The United States Residential Property Market Analysis 2025

Sales and rental segments of the American housing market are stabilizing, with moderation in price growth signaling broader market adjustment driven by persistently elevated mortgage rates and cautious buyer behavior against the background of heightened macroeconomic uncertainty.

This extended overview from Global Property Guide covers key aspects of the US housing market and takes a closer look at its most recent developments and long-term trends.

Table of Contents

- Housing Market Snapshot

- Historic Perspective

- Demand Highlights

- Supply Highlights

- Rental Market

- Mortgage Market

- Socio-Economic Context

Housing Market Snapshot

US home prices are beginning to stabilize, signaling a broader market adjustment shaped by persistently high mortgage rates and increasingly cautious buyer behavior. While home values continue to appreciate, the pace of growth is moderating. The S&P CoreLogic Case-Shiller Index, the most widely followed benchmark of US home prices, reported a 3.88% year-over-year increase in February 2025 on a seasonally adjusted basis, or 1.02% in real terms (adjusted for inflation).

"Even with mortgage rates remaining in the mid-6% range and affordability challenges lingering, home prices have shown notable resilience," commented Nicholas Godec, Head of Fixed Income Tradables & Commodities at S&P Dow Jones Indices. "Buyer demand has certainly cooled compared to the frenzied pace of prior years, but limited housing supply continues to underpin prices in most markets. Rather than broad declines, we are seeing a slower, more sustainable pace of price growth."

The United States house price annual change:

The 10-City and 20-City Composite indices continued to reflect annual growth, although at a slightly slower rate than in the previous month. In February 2025, the 10-City Composite posted a 5.18% year-over-year increase, down from 5.39% in January, while the 20-City Composite recorded a 4.50% gain, compared to 4.72% in the prior month.

Among the 20 major metro areas, New York, Chicago, and Cleveland led with annual price increases of 7.70%, 6.96%, and 6.58%, respectively. Nine cities outperformed the national average growth rate of 3.89%. At the other end of the spectrum, Denver and Dallas posted the weakest gains at 1.59% and 0.89%, while Tampa stood out as the only metro to record a year-over-year price decline (-1.46%).

S&P CoreLogic Case-Shiller Home Price Indices in 20 metro areas:

| Metro Area | February 2025 YoY, % |

February 2025 5Y annualized, % |

Metro Area | February 2025 YoY, % |

February 2025 5Y annualized, % |

|

| Atlanta | 2.49% | 9.63% | Miami | 2.93% | 12.18% | |

| Boston | 5.91% | 8.79% | Minneapolis | 3.05% | 5.88% | |

| Charlotte | 3.11% | 10.74% | New York | 7.70% | 9.46% | |

| Chicago | 6.96% | 8.30% | Phoenix | 2.32% | 10.39% | |

| Cleveland | 6.58% | 8.76% | Portland | 2.08% | 6.25% | |

| Dallas | 0.89% | 8.76% | San Diego | 2.75% | 10.65% | |

| Denver | 1.59% | 7.05% | San Francisco | 3.08% | 5.86% | |

| Detroit | 5.76% | 8.29% | Seattle | 4.95% | 8.54% | |

| Las Vegas | 4.90% | 8.84% | Tampa | -1.46% | 10.59% | |

| Los Angeles | 4.45% | 8.90% | Washington, D.C. | 4.57% | 7.08% | |

| Data Source: S&P Dow Jones Indices & CoreLogic. | ||||||

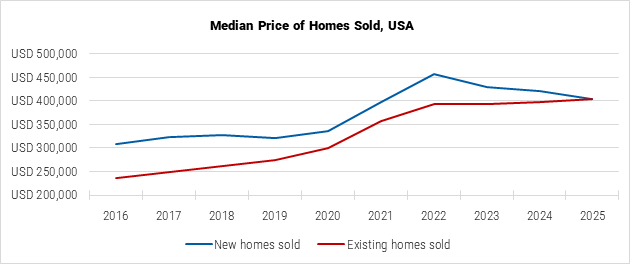

As of March 2025, the median price of newly sold homes declined 7.52% year-over-year to USD 403,600, according to data from the US Census Bureau. In contrast, the National Association of Realtors (NAR) reported a 2.75% year-over-year increase in the median price of existing homes sold, bringing the figure to USD 403,700. Looking ahead, the NAR projects a 3% rise in the median existing home price in 2025, accelerating slightly to 4% in 2026.

The traditional price gap between new and existing homes has nearly disappeared. According to the National Association of Home Builders (NAHB), this trend is largely driven by tight inventory in the existing home market, as many homeowners who locked in low mortgage rates during the pandemic are reluctant to sell amid today's higher interest rates. At the same time, new home prices remain more volatile, fluctuating based on the types of homes being constructed and their geographic locations.

Note: 2025 data is as of March 2025.

Data Source: National Association of Homebuilders (NAHB) based on the compilation of data from the US Census Bureau and the NAR.

Market expectations remain cautiously optimistic. According to a recent Reuters survey of housing analysts, US home prices are expected to continue rising modestly this year and into 2026, supported by anticipated interest rate cuts rather than a significant expansion in housing supply. "We expect home prices to continue rising, but at a more moderate rate than recently," said Sal Guatieri, Senior Economist at BMO Capital Markets. "This just reflects our view, the housing market will slowly pick up as mortgage rates decline in response to anticipated Fed easing later this year and through next year."

The median forecast from 27 analysts predicts that home prices, as measured by the S&P CoreLogic Case-Shiller 20-City Composite Index, will rise by 3.6% in 2025, followed by increases of 3.3% and 3.5% in 2026 and 2027, respectively.

Historic Perspective:

From Speculative Boom to Affordability Crisis

The US housing market has experienced significant shifts over the past two decades, characterized by a major boom, a severe downturn, and a complex recovery. The market peaked in 2006, driven by speculative buying, easy credit, and robust economic conditions. However, the subprime mortgage crisis triggered a collapse in 2008, leading to a sharp decline in home values, widespread foreclosures, and a deep recession. Housing starts and completions fell to historic lows, reflecting a surplus of unsold homes and reduced demand as unemployment spiked and access to credit tightened. By 2012, home values were down significantly, with the 10-city and 20-city S&P CoreLogic Case-Shiller composite indices showing over 35% drops compared to the peak of 2006.

The market began a gradual recovery, supported by low interest rates, an improving economy, and demographic factors like the entry of millennials into the housing market. As the labor market stabilized, housing demand increased, and new construction gradually rose, with annual housing starts surpassing one million by 2014. The COVID-19 pandemic in 2020 unexpectedly intensified housing demand, as remote work fueled interest in larger suburban homes. By 2021, housing authorizations reached the highest levels since the early 2000s.

This pandemic-driven boom, however, was followed by a rapid cooling as the Federal Reserve raised interest rates in 2022 to control inflation. Higher mortgage rates reduced affordability, limiting demand and causing housing starts to fall back. Rising home prices have made homeownership increasingly challenging, especially for younger and lower-income buyers. Many have turned to renting, putting upward pressure on rental markets. Affordability has become a pressing issue, with policymakers facing demands to address the challenges through zoning reform, incentives for affordable housing, and support for first-time buyers.

As of early 2025, affordability remains a key concern. Although mortgage rates have eased from their recent highs, they continue to hover around the mid-6% range, keeping monthly payments elevated by historical standards relative to household incomes. At the same time, ongoing supply constraints - driven in part by existing homeowners' reluctance to relinquish low pandemic-era mortgage rates - continue to outweigh subdued demand, contributing to a gradual upward trajectory in home prices.

The S&P CoreLogic Case-Shiller Index:

| Index | 2006 Peak | 2012 Through | Current | |||||

| Level | Date | Level | Date | From Peak, % | Level | From Trough, % | From Peak, % | |

| National | 184.61 | Jul-06 | 133.99 | Feb-12 | -27.4% | 324.92 | 142.5% | 76.0% |

| 20-City | 206.52 | Jul-06 | 134.07 | Feb-12 | -35.1% | 335.08 | 149.9% | 62.3% |

| 10-City | 226.29 | Jul-06 | 146.45 | Feb-12 | -35.3% | 354.26 | 141.9% | 56.6% |

| Data Source: S&P Dow Jones Indices & CoreLogic. | ||||||||

Data Source: US Census Bureau.

Demand Highlights:

Resale Market Cools Under Interest Rate Pressure; New Home Sales Supported by Strategic Price Cuts

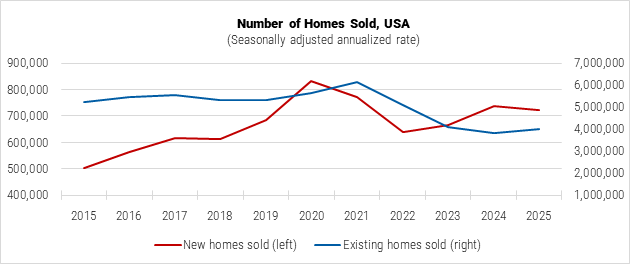

Persistently high mortgage rates, elevated home prices, and widespread affordability challenges continued to keep many prospective buyers on the sidelines, leading to a slow start for existing home sales in 2025 despite a modest recovery in late 2024. In March, sales of existing homes declined by 2.4% year-on-year to a seasonally adjusted annual rate (SAAR) of 4.02 million. "Home buying and selling remained sluggish in March due to the affordability challenges associated with high mortgage rates. Residential housing mobility, currently at historic lows, signals the troublesome possibility of less economic mobility for society," commented NAR Chief Economist Lawrence Yun.

John Sim, Head of Securitized Products Research at J.P. Morgan, emphasized that the weakness in the existing home market remains largely driven by interest rates: "The situation is not going to change until we get mortgage rates back down toward 5%, or even lower. And we aren't forecasting mortgage rates to breach 6% in 2025 <…> Based on this, demand [for existing homes] looks set to remain at exceptionally low levels."

In contrast, new home sales have shown more resilience. According to the US Census Bureau, sales of newly built single-family homes rose by 6.0% year-on-year in March 2025, reaching a SAAR of 724,000 units. This uptick is widely attributed to price cuts and various incentives offered by homebuilders seeking to manage inventory.

"With the pool of inventory refilling closer to typical levels, more builders are cutting their prices <…> giving buyers negotiating leverage and supporting [new] home sales through this bumpy period for the economy. The size of those price cuts is smaller than last year, signaling they are strategic moves rather than desperate ones," noted experts from Zillow. Assuming mortgage rates remain relatively steady, new home sales are expected to end 2025 higher than last year.

Note: 2025 data is as of March 2025.

Data Source: National Association of Homebuilders (NAHB) based on the compilation of data from the US Census Bureau and the NAR.

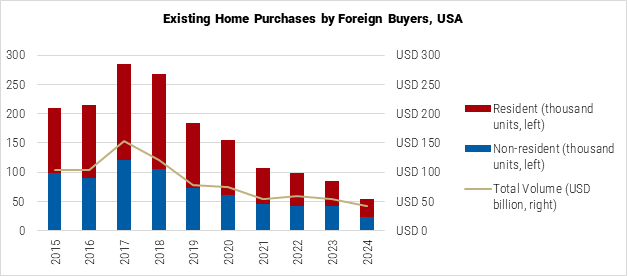

Foreign buyer activity in the secondary sales market has also weakened considerably. According to the latest annual data from the NAR, foreign purchases of existing US homes fell sharply between April 2023 and March 2024. During this period, international buyers acquired 54,300 properties, down 36.5% year-over-year and marking the lowest level since NAR began tracking in 2009. "The strong US dollar <…> makes US homes much more expensive for foreigners," said NAR Chief Economist Lawrence Yun. "Therefore, it's not surprising to see a pullback in US home sales from foreign buyers. Historically low housing inventory and escalating prices remain significant factors."

Foreign buyer dollar volume dropped by 21.2% to USD 42.0 billion, although the average purchase price increased by 21.9% to USD 780,300 due to rising property values. Resident foreign buyers - including recent immigrants and visa holders - accounted for USD 22.6 billion (a 3.4% decline) and made up 54% of total foreign transactions. Non-resident buyers purchased USD 19.4 billion worth of existing homes, representing a 35% year-on-year decrease in volume.

Canada was the leading country of origin for foreign buyers, making up 13% of transactions, followed by China and Mexico (11% each), India (10%), and Colombia (4%). Other key source countries included Brazil, the UK, Germany, Cuba, and Israel.

Florida remained the top destination, attracting 20% of foreign existing home purchases, followed by Texas (13%), California (11%), Arizona (5%), and Georgia (4%). Other popular locations included New Jersey, New York, North Carolina, Illinois, and Michigan.

Note: Reporting years are April through March, as specified by the NAR.

Data Source: NAR.

Supply Highlights:

Housing Construction Retreats as Market Headwinds Intensify

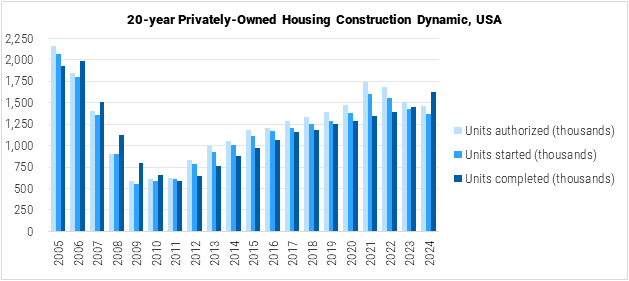

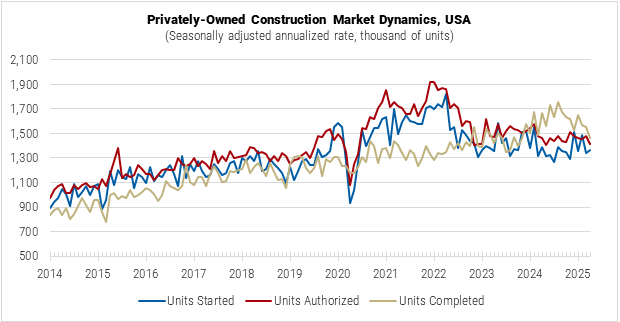

New residential construction activity declined, offering the first clear indication that the ongoing trade war is beginning to weigh on homebuilding, compounding the effects of elevated mortgage rates and weakening demand. Preliminary data from the US Census Bureau shows that privately-owned housing starts, a widely regarded barometer of the US housing market's health, fell to a seasonally adjusted annual rate (SAAR) of 1,361,000 in May 2025, marking a 1.73% year-on-year decrease.

Building permit authorizations, another forward-looking indicator of future construction, experienced a steeper drop of 3.22% to a SAAR of 1,412,000. "Many builders, like many retailers with their inventory, have been stockpiling materials in advance of tariffs being implemented, which might explain why housing starts were less affected than permits," commented experts from Realtor.com.

Reflecting the lagging impact of previously subdued permit issuances and a slower pace of new construction, the number of privately-owned housing completions declined by 12.27% year-on-year, reaching an annualized rate of 1,458,000 units.

Data Source: US Census Bureau.

The broader slowdown in new development activity is also reflected in declining builder confidence. "Elevated inventory levels and sluggish demand are keeping a lid on housing market activity in the traditionally busy spring season <…> Total homes under construction have fallen to the lowest level since August 2021. Builders are feeling the pinch from rising costs of inputs, tariff concerns, and labor shortages," said KPMG Senior Economist Yelena Maleyev.

According to preliminary results, the NAHB/Wells Fargo Housing Market Index (HMI), which measures the sentiment of US single-family homebuilders, fell sharply to 34 in May 2025, a six-point drop from the previous month and well below the neutral benchmark of 50. "Policy uncertainty stemming in large part from the stop-and-start tariff issues has hurt builder confidence, but the initial trade arrangements with the United Kingdom and China are a welcome development," said NAHB Chief Economist Robert Dietz.

Fannie Mae's latest housing market forecast projects that total housing starts will continue to decline in 2025, falling by 2.7% year-on-year to 1.33 million units, further exacerbating the long-standing supply shortage in the US housing market. Realtor.com analysts estimate that as of 2024, the country faced a deficit of 3.8 million homes due to decades of underbuilding, driving sustained pressure on home prices and affordability. "This month's new-construction data shows that the administration's trade policies will only make the supply gap worse," the experts added.

Rental Market:

Rental Inflation Stabilized, Vacancy Rates Low

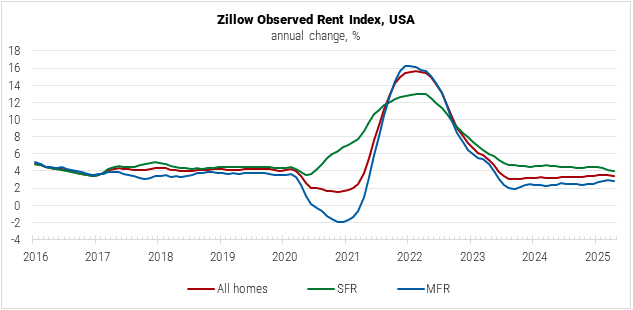

The dynamic of nationwide rental indices in recent months indicates that rental inflation in the US has generally stabilized after a period of accelerated growth and the subsequent slowdown. The rent of primary residence component of the Consumer Price Index for All Urban Consumers (CPI-U) reported by the Bureau of Labor Statistics increased by 4.0% year-on-year in April 2025, a more moderate growth compared to 5.4% reported during the same period a year earlier and the peak level of 8.8% annual growth in March 2023.

The United States rent price index:

In a similar pattern, the Zillow Observed Rent Index, compiled by the popular real estate platform, showed a 3.4% year-on-year increase in April 2025, only slightly above the 3.2% in April 2024 but significantly down from the peak level of 15.7% registered in February 2022. The single-family residential segment (SFR) continued to outpace the multifamily residential segment (MFR), the respective sub-indices registering a 4.0% and a 2.9% year-on-year increase in April 2025.

Among the 20 largest metro areas, the most pronounced annual growth was observed in Chicago (5.9%), followed by Detroit (4.9%), while rents in Denver actually decreased by 0.9% year-on-year, according to Zillow.

Data Source: Zillow.

The overall moderation of rental growth across the country is also reflected in the nationwide median asking rent for vacant units, which was reported by the US Census Bureau at USD 1,468 as of Q1 2025, virtually unchanged from USD 1,469 reported a year ago in Q1 2024. At the same time, in three out of four US macro-regions, the indicator demonstrated year-on-year decreases, with the upward dynamic reported only for the Northeast.

Median asking rent, by region:

| Median Asking Rent Q1 2025 |

Median Asking Rent Q1 2024 |

YoY Q1 2025 vs Q1 2024 |

|

| Northeast | USD 1,681 | USD 1,523 | 10.4% |

| Midwest | USD 1,201 | USD 1,244 | -3.5% |

| South | USD 1,414 | USD 1,461 | -3.2% |

| West | USD 1,777 | USD 1,855 | -4.2% |

| Data Source: US Census Bureau. | |||

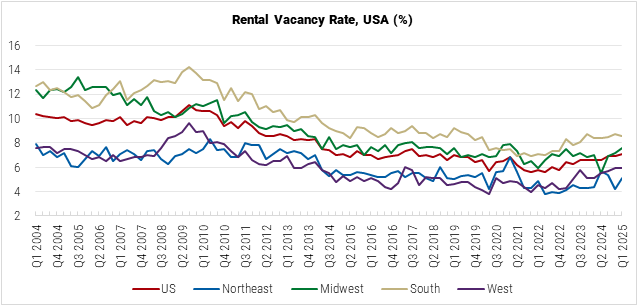

As of Q1 2025, the homeownership rate in the US stood at 65.1%, statistically unchanged from 65.5% reported during the same period a year ago, indicating a significant share of the population renting rather than owning their residences. While trending upward somewhat from the two-decade low of 5.6% observed in early 2022, the nationwide vacancy level for rental properties remains low, also pointing to consistent tenant demand. As of Q1 2025, the US Census Bureau reported a 7.1% vacancy rate for rental units across the country, with the lowest vacancy observed in the Northeast at 5.1%, followed by the West at 5.9%, while the rates for the Midwest and the South stood above the national average at 7.6% and 8.6%, respectively.

Data Source: US Census Bureau.

Mortgage Market:

Interest Rates Still Elevated, New Loan Originations Subdued

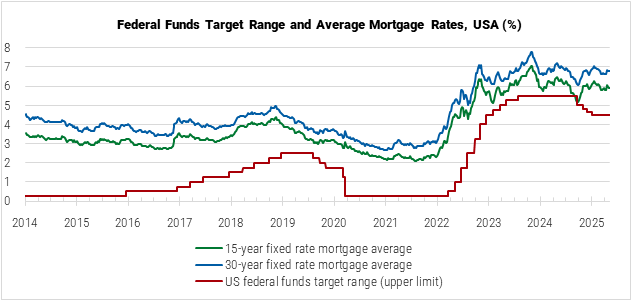

In recent months, in its monetary policy stance, the US Federal Reserve has been navigating between managing inflation and supporting economic growth amid heightened uncertainty tied to the roll-out of the new administration's domestic and international policies. Following a series of cuts in late 2024, the target range for the federal funds rate (FFTR) has been maintained at 4.25% to 4.50%, indicating the regulator's cautious approach.

The United States mortgage loan interest rates:

The May 2025 statement from the Federal Open Market Committee (FOMC) noted that while the economic activity in the country has continued to expand at a solid pace, with the unemployment rate stabilized at a low level, inflation in the country remains somewhat elevated, and the uncertainty about the economic outlook has increased. "The Committee <…> judges that the risks of higher unemployment and higher inflation have risen," said the FOMC, adding that it's prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the long-term attainment of the maximum employment and inflation at the rate of 2% goals.

With FTTR stable, the bank prime loan rate, which typically serves as a benchmark for various lending products, including adjustable-rate mortgages, has remained at 7.50% since the end of December 2024. As for the fixed-rate loans, the average interest rates on mortgages tracked by Freddie Mac have been relatively stable as well. According to the Freddie Mac weekly release, as of May 15, 2025, the average interest stood at 5.92% for 15-year fixed-rate mortgages and 6.81% for 30-year fixed-rate mortgages, both indicators slightly below what was reported a year ago, but still notably elevated compared to pre-2022 levels.

Interest rates on mortgages:

| Avg Interest Rate May 15, 2025 |

YoY | Avg Interest Rate May 16, 2024 |

YoY | Avg Interest Rate May 18, 2023 |

|

| 15-year FRM | 5.92 % | ↓ | 6.28% | ↑ | 5.75% |

| 30-year FRM | 6.81% | ↓ | 7.02% | ↑ | 6.39% |

| Data Source: Freddie Mac. | |||||

Data Sources: FRED, Freddie Mac.

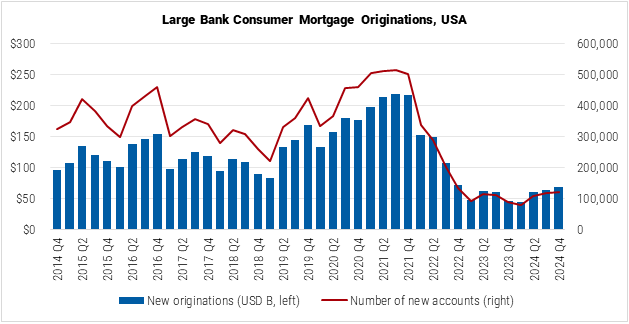

Interest rates easing from their peak levels, albeit not significantly, has supported new mortgage loan originations, which have been gradually rising since Q4 2023. Compared to pre-2022 levels, however, new lending remains notably subdued. According to the data from the Federal Reserve Bank of Philadelphia, in Q4 2024, large banks reported 121,851 new mortgage accounts with a corresponding loan value of USD 67.98 billion, compared to about 87,208 accounts (USD 45.5 billion) during the same period in 2023, and over 500,000 accounts (USD 217.5 billion) in the last quarter of 2021.

"New first-lien mortgage account originations grew for a third consecutive quarter, the longest streak since the first quarter of 2020 through the third quarter of 2021. Still, mortgage account originations were about 65 percent lower than the series average," pointed out the quarterly insights report from the Federal Reserve Bank of Philadelphia. "The size of large bank mortgages for more expensive properties is growing faster than that of the median property. <…> Growth in loan sizes is closely tied to home price appreciation over the same period."

Data Source: Federal Reserve Bank of Philadelphia.

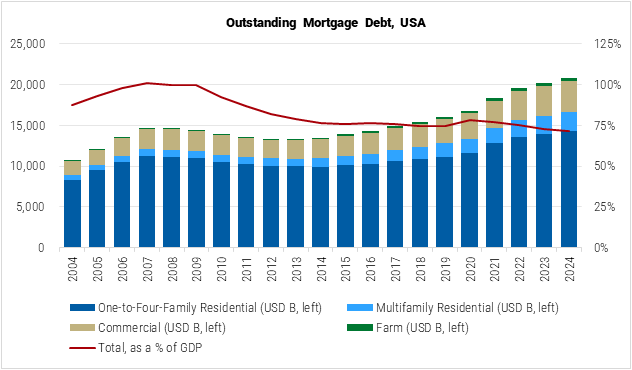

At the same time, the total value of outstanding mortgage debt of US households continues to grow, although at a decelerating pace. In 2024, the mortgage stock demonstrated a 2.8% annual increase, down from 3.2% in 2023, 7.4% in 2022, and 9.1% in 2021. Based on the Federal Reserve data published by FRED, as of Q4 2024, the overall value of outstanding mortgages was at USD 20.8 trillion, with one-to-four-family residential making up 68.7% of that amount, followed by commercial properties (18.4%), multifamily residential (11.1%), and farms (1.7%).

Sized against the US economy, the mortgage market was equivalent to about 71.4% of GDP at current prices in 2024, down from 78.5% in 2020 and significantly below the 2007 peak of the estimated 101.1%.

Data Sources: FRED, IMF.

Socio-Economic Context:

Persistent Inflation and Policy Uncertainties Cloud the Economic Outlook

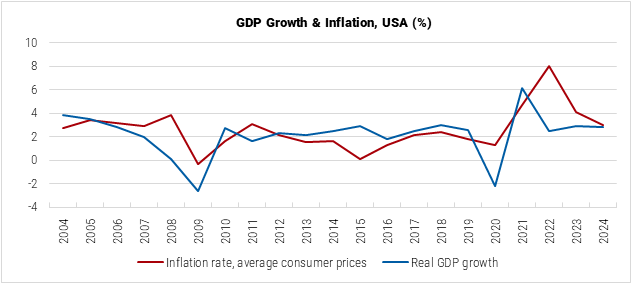

The US economy has turned in a strong performance over the past few years; the outlook, however, is tempered by persistent inflationary pressures and policy uncertainties, which arose as the new administration took office in January 2025. The country's real GDP growth in 2024 reached 2.8%, following a 2.9% expansion in 2023 and 2.5% in 2022. The growth momentum is projected by the IMF to moderate to 1.8% in 2025 and 1.7% in 2026. Deloitte's baseline scenario sees the annual GDP growth averaging 1.9% over the next three years.

Consumer Price Index (CPI) inflation in the country eased from an 8% peak in 2022 to 3% in 2024 and was most recently reported by the US Bureau of Labor Statistics at 2.3% in April 2025, which is still above the Federal Reserve's 2% target. The IMF currently projects the annual inflation level to reach 3% in 2025 before dropping to 2.5% in 2026. Deloitte also expects inflation to remain "stubbornly high" in 2025 at 2.8% and above 2% over the forecast period, limiting the speed at which monetary policy rates can be brought back down to neutral. "Because inflation expectations tend to feed through into actual inflation, the Fed's role involves controlling not only real prices but also expectations of inflation. These data points, as well as the potential inflationary effects of tariffs, will give the FOMC a pause when considering if further interest rate cuts are appropriate," said their March 2025 economic forecast.

Data Source: IMF.

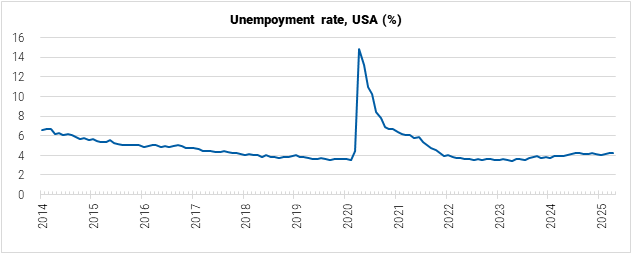

In the US labor market, the nationwide unemployment rate dropped significantly since the pandemic but has been trending slightly upward in recent months, most recently reported by the US Bureau of Labor Statistics at 4.2% in April 2025, up from 3.9% a year ago and 3.4% two years ago.

While the market remains healthy for the moment, forecasts for 2025 and beyond are cautious, as uncertainty tied to the anticipated impact of the new immigration policies and federal government layoffs looms over the projections. If the deportation scope of 1 million undocumented immigrants per year that was outlined by the new administration during the election campaign materializes, it could "result in very weak (or even negative) population growth over the forecast, with knock-on effects for labor markets," according to Deloitte's forecast.

These concerns are also echoed in the April 2025 analysis from Fitch Ratings, which points out that foreign-born individuals are estimated to make up about 20% of the US labor force, while unauthorized workers account for almost 5%. "A scenario in which 1.3 million workers are removed over two years would reduce labor force growth to a below pre-pandemic growth rate of 0.3%," said Fitch Ratings.

Data Source: US Bureau of Labor Statistics via FRED.

In 2025, among the economically impactful policies and announcements made by the new US administration since taking office, the most significant actions have been on tariffs and government operations. The numerous announcements of new tariffs (some of which have gone into effect, some have been "paused," and some are yet to come into force) led to reciprocal actions from other nations and a shift in global trade arrangements. On government operations, the administration is seeking to downsize and reshape the federal government through technology modernization, enhanced government efficiency, headcount reductions, and spending cuts.

At the same time, in public finances, the US federal government's budget has run a deficit every year since 2001. According to the information published by the Department of the Treasury, increases in spending on Social Security, health care, and interest on federal debt have outpaced the growth of federal revenue. A ten-year budget and economic outlook published by the Congressional Budget Office (CBO) projects the adjusted federal budget deficit in fiscal year 2025 to reach USD 1.9 trillion (equal to 6.4% of GDP). By 2035, the adjusted deficit is expected to equal 6.1% of GDP, significantly more than the 3.8% average over the past 50 years. Relative to the size of the economy, debt held by the public is also expected to swell further, increasing from 99.9% of GDP in 2025 to 118.5% in 2035.

Against the background of heightened economic uncertainty, in May 2025, the United States experienced a downgrade in sovereign credit rating, marking the first time in modern history that all three major credit agencies - Fitch, Moody's, and Standard & Poor's (S&P) - have rated US debt below the top-tier 'AAA' level.

Sources:

- US Census Bureau

- ACS 2023 Selected Housing Characteristics: https://data.census.gov/

- Monthly New Residential Construction, April 2025: https://www.census.gov/

- Monthly New Residential Sales, April 2025: https://www.census.gov/

- National, State, and County Housing Unit Totals: 2020-2024: https://www.census.gov/

- Quarterly Residential Vacancies and Homeownership, First Quarter 2025: https://www.census.gov/

- Nearly All U.S. Counties Had More Homeowners Than Renters Between 2019 and 2023: https://www.census.gov/

- Median and Average Sales Price of New Houses Sold, March 2025: https://www.census.gov/

- US Bureau of Labor Statistics

- Current Employment Statistics - CES (National): https://www.bls.gov/

- Consumer Price Index: https://www.bls.gov/

- New Tenant Rent Index: https://www.bls.gov/

- US Federal Reserve Board

- Federal Reserve Issues FOMC Statement: https://www.federalreserve.gov/

- Congressional Budget Office (CBO)

- An Update to the Budget and Economic Outlook: 2025 to 2035: https://www.cbo.gov/

- Federal Debt and the Statutory Limit, March 2025: https://www.cbo.gov/

- Federal Reserve Economic Data (FRED)

- Bank Prime Loan Rate: https://fred.stlouisfed.org/

- Federal Funds Target Range - Upper Limit: https://fred.stlouisfed.org/

- Mortgage Debt Outstanding: https://fred.stlouisfed.org/

- Federal Reserve Bank of Philadelphia

- Q4 2024 Insights Report: https://www.philadelphiafed.org/

- Large Bank Credit Card and Mortgage Data: https://www.philadelphiafed.org/

- FiscalData

- US Revenue Data https://fiscaldata.treasury.gov/

- US Deficit by Year: https://fiscaldata.treasury.gov/

- Freddie Mac

- Mortgage Rates: https://www.freddiemac.com/

- Fannie Mae

- National Housing Survey, April 2025: https://www.fanniemae.com/

- Economic Developments - May 2025: https://www.fanniemae.com/

- National Association of Realtors (NAR)

- Foreign Home Buyers Recede from U.S. Market as Prices Soar: https://www.nar.realtor/

- Summary of April 2025 Existing-Home Sales Statistics: https://www.nar.realtor/

- Existing-Home Sales Receded 5.9% in March: https://www.nar.realtor/

- US Economic Outlook Q2 2025: https://www.nar.realtor/

- International Transactions in U.S. Residential Real Estate, 2024: https://www.nar.realtor/

- National Association of Home Builders (NAHB)

- National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI): https://www.nahb.org/

- New and Existing Home Sales Reports: https://www.nahb.org/

- New and Existing Home Price Gap Shrinking: https://eyeonhousing.org/

- Soft Spring Selling Season Takes a Toll on Builder Confidence: https://www.nahb.org/

- International Monetary Fund (IMF)

- Country Overview: United States: https://www.imf.org/

- IMF Staff Country Report: https://www.imf.org/

- Zillow

- Housing Data: https://www.zillow.com/

- April 2025 Rent Report: https://www.zillow.com/

- March 2025: Despite Waning Consumer Confidence, New Home Sales Exceed Expectations: https://www.zillow.com/

- S&P Dow Jones Indices

- S&P CoreLogic Case-Shiller Home Price Indices: https://www.spglobal.com/

- S&P CoreLogic Case-Shiller Index Records 3.9% Annual Gain in February 2025: https://www.spglobal.com/

- J.P.Morgan

- US Housing Market Outlook 2025: https://www.jpmorgan.com/

- April 2025 CPI data report: https://www.jpmorgan.com/

- Deloitte

- United States Economic Forecast: https://www2.deloitte.com/

- PwC

- Emerging Trends in Real Estate 2025: https://www.pwc.com/

- EY

- US Economic Outlook May 2025: https://www.ey.com/

- KPMG

- Multifamily Housing Starts Expanded: https://kpmg.com/

- Fitch Ratings

- US Faces Several Fiscal Policy Challenges in 2025: https://www.fitchratings.com/

- Mass Deportations Will Likely Increase Labor Costs for Several U.S. Sectors: https://www.fitchratings.com/

- Moody's Ratings

- Moody's Ratings Downgrades United States Ratings to Aa1 from Aaa; Changes Outlook to Stable: https://ratings.moodys.com/

- Forbes

- Housing Market Predictions For 2025: When Will Home Prices Drop? https://www.forbes.com/

- Reuters

- US Housing to Get a Bit More Affordable This Year, but Mainly Due to Lower Rates: Reuters Poll: https://www.reuters.com/

- Realtor.com

- Tariffs Suppress New Construction in April, but Multifamily Projects Outperform: https://www.realtor.com/

- Housing Supply Gap Reaches Nearly 4 Million in 2024: https://www.realtor.com/

- IPX 1031

- Homeownership Data Report 2025: https://www.ipx1031.com/