Cyprus’s Residential Property Market Analysis 2025

Sales prices and rents in the Cypriot housing market demonstrate decelerating growth, signaling ongoing stabilization, as reduced demand from foreign buyers and new supply entering the market ease the pressure.

This extended overview from Global Property Guide covers key aspects of Cyprus’s housing market and takes a closer look at its most recent developments and long-term trends.

Table of Contents

- Housing Market Snapshot

- Historic Perspective

- Demand Highlights

- Supply Highlights

- Rental Market

- Mortgage Market

- Socio-Economic Context

Housing Market Snapshot

In 2024, housing prices in Cyprus continued to grow, reaching levels not seen in the market in over a decade, since before the banking crisis of 2012-2013, although the pace of growth appears to be moderating. The Residential Property Price Index published by the Central Bank of Cyprus (CBC) slowed from a 7.80% (6.51% inflation-adjusted) year-on-year growth in Q1 2024 to a 6.51% (5.78% inflation-adjusted) annual increase in Q3 2024.

In terms of price dynamics by property type, apartments continued to demonstrate stronger upward movement, recording an annual increase of 8.8% (8.1% inflation-adjusted), while for houses, the growth rate stood at 6.0% year-on-year (5.3% inflation-adjusted) as of Q3 2024.

"Residential property prices recorded decelerated increases. Other market indicators confirm that the market is entering a phase of slowdown of its upward trend. The reduced demand for properties from foreign buyers suppresses the upward pressures that had been observed on property prices in previous quarters," commented the central bank in their latest report.

Cyprus's house price annual change:

Regional price development remained uneven, with the highest year-on-year growth of 11.8% (11.0% inflation-adjusted) registered in the Paphos district, followed by Famagusta at 11.1% (10.3% inflation-adjusted), while the slowest pace of growth was registered in the capital district of Nicosia at 2.7% (2.0% inflation-adjusted).

Residential property price index dynamics in key submarkets:

| District | QoQ Q3 2024 vs Q2 2024 Nominal |

QoQ Q3 2024 vs Q2 2024 Inflation-adjusted |

YoY Q3 2024 vs Q3 2023 Nominal |

YoY Q3 2024 vs Q3 2023 Inflation-adjusted |

| Nicosia | 1.0% | 0.3% | 2.7% | 2.0% |

| Famagusta | 3.0% | 2.3% | 11.1% | 10.3% |

| Larnaca | 1.1% | 0.5% | 8.1% | 7.4% |

| Limassol | 0.9% | 0.3% | 7.4% | 6.7% |

| Paphos | 2.0% | 1.4% | 11.8% | 11.0% |

| Data Source: CBS. | ||||

The regional disparity between Cyprus's districts is also reflected in the average sale prices of new apartments and houses, as reported by Landbank Analytics. According to their analysis of sales contracts submitted to the Cyprus Department of Lands and Surveys (DLS), in 2024, the nationwide average sale price reached EUR 281,000 (USD 304,154) for new apartments and EUR 461,000 (USD 498,986) for new houses, with the highest price levels traditionally recorded in Limassol and Paphos.

The market demonstrated mixed tendencies depending on location; however, the overall decline observed in the sales of high-value new properties indicates a preference from both local and foreign buyers towards lower-priced options.

"The Limassol district is seeing exceptionally high prices, closely linked to sales of high-value properties, mainly purchased by foreign buyers. In contrast, the Nicosia market, despite increased demand, seems to adjust to the financial capabilities of local buyers, who are essentially its main source. In Larnaca, the average residential unit value declined as new developments move toward the suburbs, primarily in areas further from the coastline <…>. The data in Paphos, showing a drop in apartment prices and an increase in house prices, is not surprising as this is a market more 'dependent' on house sales," explained Andreas Christophorides, CEO of Landbank Group.

Average sales prices of new apartments and houses in key submarkets:

| District | New Apartments | New Houses | ||||

| Avg Price, EUR 2024 |

Avg Price, USD 2024 |

YoY, 2024 vs 2023 |

Avg Price, EUR 2024 |

Avg Price, USD 2024 |

YoY, 2024 vs 2023 |

|

| Nicosia | 190,000 | 205,656 | -3.8% | 314,500 | 340,415 | -5.7% |

| Famagusta | 222,000 | 240,293 | 5.2% | 367,500 | 397,782 | 15.0% |

| Larnaca | 196,000 | 212,150 | 0.0% | 340,000 | 368,016 | -8.5% |

| Limassol | 426,000 | 461,102 | -9.4% | 557,000 | 602,897 | 4.4% |

| Paphos | 312,000 | 337,709 | -20.3% | 590,000 | 638,616 | 3.6% |

| Note: Exchange rate as of 2024, EUR 1 = USD 1.0824. | ||||||

| Data Source: Landbank Analytics. | ||||||

Looking ahead, the consensus among the real estate experts in Cyprus is that the market will continue to stabilize, as growing supply is expected to balance the demand, leading to moderation of prices, if allowed by external factors.

The CBC anticipates the residential property price index to record more moderate increases in the short-term future, as the influx of new units into the market, facilitated by increasing construction activity and small decreases in construction material prices, is expected to ease the upward pressure on property prices.

Ask Wire, a local company providing real estate intelligence and analysis, also sees a potential relief in prices thanks to an increase in new housing supply, while the underlying demand, especially for apartments, remains strong. "While challenges like high mortgage rates and elevated construction costs persist, they are tempering demand selectively rather than broadly. Overall, the market is stabilizing, with opportunities emerging in segments driven by both tourism and sustained local demand," said Pavlos Loizou, the CEO of Ask Wire, in a recent press release.

At the same time, it is widely understood that the Cypriot market remains subject to external inflationary forces. This year's first quarter handed out a great sense of uncertainty to the global economy with the escalation of tariff-based trade tensions. As reported, said unpredictability could affect both the global and the local real estate markets, namely through price increases across the supply chain.

Historic Perspective:

Foreign Investment Shaping the Residential Real Estate Landscape

Over the past two decades, the development of Cyprus's housing market has been marked by significant fluctuations. From 2000 to 2008, the market experienced a substantial boom, with house price growth peaking at 22.1% year-on-year in Q4 2007 (17.46% inflation-adjusted). During this period, the number of new dwellings increased by 10.3%, driven by strong economic growth, heightened foreign investment (particularly from Russia and the UK), Cyprus's accession to the EU in 2004, and easy access to credit.

However, the global financial crisis of 2008 triggered a sharp decline in the housing market, which was further exacerbated by Cyprus's banking crisis in 2012-2013. This led to economic contraction and austerity measures that suppressed domestic demand. The steepest decline in house prices, exceeding 8% year-on-year, was recorded in 2013-2014, with new construction plummeting by an average of 35.4% during the period. The market bottomed out in 2016.

Starting in 2017, recovery began with prices increasing at an average annual rate of 2.15% between 2017 and 2019 (1.54% inflation-adjusted). Concurrently, the growth rate of new dwelling volume added to the stock averaged 20% annually. This resurgence was fueled by the thriving tourism sector, increased demand for rental properties, and continued strong foreign demand, especially from non-EU countries (particularly through the citizenship-by-investment program). Additionally, improved economic conditions, marked by declining unemployment and rising consumer confidence, contributed to the market's recovery.

In more recent years, the housing market has sustained this dynamic despite the initial uncertainty caused by the COVID-19 pandemic. Property prices continued to demonstrate positive, even though limited, growth, and new construction remained active. The economic rebound, driven by ongoing foreign investment and new infrastructure projects, has maintained the upward trajectory of property prices, even though real growth remained hindered by high levels of inflation up to mid-2023.

In 2024, property prices approached peak levels observed before the banking crisis, with the apartment price index hitting a historic high. At the same time, the latest available data from the CBC indicates that the pace of price growth peaked at the end of 2023 and has been moderating since, suggesting ongoing market stabilization.

20-year annual house price change (based on end-of-year residential property price index and consumer price index):

| Year | Nominal house prices (%) |

Inflation-adjusted house prices (%) |

Year | Nominal house prices (%) |

Inflation-adjusted house prices (%) |

|

| 2004 | n/a | n/a | 2014 | -8.02% | -6.66% | |

| 2005 | n/a | n/a | 2015 | -1.82% | -0.85% | |

| 2006 | n/a | n/a | 2016 | -0.94% | -0.69% | |

| 2007 | 22.06% | 17.46% | 2017 | 1.78% | 2.38% | |

| 2008 | 9.73% | 7.47% | 2018 | 2.51% | 0.80% | |

| 2009 | -1.86% | -3.83% | 2019 | 2.16% | 1.44% | |

| 2010 | -3.57% | -5.13% | 2020 | 0.75% | 1.92% | |

| 2011 | -4.96% | -8.55% | 2021 | 2.63% | -2.09% | |

| 2012 | -4.71% | -5.75% | 2022 | 6.60% | -1.22% | |

| 2013 | -8.50% | -6.34% | 2023 | 8.28% | 6.54% | |

| Data Sources: CBC, OECD, Global Property Guide. | ||||||

Demand Highlights:

Market Adapts to a Slowdown in Foreign Buyer Activity

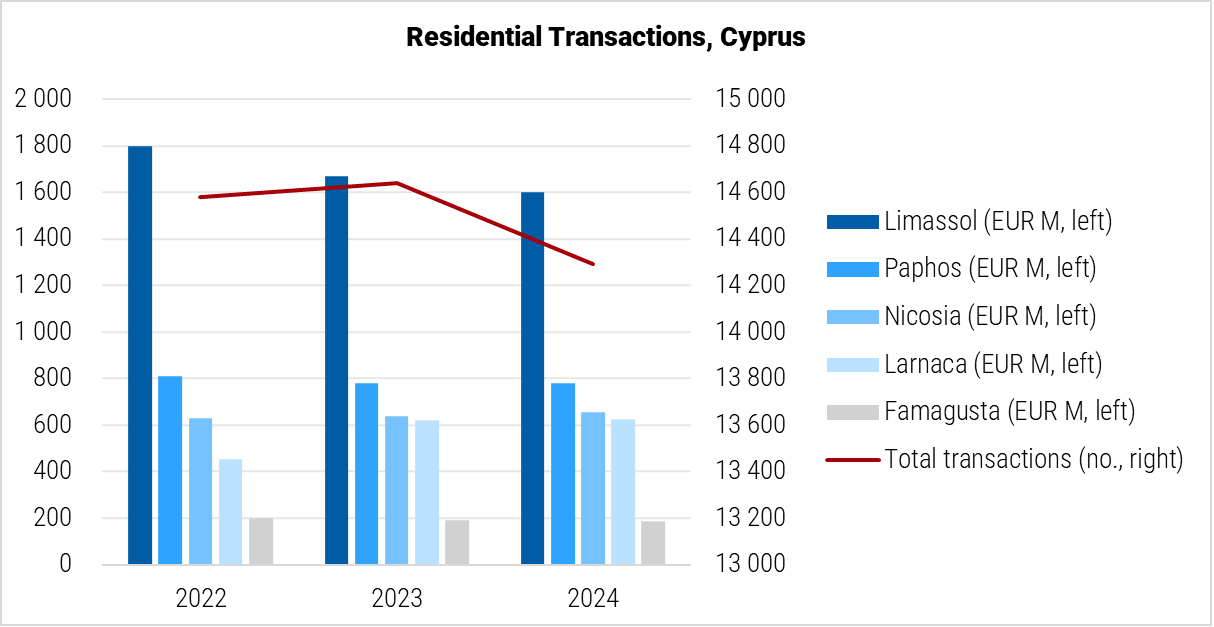

According to the latest insights from PwC based on the analysis of the DLS data, the Cypriot real estate market experienced an overall 10% drop in transactions from foreign buyers in 2024. Against the backdrop of high property prices and easing demand from foreigners, sales activity in the residential sector saw a drop in both the volume and value of transactions.

Throughout the year, a total of 14,290 residential transactions were registered across all districts, reflecting a 2.4% decrease compared to 2023. The cumulative value of residential investments reached EUR 3.8 billion (USD 4.2 billion), a 1.4% decrease year-on-year. Apartment sales accounted for 68% of all residential transactions in 2024, while houses made up 32%.

Analyzing the dynamic in their latest quarterly report, Sotheby's International Realty Cyprus pointed out that last year's decline in sales was to be expected: "The year 2024 has been a period of restructuring and adaptation for the Cypriot real estate market. Following the unprecedented growth in 2022-2023, driven by an influx of foreign buyers and displaced persons, the market has naturally corrected itself. However, despite a decline in transaction volumes, the market continues to show resilience, and certain regions are exhibiting positive trends."

Data Source: PwC analysis of DLS data.

In terms of regional distribution of buyer activity, Limassol led other districts with 2,800 apartment sales and 1,200 house sales in 2024, followed by Nicosia with 3,460 residential transactions, Larnaca with 3,270, and Paphos with 2,710, while Famagusta saw limited market activity, recording only 850 transactions, according to PwC. Notably, Nicosia was the only district to record an upward dynamic, with a 4.2% annual increase in the number of properties transacted. The remaining districts experienced a decline, with Paphos registering the most pronounced drop at 8.5%.

PwC analysis shows that the majority of residential transactions in 2024 involved properties priced under EUR 250,000 - 72.8% of apartment sales and 44.7% of house sales. A total of 188 transactions were recorded in the high-end residential segment of the market (properties priced at EUR 1.5 million or more), of which 93% were concentrated in the coastal districts of Limassol and Paphos.

Residential transactions in key submarkets:

| District | Apartments | Houses | ||

| No. of transactions, 2024 |

YoY, 2024 vs 2023 |

No. of transactions, 2024 |

YoY, 2024 vs 2023 |

|

| Nicosia | 2,560 | 4.1% | 900 | 4.7% |

| Limassol | 2,800 | -4.1% | 1,200 | 0.0% |

| Larnaca | 2,410 | 0.8% | 860 | -9.5% |

| Famagusta | 430 | -10.4% | 420 | 0.0% |

| Paphos | 1,520 | -6.2% | 1,190 | -11.2% |

| Data Source: PwC analysis of DLS data. | ||||

Looking ahead, Marinos Kineyirou MRICS, President of the Council for the Registration of Estate Agents, shared his outlook for this year in Cyprus Property News: "The outlook remains encouraging, with demand still running high and supply increasingly meeting market needs. Factors such as potential further interest rate cuts by the European Central Bank could stimulate even more buyer activity. On the other hand, risks remain - particularly in the housing sector - with the ongoing trade war and the potential for rising construction costs likely to pose challenges".

Supply Highlights:

Government Initiatives Introduced to Support Construction

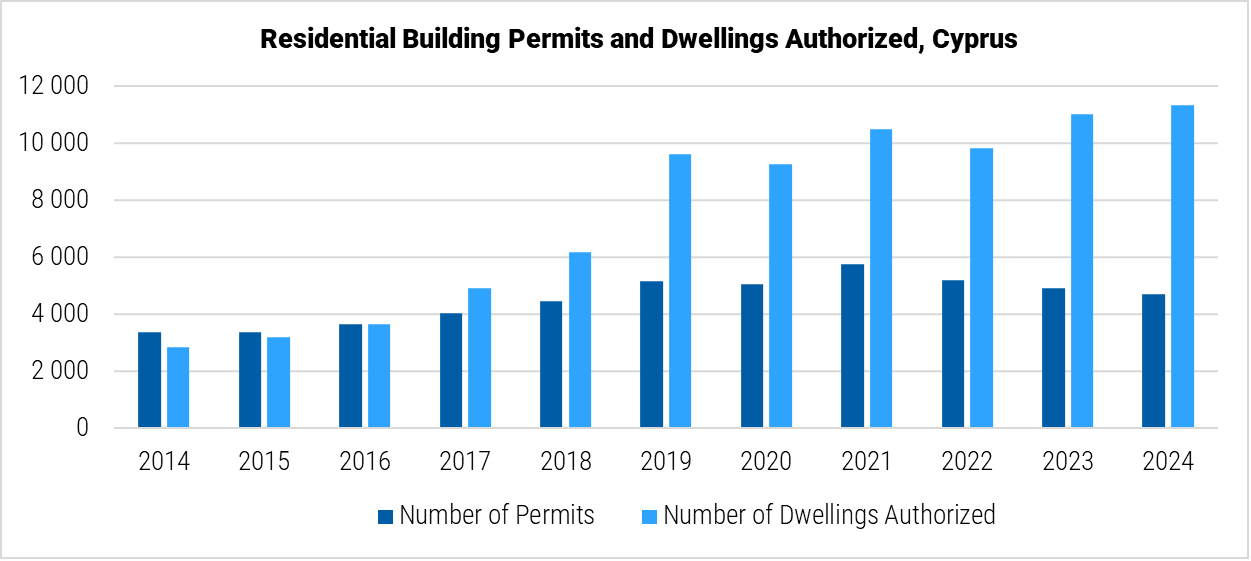

While the official data on housing completions in Cyprus in 2024 is not available, the dynamic in the forward-looking indicators of residential construction suggests a gradually improving supply landscape in the country. The Statistical Service of Cyprus (CYSTAT) reporting shows that 4,706 residential building permits were issued in Cyprus in 2024, reflecting a 4.4% year-on-year decrease, a moderation compared to a 5.5% and 9.4% declines previously observed in 2023 and 2022, respectively. At the same time, the number of authorized dwellings continued to grow, registering an annual increase of 2.6% in 2024.

The largest share of dwelling authorizations (35%, 3,952 units) was allocated to Limassol, followed by Nicosia (27%, 3,113 units) and Larnaca (22%, 2,824 units), while development plans for Paphos (1,184 units) and Famagusta (596 units) are limited.

Data Source: CYSTAT.

The slowdown in residential building permit issuance in the second half of 2024 is tied, in part, to operational challenges brought on by the ongoing administrative reform aimed at modernizing the construction and land development sectors in Cyprus.

Since July 2024, applications for building permits in Cyprus have only been accepted electronically via "Ippodamos", an integrated permit processing system introduced to streamline administrative procedures in urban planning and development. At the same time, the authority to review building applications has been transferred from municipalities to five specially created regional development organizations in Nicosia, Limassol, Larnaca, Paphos, and the free territories of Famagusta. The reform also introduced fast-track examinations for planning permission applications by reducing assessment times to fewer than 80 days for medium-risk developments and 40 days for low-risk projects.

Despite technical difficulties and delays caused by the launch of the new system, it is seen as an overall positive change to the Cypriot property market, as it is expected to simplify and expedite the licensing process for new developments and, therefore, directly contribute to the availability of new supply in the market. According to Cyprus Property News, the ongoing reform plays a crucial role in addressing the housing shortage for both renters and buyers by significantly accelerating approvals. The elimination of unnecessary delays will ensure that housing needs are met efficiently while also enabling properties to re-enter the market more quickly, benefiting both residents and investors.

Among other notable government measures is a bill on urban land redistribution, which has already been submitted to the Cyprus House of Representatives. The bill proposes to unlock the potential of landlocked plots in urban areas, addressing a long-standing issue for property developers.

Overall, in light of the ongoing administrative reforms and moderation of construction material costs, the supply of residential properties in Cyprus can be expected to grow, ultimately helping to stabilize prices and meet the sustained demand from local residents and foreign buyers.

Rental Market:

Continued Moderation of Rental Growth, Yields Stable

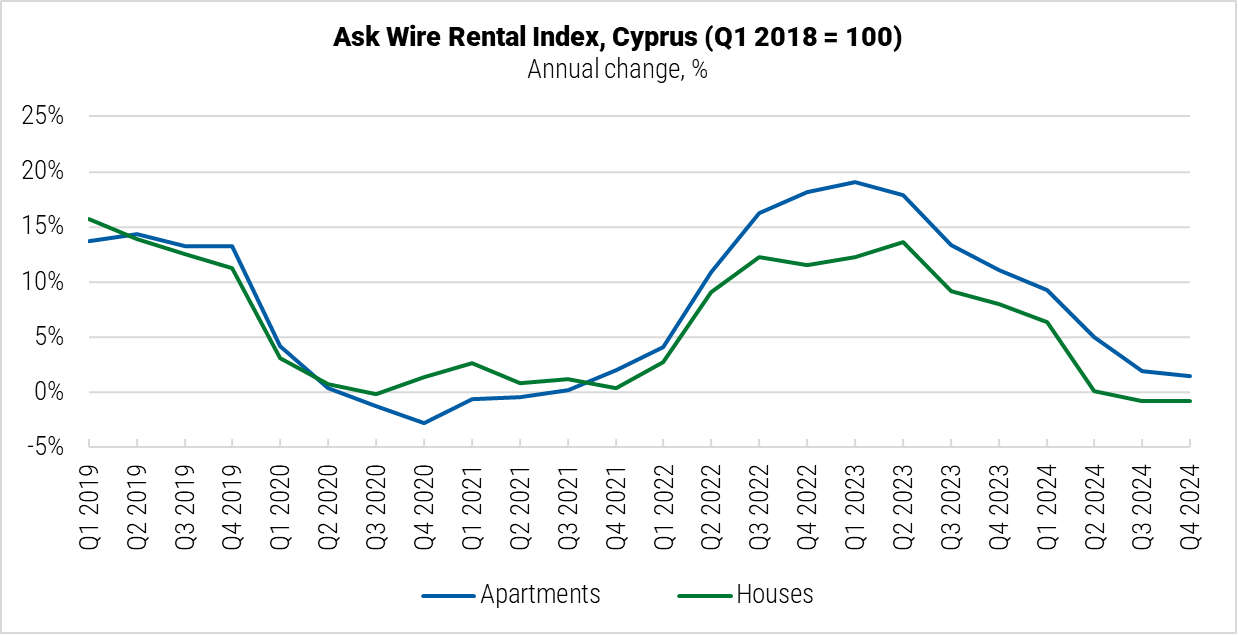

The Cypriot rental market is showing signs of stabilization, with notable moderation of rent increases and marginal movement in yields. Both the RICS KPMG Rental Index and the Ask Wire Rental Index, while varying in methodology and recording slightly different values, have demonstrated a similar decelerating dynamic in the second half of 2024.

In Q4 2024, the Ask Wire Rental Index showed a moderate 1.5% year-on-year increase for apartments and a 0.8% year-on-year decrease for houses across Cyprus, both indicators down significantly from the corresponding annual growth rates of 11.1% and 8.0% reported a year prior. During the same period, the RICS KPMG index showed a 2.01% year-on-year increase for apartments and a 2.29% year-on-year increase for houses, both having moderated from the corresponding 14.25% and 12.22% annual growth rates previously reported in Q4 2023.

On the regional level, according to Ask Wire, growth in apartment rents in Q4 2024 was observed in Paphos (10.0% year-on-year) and Nicosia (1.6% year-on-year), while Limassol stood out as a submarket with decreases reported both in apartment rents (-4.1% year-on-year) and house rents (-4.0% year-on-year).

Commenting on recent developments, Pavlos Loizou, the CEO of Ask Wire, noted that the market is currently in transition, balancing strong fundamentals with evolving dynamics. "Demand for apartments remains healthy, supported by resilience in tourism, which is set for a record year in 2025. New housing supply is beginning to ease pressure on residential prices and rents, offering relief to a market that has faced rapid growth in recent years," he said in a press release.

Data Source: Ask Wire.

In nominal terms, the January 2025 analysis from Landbank Analytics estimated the average asking rent in Cyprus at EUR 1,803 (USD 1,897) for apartments and EUR 3,249 (USD 3,419) for houses. According to the CEO of Landbank Group, Andreas Christophorides, the national average was significantly influenced by Limassol, which accumulated 45% of about 3,200 apartments and 44% of about 1,200 houses available for rent nationwide at the time and demonstrated notably higher listed rates compared to other districts.

Average asking rent and available properties for rent in key submarkets:

| Apartments, January 2025 | Houses, January 2025 | |||||

| District | Avg rent, EUR/month |

Avg rent, USD/month |

No. of available properties | Avg rent, EUR/month |

Avg rent, USD/month |

No. of available properties |

| Nicosia | EUR 1,017 | USD 1,070 | 917 | EUR 1,900 | USD 1,999 | 190 |

| Famagusta | EUR 795 | USD 837 | 42 | EUR 1,624 | USD 1,709 | 68 |

| Larnaca | EUR 1,120 | USD 1,179 | 536 | EUR 2,340 | USD 2,462 | 219 |

| Limassol | EUR 2,742 | USD 2,885 | 1,473 | EUR 4,492 | USD 4,727 | 546 |

| Paphos | EUR 1,193 | USD 1,255 | 289 | EUR 2,692 | USD 2,833 | 204 |

| Note: Exchange rate as of Q1 2025, EUR 1 = USD 1.0523. | ||||||

| Data Source: Landbank Analytics. | ||||||

According to RICS and KPMG, as of Q4 2024, rental yields in Cyprus stood at 5.42% for apartments and 3.03% for houses, showing only marginal movements from the corresponding 5.49% and 2.99% reported in Q4 2023. The research carried out by Global Property Guide in March 2025 found gross rental yields at 5.29% in Limassol, 4.78% in Nicosia, and 4.25% in Paphos.

Overall, despite gradually improving lending conditions and slower growth of sales prices, local experts don't anticipate the demand for rental properties in Cyprus to subside this year. "At the market level, I believe that the trend towards renting will continue even if we see a stabilization in the sale price of residential properties," said Andreas Christophorides of Landbank Group.

According to the Eurostat data, in the last decade, the share of tenants among Cypriot households increased from 27.1% in 2014 to 30.6% in 2024, while the homeownership rate declined from 72.9% to 69.4%.

Mortgage Market:

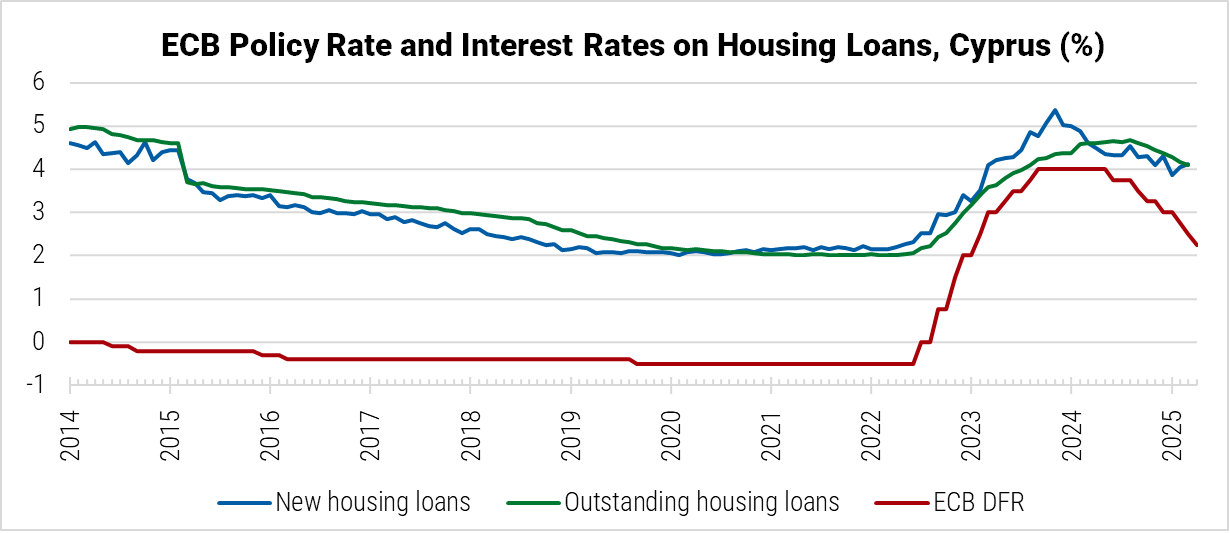

Interest Rates Still Elevated, Gradually Adjust to Policy Easing

Lending interest rates in Cyprus are past peak but remain elevated, demonstrating a slower adjustment to the overall downward trend observed across the eurozone since the beginning of the European Central Bank (ECB) monetary policy easing cycle in June 2024. Since then, the ECB lowered its benchmark rates by 175 b.p., with the most recent cut in April 2025 bringing the deposit facility rate to 2.25%, the main refinancing operations rate to 2.40%, and the marginal lending facility rate to 2.65%. Responding to consequent key rate cuts, the eurozone average interest rate on new loans to households for house purchase dropped by 0.46 p.p. within a year, reaching 3.31% in March 2025.

Cyprus's mortgage loan interest rates:

During the same period, the average interest rates on housing loans in Cyprus stood at 4.11% for new loans and 4.10% for outstanding loans, both indicators down year-on-year but still exceeding the respective levels recorded two years prior.

"Regarding interest rates on new loans to households for house purchase, they exhibit a slower adjustment to changes in the ECB's policy rates, given that a significant proportion of housing loans are linked to banks' base rates. It should be noted that banks' base rates are partly based on the aggregate household deposit rate, <…> which also exhibits an adjustment lag, mainly due to the excess liquidity held by domestic banks," noted the CBC in their latest economic bulletin.

Data Source: ECB.

Average interest rates on loans to households for house purchase:

| Mar 2025 | YoY | Mar 2024 | YoY | Mar 2023 | |

| New housing loans | 4.11% | ↓ | 4.59% | ↑ | 4.10% |

| - Floating rate and IRF up to 1 year | 4.56% | ↓ | 4.75% | ↑ | 3.99% |

| - IRF of over 1 and up to 5 years | 4.04% | ↓ | 4.33% | n/a | n/a |

| - IRF of over 5 and up to 10 years | n/a | n/a | n/a | n/a | n/a |

| - IRF of over 10 years | n/a | n/a | n/a | n/a | n/a |

| Outstanding housing loans | 4.10% | ↓ | 4.61% | ↑ | 3.58% |

| - Original maturity up to 1 year | 3.47% | ↑ | 3.19% | ↑ | 2.63% |

| - Original maturity over 1 and up to 5 years | 4.24% | ↑ | 4.00% | ↑ | 3.74% |

| - Original maturity of over 5 years | 4.10% | ↓ | 4.63% | ↑ | 3.58% |

Overall, compared to other eurozone countries, Cyprus's higher interest rates are often tied to the smaller size of the country's banking sector, limited competition, and higher risks perceived by lenders, as well as the prevalence of variable-rate credit.

"I think that in Cyprus we should expect a slightly higher interest rate on loans than the European average because of the small size and high level of private debt," said Panicos Nicolaou, the CEO of Bank of Cyprus, the country's largest financial institution, in a recent interview. "Cypriot banks do not have many fixed-rate loans, so I think that when the ECB rate stabilizes, the country will converge towards the European average."

While the Cypriot mortgage market was previously dominated by variable-rate loans, making it more vulnerable to short-term interest rate fluctuations, in recent years, the share of such loans in total new credit for house purchase has declined sharply from over 90%, on average, in 2022 to about 30% most recently reported in March 2025, according to the ECB data, suggesting a shift in demand toward more stable financing options against the background of global uncertainty.

Data Source: CBC.

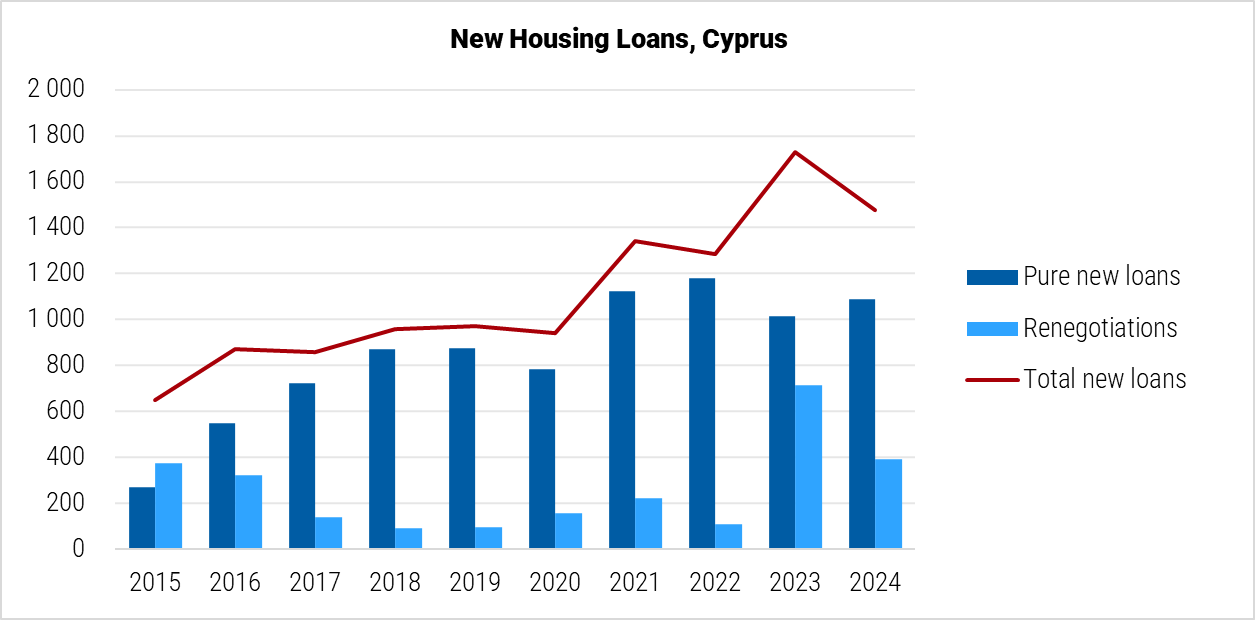

Despite elevated interest rates and the uncertainties created by geopolitical tensions for both lenders and borrowers, lending activity in Cyprus remains buoyant. While the total value of all new housing loans reported by the CBC in 2024 declined by 14.7% year-on-year due to a notable moderation in renegotiations, pure new loans actually picked up, showing a 7.0% increase compared to 2023. The first three months of 2025 demonstrated an even more positive dynamic, the total new lending for house purchase reaching EUR 473 million (USD 511.1 million), a 22.6% increase year-on-year, of which pure new loans amounted to EUR 284.1 million (USD 307.1 million), a 19.4% increase year-on-year.

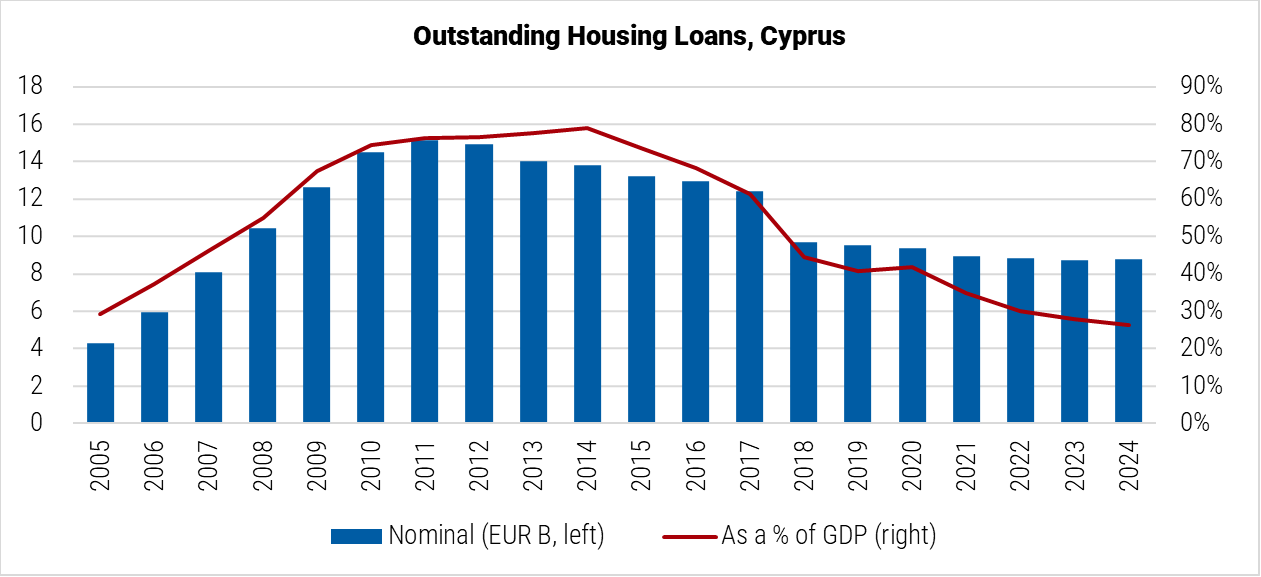

The overall housing loan stock maintained by the country's financial system has remained relatively stable in recent years. After 1.3% and 1.1% annual declines in 2022 and 2023, respectively, the total value of outstanding housing loans registered a marginal 0.8% year-on-year increase in 2024 and stood at EUR 8.7 billion (USD 9.4 billion) in March 2025. The relative size of the market, represented by the ratio of outstanding housing loans to GDP at current prices, continued to decline, dropping from an estimated 78.8% in 2014 to 26.2% in 2024.

Data Sources: CBC, CYSTAT.

Socio-Economic Context:

Resilient Growth Set to Continue, Investment-Grade Status Affirmed by Agencies

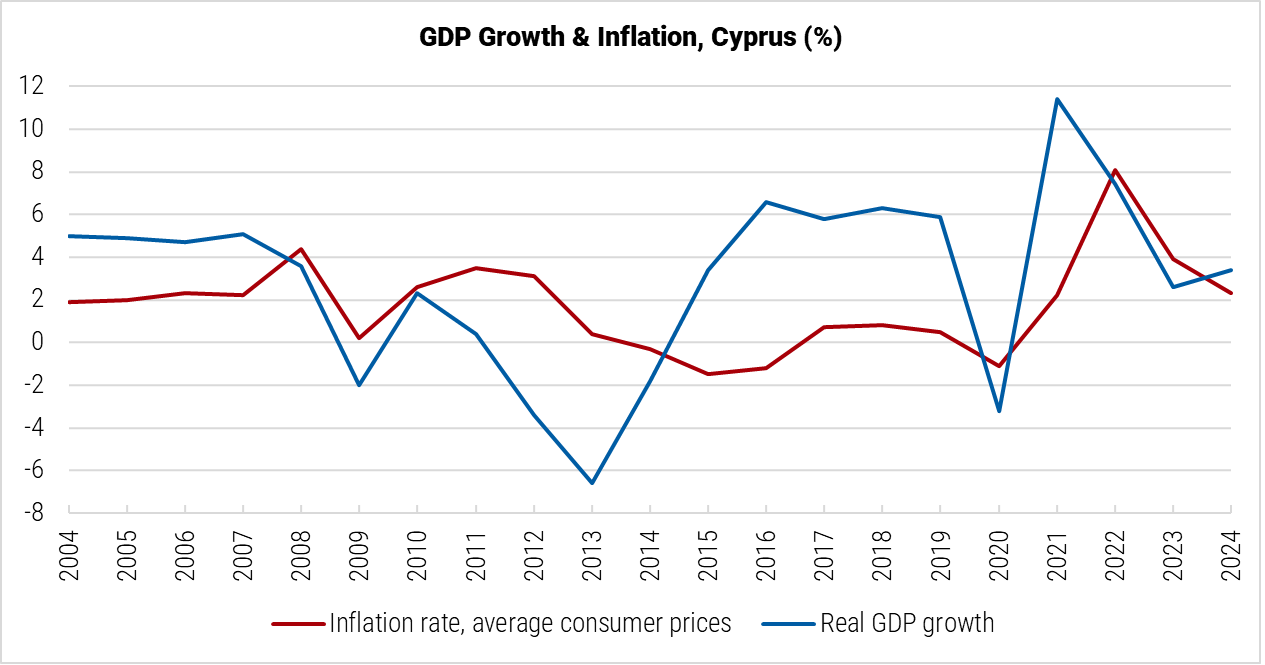

In 2024, Cyprus's real GDP growth reached 3.4%, according to CYSTAT data. The European Commission analysis and CYSTAT attribute this positive growth to strong private consumption, solid investment growth, and robust exports, particularly in tourism and ICT. The construction sector has been a key contributor, buoyed by positive market sentiment and increased activity. Looking ahead, economic growth is expected to moderate to 2.8% in 2025 and 2.5% in 2026, supported by sustained export performance in tourism and a dynamic outlook for ICT-related services. Continued strength in construction and foreign demand for services further underpins this growth trajectory.

Nationwide inflation, measured by the Harmonised Index of Consumer Prices (HICP), has shown a remarkable slowdown to just 2.1% year-on-year in March 2025, as demonstrated by CYSTAT data. Projections suggest that the inflation rate will remain at 2.1% in 2025, expected to stabilize around the ECB's 2% target over the medium term, supported by anticipated continued decreases in energy prices.

Data Source: IMF.

Travel and tourism-related activities continue to generate a significant amount of Cyprus's GDP. In 2024, the tourism sector revealed record-breaking numbers in revenue and visits. With over 4 million tourists arriving last year, the January-December 2024 period was responsible for a revenue that surpassed EUR 3.2 billion, according to the data from CYSTAT. Apart from serving as a backbone of the Cypriot economy, tourism's impressive performance ensures steady demand in other sectors, such as construction. Interest in investment properties in the country is expected to remain high, encouraging developers to supply a warmed-up market.

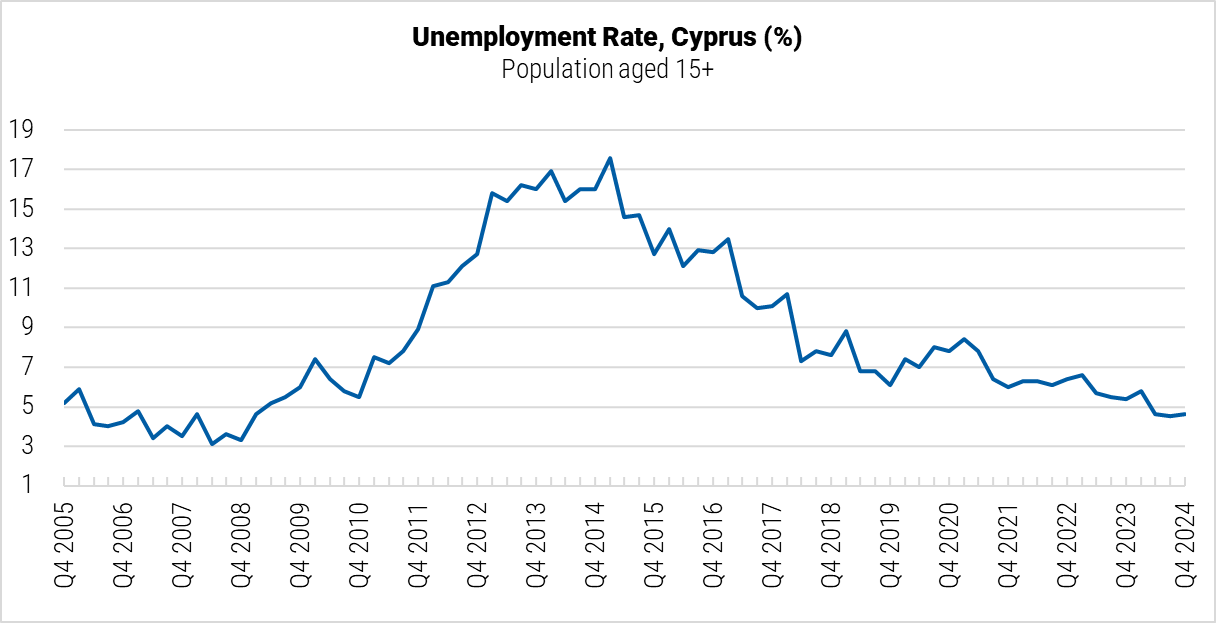

In parallel, Cyprus's labor market remains strong, serving as one of the key factors supporting macroeconomic growth. In the last quarter of 2024, the unemployment rate in the country was registered at 4.6%, according to the Labor Force Survey figures provided by CYSTAT, down from 5.4% in the corresponding period of 2023, and the lowest level recorded since 2008. The European Commission forecasts the unemployment rate to continue declining due to an inflow of foreign workers attracted by government incentives encouraging multinational companies to establish their headquarters in Cyprus.

Data Source: CYSTAT.

Reflecting the country's significant improvements in fiscal and debt indicators and a resilient economic growth, throughout 2024, Cyprus received a series of sovereign credit rating improvements from all major agencies, reaffirming its investment-grade status. In November 2024, Moody's rating was upgraded to 'A3', acknowledging sustained fiscal improvements and a strong medium-term outlook supported by foreign investment and immigration. S&P Global Ratings upgraded Cyprus to 'A-' in December 2024, pointing to the country's reduced dependence on short-term external financing and enhanced resilience in its foreign-owned banking system, despite regional geopolitical risks. Similarly, Fitch Ratings raised its rating to 'A-' at the end of the year, attributing the upgrade to rapid debt reduction, high primary surpluses, fiscal discipline, and a growing economy.

Overall, the outlook for the Cypriot economy is promising, supported by solid growth and strong fiscal performance. In its concluding statement for the 2025 Article IV Mission, the International Monetary Fund (IMF) said: "Cyprus has demonstrated impressive resilience to successive shocks. Growth has remained among the highest in the euro area, mainly supported by foreign investment, strong tourism, and a boom in the ICT sector. <…> Fiscal performance continues to be strong, with debt on a firm downward trajectory."

Sources:

- Cyprus Statistical Service (CYSTAT)

- National Accounts: https://www.cystat.gov.cy/

- Construction: https://www.cystat.gov.cy/

- Price Indices: https://www.cystat.gov.cy/

- Labor Market: https://www.cystat.gov.cy/

- Harmonized Index of Consumer Prices March 2025: https://www.cystat.gov.cy/

- Price Index of Construction Materials March 2025: https://www.cystat.gov.cy/

- Revenue from Tourism December 2024: https://www.cystat.gov.cy/

- Labor Force Survey Q4 2024: https://www.cystat.gov.cy/

- Central Bank of Cyprus (CBC)

- Residential Property Price Indices: https://www.centralbank.cy/

- Statistics on Interest Rates Applied by Monetary Financial Institutions: https://www.centralbank.cy/

- Monetary Financial Institutions (MFIs) Deposits and Loans Statistics: https://www.centralbank.cy/

- Economic Bulletin, December 2024: https://www.centralbank.cy/

- Department of Lands and Surveys (DLS)

- Statistical Data on Transfers of Sales and Sales Contracts: https://portal.dls.moi.gov.cy/

- European Central Bank (ECB)

- ECB Data Portal: https://data.ecb.europa.eu/

- Key ECB interest rates: https://www.ecb.europa.eu/

- Monetary Policy Decisions. April 17, 2025: https://www.ecb.europa.eu/

- Inflation and Consumer Prices: https://www.ecb.europa.eu/stats/macroeconomic_and_sectoral/hicp/html/index.en.html

- US Dollar/Euro, Quarterly: https://data.ecb.europa.eu/

- US Dollar/Euro, Monthly: https://data.ecb.europa.eu/

- European Commission

- Economic Forecast for Cyprus: https://economy-finance.ec.europa.eu/

- Post-Programme Surveillance Report - Cyprus, Autumn 2024: https://economy-finance.ec.europa.eu/

- Distribution of Population by Tenure Status, Type of Household and Income group: https://ec.europa.eu/

- International Monetary Fund (IMF)

- Country Overview: Cyprus: https://www.imf.org/

- Cyprus: Staff Concluding Statement of the 2025 Article IV Mission: https://www.imf.org/

- Organization for Economic Co-operation and Development (OECD)

- OECD Data Explorer: https://data.oecd.org/

- PwC

- Cyprus Real Estate Market. Year in Review - 2024: https://www.pwc.com.cy/

- RICS

- RICS Cyprus Property Index with KPMG in Cyprus, Q4 2024: https://www.rics.org/

- KPMG

- RICS Cyprus Property Price Index with KPMG in Cyprus Announces Results of 2024 Q4: https://kpmg.com/

- Bank of Cyprus

- P. Nicolaou: The Bank of Cyprus Mobile App is Evolving Into a Super App: https://www.bankofcyprus.com/

- Ask Wire

- Ask Wire Index Q4 2024: https://ask-wire.com/

- Ask Wire Index Q4 2024: Cyprus Real Estate Market Reflects Resilience in Apartments Amid Broad Sectoral Adjustments: https://ask-wire.com/

- Sotheby's International Realty Cyprus

- Insights Q4 2024, Quarterly Report: https://www.cyprus-sothebysrealty.com/

- Landbank Analytics

- Residential Market Trends 2024: New Apartment & House Price Dynamics by Landbank Analytics: https://landbankproperties.com.cy/

- Fluctuations in the Average Sale Prices of New Residential Units, Showing Both Increases and Decreases: https://landbankproperties.com.cy/

- Rental Market Overview: Market and Asking Rents for Apartments and Houses: https://landbankproperties.com.cy/

- 2025 Will be a Year of Opportunities for the Real Estate Sector: https://landbankproperties.com.cy/

- Cyprus Property News

- Cyprus Property Transactions Hit New Heights: https://www.news.cyprus-property-buyers.com/

- Cyprus Property Sales Surged 19% in March: https://www.news.cyprus-property-buyers.com/

- Cyprus Plans to Modernise Planning & Permit Processes: https://www.news.cyprus-property-buyers.com/

- Cyprus Mail

- Fast-track Planning Permission Begins for Medium-Risk Projects: https://cyprus-mail.com/

- Roads to Landlocked Land Would Allow it to be Developed: https://cyprus-mail.com/

- Tourism Surpasses 4 Million Visitors in 2024: https://cyprus-mail.com/

- Philenews

- Empty Plots of Land in Cities are Being Released - Bill Redistributes Land and Protects the Environment (EL): https://www.philenews.com/

- Fitch Ratings

- Fitch Upgrades Cyprus to 'A-'; Outlook Stable: https://www.fitchratings.com/

- Moody's Ratings

- Moody's Ratings Upgrades Cyprus' Ratings to A3 and Changes Outlook to Stable: https://ratings.moodys.com/

- S&P Global

- Cyprus Upgraded to 'A-' on Economic and Fiscal Outperformance; Outlook Stable: https://disclosure.spglobal.com/