As one of the world’s top destinations for tourism and expat living, Spain continues to draw strong interest from foreign property investors. Its diverse regions and steady demand have supported healthy returns and long-term growth, but have also contributed to housing shortages and rising prices for local residents. In response, authorities are tightening short-term rental regulations and considering new measures aimed at limiting non-EU investment. These changes highlight the need for investors to stay informed and approach Spain’s evolving property market with care.

This newly updated 2025 edition guide will take you through the basic steps and important things to consider when buying property in Spain as a foreign first-time buyer.

12 Things to Know Before Buying a Property in Spain

Yes, foreign investors can currently purchase property in Spain. However, the Spanish government is proposing possible major changes in 2026 for non-resident, non-EU citizens due to the oversaturation of foreign-owned properties in the country. Potential changes being discussed include a 100% tax for non-EU buyers or possibly prohibiting non-EU citizens from purchasing property altogether.

Spain offers diverse and dynamic real estate opportunities, ranging from cosmopolitan urban centers and coastal luxury markets to tech-driven hubs and culturally rich historic cities. Each location presents unique advantages depending on investor goals, rental strategies, and lifestyle preferences.

As the capital and financial center of Spain, Madrid is one of the most attractive markets for both residential and commercial investors. Districts such as Salamanca, Chamberí, and Chamartín are highly prized for their elegant architecture, vibrant cultural scene, and excellent connectivity. The city’s strong job market, consistent demand from international professionals, and limited central housing supply contribute to stable long-term returns and a robust rental market.

Known for its Mediterranean lifestyle, world-renowned architecture, and strong tourism sector, Barcelona remains a major hotspot for real estate investment. Neighborhoods like Eixample, Gràcia, and Poblenou offer distinct atmospheres, from classic urban living to modern innovation districts. Barcelona’s appeal to international residents, combined with its strong tech and startup ecosystem, supports solid rental demand and capital appreciation potential.

Valencia combines coastal living with a rapidly growing economy, making it a compelling choice for investors seeking affordability without sacrificing quality of life. Areas such as Ruzafa, El Carmen, and the City of Arts and Sciences district are popular for their blend of culture, modern development, and accessibility. With increasing interest from remote workers and expats, Valencia’s real estate market continues to strengthen.

As one of the key cities on the Costa del Sol, Málaga has transformed into a cultural, technological, and tourism-driven hub. Districts like Soho, La Malagueta, and the surrounding coastal areas offer a mix of luxury apartments, beachfront properties, and vibrant urban regeneration projects. Málaga’s warm climate, international airport, and emerging tech ecosystems create both lifestyle appeal and strong rental performance.

Rich in history and architectural beauty, Seville offers a stable and increasingly attractive property market. Neighborhoods such as Triana, Los Remedios, and Nervión stand out for their charm, livability, and demand from both locals and long-term renters. The city’s status as a major cultural and administrative center ensures reliable occupancy and steady investment growth.

A model of urban regeneration, Bilbao has evolved into a modern cultural and economic powerhouse in northern Spain. The Abando, Indautxu, and Deusto districts provide a mix of contemporary living and traditional Basque character. With strong infrastructure, the presence of major cultural institutions, and ongoing innovation initiatives, Bilbao appeals to investors seeking long-term stability and diversification within Spain.

Square meter prices in Spain vary significantly based on the location, with Madrid’s prices, which are the highest, more than tripling those of Córdoba, which are the lowest.

As of October 2025, square meter prices in Spain’s key cities were as follows:

Spain’s median asking prices vary considerably based on the city. Palma De Mallorca is the most expensive, averaging three times higher than Murcia, which has the lowest rates.

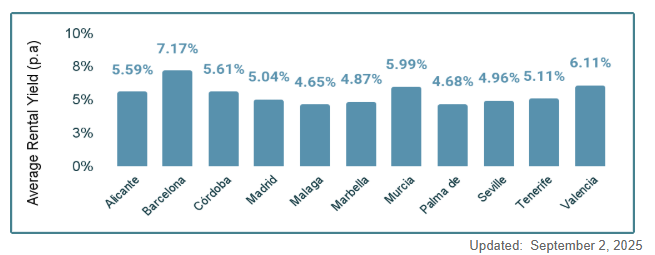

Overall, rental yields for a one-bedroom apartment in Spain are considered moderate, but yields vary quite a bit by city.

As of September 2025, rental yields for one-bedroom apartments in key cities were as follows:

Spain's rent price index:

Data Source: OECD.

Spain’s property market has seen dramatic shifts over the past few decades. After a boom from the late 1990s through 2007, the market collapsed during the 2008 global financial crisis, sending property prices plummeting. Gradual recovery began around 2014, with steady price growth and greater market stability through 2019.

By 2024, Spain’s housing sector had strengthened considerably. National home values rose by about 7% year-on-year, driven by limited housing supply, strong rental demand, and increased foreign investment — with some regions seeing double-digit growth. However, as affordability has worsened, policymakers have introduced measures aimed at cooling the market. New rules on short-term rentals and proposed taxes targeting non-EU investors could substantially increase the cost of buying investment property in Spain.

Spain's house price annual change:

Data Source: Banco de España.

Spain’s laws between landlords and tenants are deemed pro-tenant by the Global Property Guide. The Ley de Arrendamientos Urbanos (LAU) especially protects long-term tenants and has strong tenant eviction regulations.

Spain’s tax system is complex, and it is changing.

In July 2025, a Spanish Audiencia Nacional ruling allowed non-EU foreign-owned properties to be taxed on net rental income, not gross. However, the ruling is being challenged and is subject to change. Income is taxed at a 19% to 24% rate, minus allowable deductions.

All property owners must also pay an annual Municipal Real Estate Tax (Impuesto sobre Bienes Inmuebles - IBI). The amount is determined by the local municipality, and generally ranges from 0.4% to 1.1% of the assessed value.

In some areas, an annual wealth tax (Impuesto sobre el Patrimonio - IP) is applied to income over a specified amount. The exact limit varies by location, but generally is around €700,000. The progressive tax rate is determined by the region and ranges from 0.2% to 3.5%.

Buyers of resale properties currently must pay a property transfer tax (Impuesto sobre Transmisiones Patrimoniales or ITP), with rates varying from 6% to 11% depending on the region. However, if passed, a controversial new tax proposal would require a 100% transfer tax on non-EU foreign investors buying resale residential property. The draft law is still being debated, but it could potentially impact future investments.

New residential properties purchased directly from a developer must pay a value-added tax (Impuesto sobre el Valor Añadido - IVA), which is 10%. A recent (2025) proposal would apply a 21% VAT rate to short-term rentals, but the measure has not yet passed.

New property buyers also must pay a stamp duty (Actos Jurídicos Documentados, or AJD), ranging from 0.5% to 1.5% depending on the location.

Sellers must pay capital gains taxes (Impuesto sobre la Venta de Inmuebles), which is a fixed 19% for non-residents, regardless of their country of origin. In most situations, buyers must pay 3% of the capital gains tax, although there are a few exceptions.

Here's a full breakdown:

| Transaction Costs | ||

| Who Pays? | ||

| Property Transfer Tax | 6.00% - 11.00% | buyer |

| Legal Fees | 1.00% - 2.00% | buyer |

| Notary Fees | 0.50% - 1.00% | buyer |

| Real Estate Agent Fee | 3.00% - 6.00% | seller |

| Costs Paid by Buyer | 7.50% - 14.00% | |

| Costs Paid by Seller | 3.00% - 6.00% | |

| ROUNDTRIP TRANSACTION COSTS | 10.50% - 20.00% | |

| Source: Global Property Guide, PWC, Deloitte | ||

Short-term rental regulations are tightening throughout Spain, with changes that will likely limit or prohibit new short-term rentals. In Barcelona, new short-term rentals are expected to be phased out by 2028. In Madrid, new rental licenses have been put on hold until 2026.

Across Spain, short-term rental owners must register their rental properties to attain an official government-issued license. Owners must also register with the property’s regional tourism authority, and if it is listed online, it must be registered with Spain’s national tourism database.

Specific regions have additional regulations, and starting in April 2025, some areas may require written approval from neighbors.

Many areas require regular reporting of guests, especially foreign visitors. Hosts must also register any guests over age 16 with the local police.

Foreigners can often get mortgage loans in Spain, but interest rates may be higher and lenders will require thorough financial information. Expect to pay a down payment of 30% to 40%. Loan terms usually have a maximum of 25 years, but must also be paid off by the time the buyer reaches a certain age – usually 75.

To apply for a mortgage, foreign buyers must have a mandatory tax identification number known as the NIE (Número de Identificación de Extranjero).

Spain's mortgage loan interest rates:

Data Source: ECB.

Timeline: Expect 2-4 months from offer to official registration.

Buying property in a foreign country can feel overwhelming, but we're here to help.

At Global Property Guide, we offer:

Whether you're looking for your first investment in Spain or expanding your international portfolio, we can help you make smart, secure decisions.

Contact our team or book a free consultation to get started.