survey in Q1 2025, expectations of future demand growth have moderated. "Declining interest rates remain a demand driver however, it appears that cyclically high unemployment and mortgage stress are a headwind on broader market activity," stated the report.

Supply Highlights:

Residential Pipeline Stabilizes Amid Post-Boom Adjustment

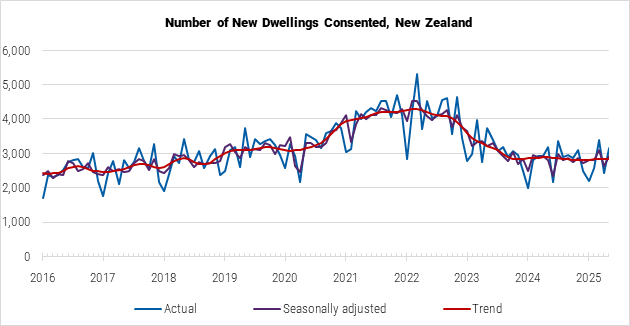

New Zealand's residential construction sector continues to recalibrate following the post-pandemic building boom. According to data from Statistics New Zealand (Stats NZ), 3,151 new dwellings were consented for construction in May 2025, representing a marginal year-on-year decline of 0.76%. The 12-month rolling average fell to 33,530 dwellings, down 3.79% compared to the year ended May 2024.

These figures reflect a continued moderation from the peak of 51,015 dwellings consented in the year ended May 2022. However, the pace of decline has eased in recent months. "While consent numbers fell sharply after that peak, they have leveled out over the past year," noted Michelle Feyen, economic indicators spokesperson at Stats NZ.

Data Source: Stats NZ.

On a regional level, the strongest growth in new dwelling consents was recorded in Otago (37.25%), Taranaki (27.51%), and Tasman (15.73%). In contrast, Marlborough (-34.80%), Northland (-27.19%), and Gisborne (-21.58%) experienced the most pronounced declines.

Number of new dwellings consented, by region:

| Region | New Dwellings Consented, May 2025, annualized |

YoY, % |

| Northland | 731 | -27.19% |

| Auckland | 13,864 | -4.31% |

| Waikato | 2,876 | -9.16% |

| Bay of Plenty | 1,446 | -10.85% |

| Gisborne | 149 | -21.58% |

| Hawke's Bay | 664 | -4.46% |

| Taranaki | 482 | 27.51% |

| Manawatū-Whanganui | 1,111 | -0.80% |

| Wellington | 1,851 | -15.60% |

| Tasman | 309 | 15.73% |

| Nelson | 219 | -5.19% |

| Marlborough | 178 | -34.80% |

| West Coast | 201 | 0.50% |

| Canterbury | 6,501 | -3.72% |

| Otago | 2,616 | 37.25% |

| Southland | 330 | -9.59% |

| New Zealand | 33,528 | -3.79% |

| Data Source: Stats NZ. | ||

According to the latest National Construction Pipeline Report, which provides a six-year outlook for national building and construction activity, total construction volumes are expected to decline further in 2025 before returning to growth in 2026 and trending upward through 2029, supported by a recovery in residential demand. Nearly 200,000 new homes are projected to be consented over the forecast period, with over 40% anticipated to be multi-unit dwellings. Regionally, the Waikato/Bay of Plenty area is expected to see the fastest growth in new consents, with a projected increase of 60% between 2024 and 2029.

Rental Market:

Rental Inflation Slows as Migration Gains Fall

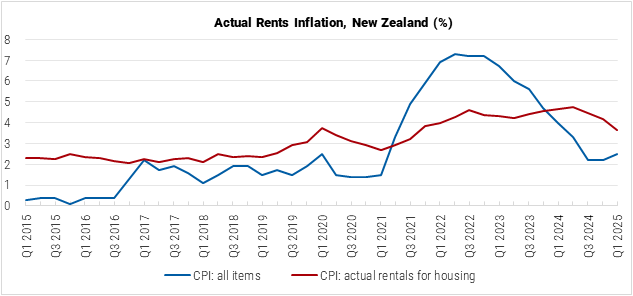

After reaching its peak level of 4.8% in Q2 2024, rental inflation in New Zealand has slowed, but continues to trend above the overall price growth in the country. In Q1 2025, the actual rentals for housing component of the consumer price index (CPI) registered a 3.7% year-on-year increase against a 2.5% annual increase in the all-items CPI.

New Zealand's rent price index:

Data Source: Stats NZ.

"Turning to rents, the pace of growth remains subdued, with net migration having fallen a long way from its peak, and the stock of available rental listings on the market still elevated," Cotality explained. "There's also a constraint on how much further rents can rise anyway, given that their level is already high in relation to households' incomes."

This view is supported by local real estate experts from Bayleys. "Net migration gains continue to ease, with the trend particularly noticeable in the Auckland region, where new arrivals typically settle first," noted their Q2 2025 residential investment update. "This coincides with a period of rising vacancy rates and a clear softening in rental growth."

In the year to May 2025, Stats NZ reported an estimated net migration gain of 14,808, which was about 82% below the levels observed during the same period last year and 85% below the comparable 2023 level. The drop was tied not only to lower arrival numbers, but also, provisionally, the highest on record number of migrant departures for an annual period.

Data Source: Stats NZ.

In nominal terms, the mean weekly rent in New Zealand for the year to April 2025 reached NZD 574 (USD 333), according to the figures from the Ministry of Business, Innovation & Employment (MBIE). Regionally, the highest weekly rent level was reported in Auckland (NZD 631 / USD 366). West Coast (NZD 394 / USD 229) stayed notably more affordable than other submarkets, but showed the most pronounced annual increase in the mean rent (8.4%).

Mean weekly rent for the year, by region:

| Region | Mean Weekly Rent, NZD Year to April 2025 |

Mean Weekly Rent, USD Year to April 2025 |

YoY Year to April 2025 vs Year to April 2024 |

| Auckland | NZD 631 | USD 366 | 0.9% |

| Northland | NZD 522 | USD 303 | 0.2% |

| Waikato | NZD 523 | USD 304 | 5.0% |

| Bay of Plenty | NZD 599 | USD 348 | 2.1% |

| Gisborne | NZD 561 | USD 326 | 1.7% |

| Hawke's Bay | NZD 582 | USD 338 | 4.1% |

| Manawatu-Wanganui | NZD 491 | USD 285 | 4.1% |

| Taranaki | NZD 538 | USD 312 | 3.9% |

| Wellington | NZD 587 | USD 341 | 0.9% |

| Marlborough | NZD 506 | USD 294 | 2.4% |

| Nelson | NZD 497 | USD 289 | 3.5% |

| Tasman | NZD 535 | USD 311 | 2.0% |

| Canterbury | NZD 515 | USD 299 | 2.7% |

| Otago | NZD 567 | USD 329 | 7.1% |

| Southland | NZD 425 | USD 247 | 6.2% |

| West Coast | NZD 394 | USD 229 | 8.4% |

| New Zealand | NZD 574 | USD 333 | 2.1% |

| Note: Exchange rate as of April 2025, NZD 1 = USD 0.58056. | |||

| Data Source: MBIE. | |||

In their most recent overview of the rental market, the local listing platform Trade Me Property also notes a substantial cooling trend for asking rents, with median weekly rents based on current listings actually in decline in most regions of New Zealand. According to the platform's assessment, the supply-demand equation is pushing prices down. Commenting on the latest developments, Trade Me Property spokesperson Casey Wylde said: "The easing of rental prices, coupled with increased listings and less competition, is creating a more favorable environment for renters, offering them more choice and potentially better negotiating power."

The ongoing adjustments in sales and rental price trends reflect in estimated levels of gross rental yields for residential properties in the country. Global Property Guide research conducted in July 2025 found residential yields in New Zealand at the average level of 3.99%, down from 4.21% previously reported in December 2024 and 4.31% in May 2024.

Mortgage Market:

Lower Interest Rates Environment Boosts Demand for Loans

Continuing the monetary policy easing cycle, in May 2025, the RBNZ lowered its official cash rate (OCR) to 3.25%, bringing the key rate down by a total of 225 bps since the beginning of the cycle last August. "The New Zealand economy is recovering after a period of contraction," the central bank's governor, Christian Hawkesby, commented on the decision. "High commodity prices and lower interest rates are supporting overall economic activity."

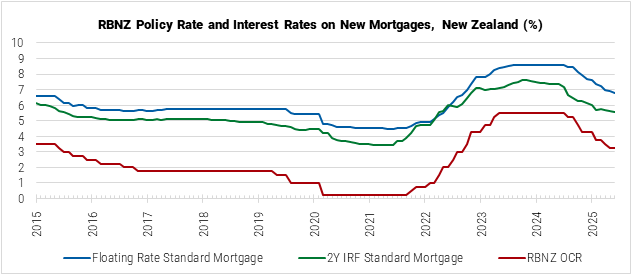

New Zealand's mortgage loan interest rates:

Data Source: Reserve Bank of New Zealand.

As was widely expected, in June and July the regulator maintained the OCR at the same level; however, most economists believe the cuts are to resume later this year. The forecasts see the rate eventually drop to a low of 2.5%.

Data Source: RBNZ.

In line with relaxing monetary policy, interest rates on new residential mortgages in New Zealand have also continued to decrease from peak levels observed in 2023-2024. In June 2025, the RBNZ reported the average floating rate on standard mortgages at 6.79%, notably down from 8.61% a year ago and 8.45% two years prior. A similar trend was also observed for interest rates with varying initial rate fixation (IRF) periods.

After additional cuts to the OCR, mortgage rates are expected to fall further. With the end of the easing cycle anticipated relatively soon, however, other factors impacting average interest rate levels might become more relevant. "Mortgage rates could also fall a bit further in the medium term, but it might now be about bank competition rather than lower policy rates from the RBNZ," said the latest market overview from Cotality.

Average interest rates on new standard residential mortgages:

| June 2025 | YoY | June 2024 | YoY | June 2023 | |

| Floating rate | 6.79 | ↓ | 8.61 | ↑ | 8.45 |

| IRF 6 months | 5.85 | ↓ | 7.76 | ↑ | 7.40 |

| IRF 1 year | 5.56 | ↓ | 7.60 | ↑ | 7.35 |

| IRF 2 years | 5.59 | ↓ | 7.35 | ↑ | 7.15 |

| IRF 3 years | 5.59 | ↓ | 6.99 | ↑ | 6.70 |

| IRF 4 years | 5.93 | ↓ | 6.99 | ↑ | 6.80 |

| IRF 5 years | 6.00 | ↓ | 6.98 | ↑ | 6.78 |

| Data Source: RBNZ. | |||||

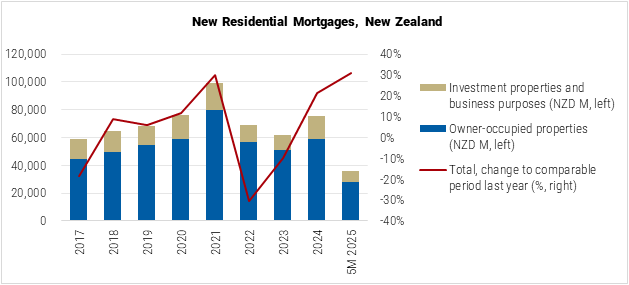

Cuts to the OCR and corresponding drops in mortgage interest rates have improved loan affordability and strengthened household demand for this category of credit. "Banks noted an uptick in residential mortgage demand, including early signs of renewed interest from property investors, following lower lending rates," said the results of the Credit Condition Survey published by the RBNZ.

According to the publication, the increase in residential mortgage lending (both investor and owner-occupied) was observed for the first time since 2021. At the same time, the surveyed banks noted that while the market sentiment is gradually improving, the impact from the lower interest rate environment will take time to fully materialize, as the overall economic environment remains challenging.

In the first five months of 2025, over 93,000 new residential mortgages amounting to NZD 35.6 billion (USD 21.1 billion) were drawn, based on the RBNZ figures, the total value of new lending showing a 30.0% increase compared to the same period in 2024. About 78% of the new lending was represented by loans to owner-occupiers, with the remaining 22% of credit taken for investment properties and other business purposes.

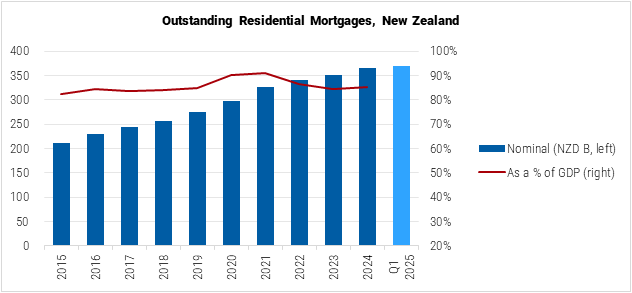

Data Source: RBNZ.

The total value of outstanding residential mortgages in New Zealand continues to grow, although the market has been expanding at a slower pace since 2022. According to the RBNZ reporting, in Q1 2025, the mortgage stock reached NZD 370.3 billion (USD 212.0 billion), demonstrating a 4.6% increase since the same period last year. The relative size of the market, represented by the ratio of outstanding mortgages to GDP at current prices, moderated from an estimated decade peak of 91.1% in 2021 to an estimated 85.1% in 2024.

Data Source: RBNZ.

Socio-Economic Context:

Recovery Underway After Technical Recession

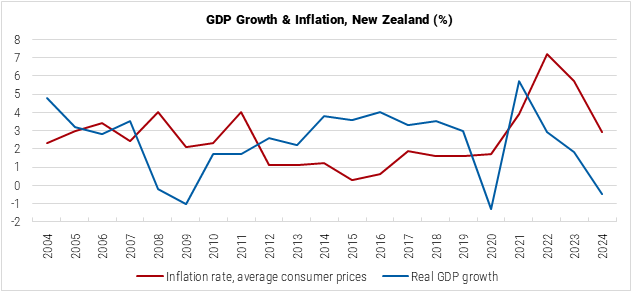

Amid tight financial conditions after a prolonged period of price pressures, the New Zealand economy faltered in 2024, with the real GDP contracting by 0.5%, investment falling by 4.1%, private consumption stagnating, and public demand softening as the government consolidated its fiscal position. According to the 2025 Article IV staff report from the International Monetary Fund (IMF), the slowdown was particularly pronounced in interest-rate-sensitive sectors, including retail trade, construction, and manufacturing.

Tight monetary policy has, however, helped bring consumer price index (CPI) inflation in the country back to target, lowering it from the peak level of 7.20% in 2022 to 2.9% in 2024. Most recently, the indicator was reported by Stats NZ at 2.5% in Q1 2025.

A gradual recovery is currently underway as monetary policy is easing again. The IMF expects the recovery to continue this year and into the next, with output gradually reaching its potential. The current forecast sees the New Zealand economy expand by 1.4% in 2025 and 2.7% in 2026. The inflation is expected to remain within the target band at around 2%.

Data Source: IMF.

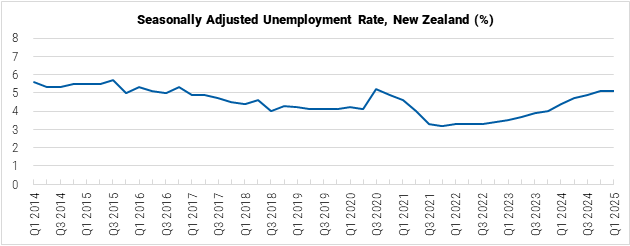

The ultra-tight conditions observed in New Zealand's labor market in the post-pandemic period have re-normalized, with the unemployment rate rising to 5.1% in Q1 2025, according to Stats NZ. Net migration remains positive, posting gains of about 14,800 in the year to May 2025 and helping support demand and address supply constraints in the labor market. However, the more detailed analysis of migration flows shows record numbers of New Zealand citizens departing the country, which, according to the IMF, is raising a risk of brain drain and skill shortages. In the year to May 2025, Stats NZ reported a net migration loss of 46,300 New Zealand citizens.

Data Source: Stats NZ.

Overall, New Zealand remains a wealthy economy with robust governance standards and policy framework. In the last six months, Moody's, S&P, and Fitch Ratings have all maintained New Zealand's sovereign credit ratings with stable outlooks.

The current period of post-contraction recovery and return to more sustainable immigration levels is seen as an opportunity for a "bold reform agenda to address medium- and long-term challenges stemming from an aging population and weak productivity growth," as noted in the IMF staff report.

While the country's economic growth is expected to return to a positive trajectory and stabilize around 2.2% over the medium term, current risks to the outlook are tilted to the downside due to elevated global uncertainty and a weak labor market. "Increased trade restrictions and high uncertainty about trade policy globally will temper external demand, confidence and the pace of the recovery," said the most recent projection note from the OECD.

Sources:

- Statistics New Zealand (Stats NZ)

- Consumers Price Index: March 2025 Quarter: https://www.stats.govt.nz/

- Building Consents Issued: May 2025: https://www.stats.govt.nz/

- International Migration: May 2025: https://www.stats.govt.nz/

- Aotearoa New Zealand's Population Passes 5.3 Million People: https://www.stats.govt.nz/

- Labor Market Statistics: March 2025 Quarter: https://www.stats.govt.nz/

- Reserve Bank of New Zealand (RBNZ)

- Housing (M10): https://www.rbnz.govt.nz/

- Exchange and Interest Rates: https://www.rbnz.govt.nz/

- Monetary Policy Statement May 2025: https://www.rbnz.govt.nz/

- The Official Cash Rate (OCR): https://www.rbnz.govt.nz/

- Lending and Monetary Statistics: https://www.rbnz.govt.nz/

- Credit Conditions Survey Results, March 2025: https://www.rbnz.govt.nz/

- Ministry of Business, Innovation & Employment (MBIE)

- National Construction Pipeline Report 2024: https://www.mbie.govt.nz/

- Weekly Rent in New Zealand: https://webrear.mbie.govt.nz/

- Real Estate Institute of New Zealand (REINZ)

- New Zealand Property Report - June 2025: https://www.reinz.co.nz/

- International Monetary Fund (IMF)

- Country Overview: New Zealand: https://www.imf.org/

- 2025 Article IV Staff Report: https://www.imf.org/

- Organization for Economic Co-operation and Development (OECD)

- OECD Economic Outlook, Volume 2025 Issue 1: https://www.oecd.org/

- Cotality

- Monthly Housing Chart Pack - June 2025: https://www.cotality.com/

- Monthly Housing Chart Pack - April 2025: https://www.cotality.com/

- Bayleys

- Q2 2025 Residential Investment Update: https://cms-cdn.bayleys.co.nz/

- CBRE

- Q2 Residential Valuer Insights: https://mktgdocs.cbre.com/

- Chapman University

- Demographia International Housing Affordability, 2025 Edition: https://www.chapman.edu/

- Trade Me Property

- Rental Price Index - June 2025: https://www.trademe.co.nz/

- Reuters

- New Zealand Home Prices to Rise 3.8% in 2025 as Rate Cuts Support the Market - Reuters Poll: https://www.reuters.com/

- The New Zealand Herald

- OCR Decision: Reserve Bank Keeps Official Cash Rate on Hold at 3.25%: https://www.nzherald.co.nz/

- OneRoof

- How Did NZ House Prices Quadruple In The Space Of 25 Years?: https://www.oneroof.co.nz/

- NZ Adviser

- Home Building Slows Across New Zealand in May: https://www.mpamag.com/