Croatia's Residential Property Market Analysis 2025

Croatia’s housing market continues to register strong house price growth, supported by improving demand, rising residential construction activity, and a healthy macroeconomic environment.

Table of Contents

- Housing Market Snapshot

- Demand Highlights

- Supply Highlights

- Rental Market

- Mortgage Market

- Socio-Economic Context

Housing Market Snapshot

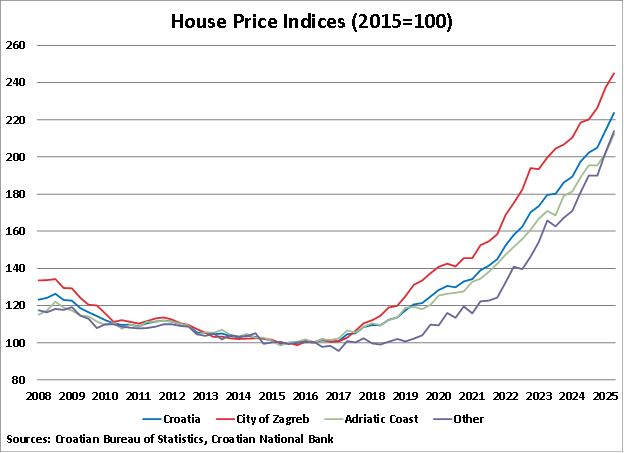

In Q2 2025, the nationwide house price index soared by 13.22% from a year earlier, following year-on-year increases of 13.08% in Q1 2025, 10.08% in Q4 2024, 12.27% in Q3 2024, and 9.96% in Q2 2024, based on figures from the Croatian Bureau of Statistics (CBS). House prices have been continuously growing strongly in the past eight years.

When adjusted for inflation, nationwide house prices increased by 9.25% over the same period. It is considered one of the country's strongest real house price growth records in recent memory.

Quarter-on-quarter, house prices were up by 4.42% (3.17% inflation-adjusted) in Q2 2025.

Croatia's house price annual change:

Note: Croatia's National House Price Index

Data Source: Croatian National Bank.

By property type:

- For new dwellings, prices were up by an average of 11% (7.1% inflation-adjusted) in Q2 2025 from the same period last year and by 1.5% (0.3% inflation-adjusted) from the previous quarter.

- For existing dwellings, prices surged by 13.7% (9.8% inflation-adjusted) y-o-y in Q2 2025. Quarterly, prices were up by 5.2% (4% inflation-adjusted) in Q2.

All major regions saw strong house price growth during the year to Q2 2025.

- In Zagreb, Croatia's capital and largest city, dwelling prices rose by an average of 12.23% (8.29% inflation-adjusted) in Q2 2025 from a year earlier, up from a y-0-y increase of 9.41% in Q2 2024, according to CBS. It was the 34th consecutive quarter of y-o-y growth. Quarter-on-quarter, prices increased by 3.26% (2.03% inflation-adjusted).

- On the Adriatic Coast, prices of dwellings increased by 12.35% (8.4% inflation-adjusted) in Q2 2025 from a year earlier, following a y-o-y increase of 10.61% in Q2 2024. Quarter-on-quarter, prices were up 5.14% (3.88% inflation-adjusted) during the latest quarter.

In other settlements, dwelling prices rose by a huge 18.18% (14.03% inflation-adjusted) in Q2 2025 from a year ago, an acceleration from the prior year's 9.16% increase. Quarter-on-quarter, prices were up by 5.6% (4.34% inflation-adjusted).

In the first half of 2025, the average price of new dwellings in Croatia rose strongly by 15.9% to €2,754 per square meter (sqm) from a year earlier, an acceleration from the year-on-year growth of 7.1% in H1 2024. In Zagreb, house prices averaged €2,958 per sqm, while they were €2,511 per sqm in other settlements.

Before the housing boom, there was a long period of declining house prices - 2.13% in 2015, 1.44% in 2014, 1.68% in 2013, and 5.88% in 2012, according to CBS figures. The housing market started to show improvements since, with house prices rising by a cumulative 122% (64.8% inflation-adjusted) from 2016 to H1 2025.

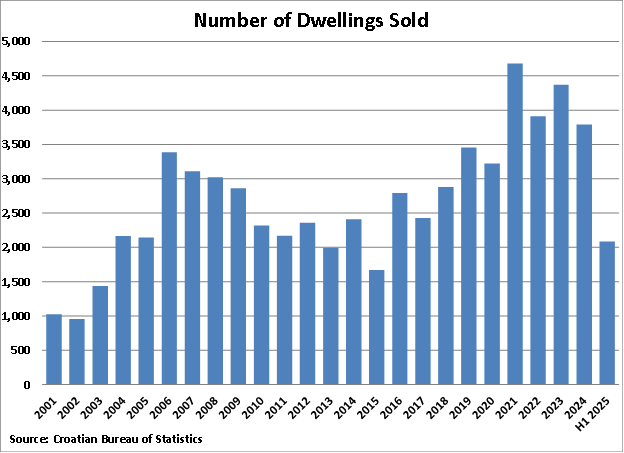

The recent strong growth in house prices in Croatia was mainly driven by improving demand. In the first half of 2025, the total number of new dwellings sold in Croatia increased strongly by 13.5% to 2,086 units as compared to the same period last year, according to figures from CBS. Likewise, the total useful floor area of dwellings sold also rose by 15.7% y-o-y to 140,012 sqm over the same period.

This partly offsets the decline in demand experienced last year. During 2024, the total number of new dwellings sold in Croatia dropped 13.3% y-o-y to 3,789 units, following an annual growth of 11.8% in 2023. Similarly, the total area of new dwelling sales also declined by 11.7% y-o-y to 259,177 sqm last year, in stark contrast to the annual increase of 7% in 2023.

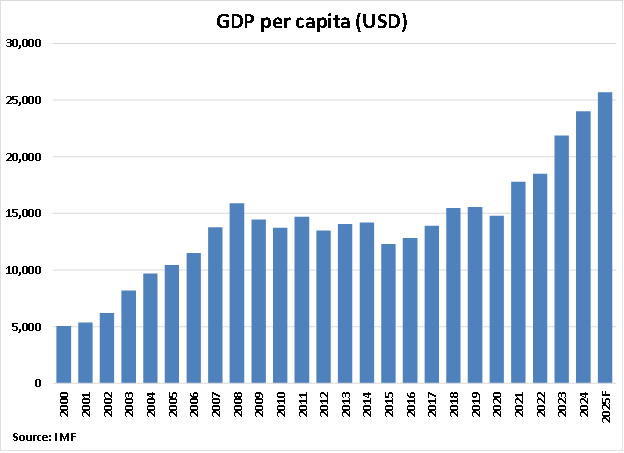

The broader economy remains healthy. Croatia's economy recorded a moderate real GDP growth rate of 3.8% during 2024, following annual expansions of 3.3% in 2023, 7.3% in 2022, and 12.6% in 2021. The country's economic growth last year remains among the highest level in the euro area.

In the third quarter of 2025, economic growth slowed sharply to 2.3% as compared to a year earlier, following year-on-year growth of 3.6% in Q2 and 3.3% in Q1, according to figures released by the Croatian Bureau of Statistics. In fact, it is the lowest expansion recorded since Q3 2023. On a seasonally-adjusted quarterly basis, the country's real GDP increased by a miniscule 0.3% in Q3 2025, following a 0.9% growth in the previous quarter.

With this, the European Commission expects Croatia's economy to expand by 3.2% this year, and gradually slow to 2.9% in 2026 and to 2.5% in 2027. The IMF is a bit more conservative, projecting a real GDP growth rate of 3.1% for Croatia this year, before slowing to 2.7% this year and 2.6% in 2027.

Croatia joined the Euro area on January 1, 2023.

The country's GDP per capita is estimated to reach approximately €18,000 this year, representing an increase of about 11% compared with the pre-euro-area accession level, according to IMF figures.

Demand Highlights:

Overall demand improving again

Residential property demand is showing signs of improvement this year. In the first half of 2025, the total number of new dwellings sold in Croatia increased strongly by 13.5% to 2,086 units as compared to the same period last year, according to figures from CBS. Likewise, the total useful floor area of dwellings sold also rose by 15.7% y-o-y to 140,012 sqm over the same period.

This partly offsets the decline in demand experienced last year. During 2024, the total number of new dwellings sold in Croatia dropped 13.3% y-o-y to 3,789 units, following an annual growth of 11.8% in 2023 and a decrease of 16.4% in 2022. Similarly, the total area of new dwelling sales also declined by 11.7% y-o-y to 259,177 sqm last year, in stark contrast to the annual increase of 7% in 2023.

By major area, in the first half of 2025:

- In Zagreb, demand is increasing sharply. The number of new dwellings sold surged by 52.1% y-o-y to 1,205 units in H1 2025, while the total sales area also rose by a huge 52.4% to 76,072 sqm over the same period.

- In other settlements, on the other hand, property demand is slowing rapidly despite strong tourism with its stunning coastline, clear waters, and historic towns attracting over 20 million visitors annually. In H1 2025, the number of new dwelling sales declined by 15.8% to 881 units while the area sold dropped 10.1% to 63,940 sqm.

"Demand is primarily driven by buyers seeking permanent residences, followed by second-home and investment buyers," said Colliers International. "After the housing loan scheme APN ended in 2023, discussions about new government measures in the housing market have begun."

Croatia's high-end residential market thriving

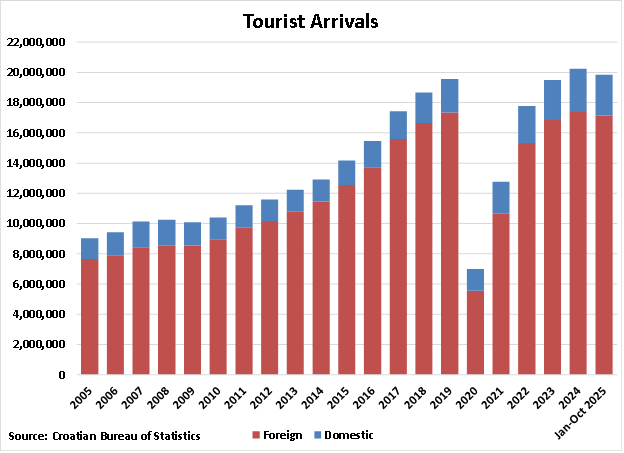

Croatia's high-end residential market, which is primarily buoyed by foreign buyers, is growing again, amidst the continued growth of the tourism sector. During 2024, the total number of tourist arrivals in the country rose by 3.9% y-o-y to a record-breaking 20.25 million visitors, following strong growth of 9.7% in 2023, 39.1% in 2022 and 82.5% in 2021, based on figures released by CBS.

Last year's figures have surpassed the previous record high of 19.57 million arrivals recorded in the pre-pandemic year of 2019.

The tourism sector continues to grow this year, albeit at a slower pace. In the first ten months of 2025, tourist arrivals totalled 19.85 million people, up by 2.3% from the same period last year. Over the same period:

- Domestic: total tourist arrivals reached 2.71 million people, up by 8.5% from a year earlier

- Foreign: arrivals totalled 17.14 million people, up slightly by 1.4% compared to the same period last year

The main reason for its resilience is limited supply.

"There are only a few large-scale resorts with residential components on the entire Croatian coast," said Colliers International. "Most renowned mixed-use resorts on the coast are Sun Gardens in Orašac near Dubrovnik, Punta Skala in Petrčane near Zadar, and Skiper resort in Savudrija near Umag."

More than 70,000 foreigners own property on the Adriatic Coast. Only 3% of foreign buyers chose Zagreb City. The most popular locations for foreigners are Dubrovnik, Split, Opatija, Istria, the Island of Hvar, and the Island of Brač.

"The demand is strongest for the seafront properties. The most popular destinations are those in developed destinations with good infrastructure and relative proximity to the airport," Colliers noted.

Most foreign homebuyers are Germans, Austrians, Britons, Slovenians, Slovaks, Czechs, Dutch, Hungarians, and Russians.

The right of non-EU foreign nationals to buy a property in Croatia depends on reciprocity agreements between Croatia and the foreign buyer's home country.

Luxury properties in Istria are popular among Germans, Austrians, and Slovenians. In Dalmatia, most luxury demand comes from the Croatian diaspora: Sweden, Slovakia, and the Czech Republic. Luxury homebuyers in Opatija are mostly Russians.

Last August 2020, the Maslina Resort in Stari Grad was finally opened, the second 5-star hotel on the island of Hvar in Maslinica Bay. The property offers private villas, a resort, and luxury hotel suites.

Petram Resort and Residences in Savudrija, Istria, is one of the largest tourism projects in recent years. It offers 179 holiday apartment units, 55 luxury villas, and three apartment buildings with 18 flats, all of which will have a 4 or 5-star standard. The construction began in October 2020 and was officially opened in June 2023.

LIOQA Resort, located on the west coast of Ugljan, was finished last year. This modern, fully serviced resort comprises 21 deluxe villas, a private beach, and a marina.

There are also small-scale tourist resorts, usually waterfront developments with up to 10 units or less in Dalmatia (the islands of Brač and Hvar, Makarska Riviera, and Rogoznica) and in the Kvarner region's Krk Island.

The five-star Hyatt Regency Zadar Maraska Hotel, located in Zadar, officially opened in May 2025. The luxurious hotel includes 133 rooms, a bar, a spa, a conference hall, and restaurants. Behind the hotel, a 200-unit residential complex is also being planned.

The five-star Riva's Hotel, to be operated under the Marriott brand, is also currently being built in Ičići near Opatija. The project, which has an estimated cost of €70 million, will offer 180 rooms and 12 villas when completed next year.

More tourist resorts have been launched in recent months.

The Heritage & Resort Hotel Monumenti, completed in May 2025, is a €85 million resort located in Pula. Historic Austro-Hungarian buildings were restored and expanded into a luxury resort with sea-view rooms, spa and wellness facilities, meeting and event spaces, and modern amenities, adding to the premium tourism offering in Istria.

The Pical 5-Star Resort, located in Poreč, Istria, is also a major new luxury resort currently under construction and slated to open in spring 2026. Valamar's €200 million project will feature 514 accommodation units, 11 restaurants, 10 bars, an expansive wellness spa (including Croatia's first ESPA spa), beaches, promenades, sports facilities, and Istria's largest conference centre.

Recently, Aminess began a €26 million transformation of the Atea Camping Resort in Njivice on Krk into a 5-star luxury camp resort named Aminess Atea Luxury Camp Resort. The redevelopment includes upgraded facilities and modern amenities, with reopening planned this year.

In October 2025, Hilton signed a management agreement for a seafront resort on Lopud Island near Dubrovnik. The existing property will be extensively renovated and relaunched as Hilton Lopud Beach Resort & Spa, with 111 rooms and suites plus additional luxury apartments, spa and wellness areas, and leisure facilities. The resort is scheduled to open in 2027 after renovation works begin in 2026.

Supply Highlights:

Residential construction activity continues to increase

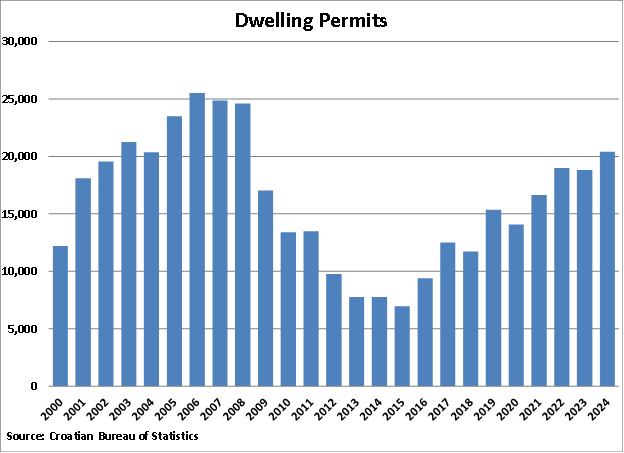

During 2024, the number of dwellings for which permits were issued increased by 8.5% to 20,405 units, following a slight decline of 1% in 2023 and strong growth of 14% in 2022 and 18.3% in 2021, according to the CBS.

Residential construction activity continues to strengthen this year. In October 2025, a total of 1,223 building permits were issued, up by 12.1% from a year earlier. In the first ten months of 2025, the number of building permits issued increased by 1.9% compared to the previous year.

By no. of rooms:

- One-room dwellings: the number of dwellings for which permits were issued rose by 9.8% y-o-y to 1,574 units last year, and total floor area increased by 11.2% to 68,109 sqm.

- Two-room dwellings: the number of dwelling permits soared by 19.4% y-o-y to 6,283 units, and floor area also increased strongly by 20.3% to 377,739 sqm.

- Three-room dwellings: dwellings for which permits were issued were up by 4.9% to 5,923 units, while the total floor area rose by 4.2% to 485,219 sqm.

- Four-room dwellings: the number and floor area of dwellings for which permits were issued increased by 3.9% to 4,370 units in 2024 and by 5.1% to 544,926 sqm, respectively.

- Five-room dwellings: the number of dwelling permits increased by 4% y-o-y to 1,655 units last year, while the floor area was up by 5.7% to 306,825 sqm.

- Six-room dwellings: the number of dwelling permits dropped 12.4% y-o-y to 425 units last year, while floor area also declined by 6% to 107,906 sqm.

- Seven-room dwellings: dwelling permits were down by 12.6% y-o-y to 97 units, and floor area decreased by 15.6% to 26,804 sqm.

- Eight or more-room dwellings: the number of dwellings completed increased by 14.7% y-o-y to 78 units in 2024, while the total floor area was steady at 24,252 sqm.

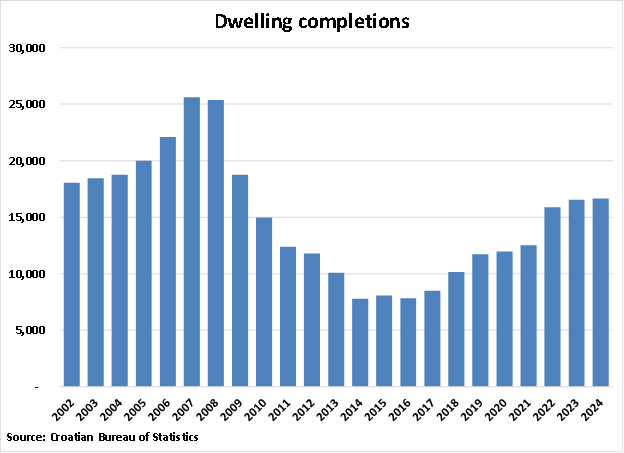

During 2024, the total number of dwelling completions rose slightly by 0.6% to 16,654 units from a year earlier, following annual growth of 4.3% in 2023, 26.9% in 2022, 4.7% in 2021, and 2% in 2020, according to the CBS. It was the eighth consecutive year of expansion and the highest number of completions seen since 2009.

Likewise, the total floor area of dwelling completions also increased by 5.5% y-o-y to 1,581,544 sqm last year, also the highest recorded in recent history.

By number of rooms:

- One-room dwellings: the number of dwellings completed for permanent residence fell by a huge 33.2% y-o-y to 1,179 units in 2024, while the total floor area declined by 34.3% to 49,907 sqm.

- Two-room dwellings: the number of dwelling completions dropped by 6.5% to 4,885 units in 2024 from a year earlier, while floor area also fell by 6% to 295,837 sqm.

- Three-room dwellings: dwellings completed were up by 11.6% to 5,133 units while the total floor area rose by 12.4% to 428,302 sqm.

- Four-room dwellings: the number and floor area of dwellings completed increased by 14.3% to 3,675 units in 2024 and by 16.4% to 447,576 sqm, respectively.

- Five-room dwellings: the number of dwellings completed increased slightly by 0.6% y-o-y to 1,257 units last year, while the floor area was up by 4.2% to 228,111 sqm.

- Six-room dwellings: the number of dwelling completions fell by 2.1% y-o-y to 380 units in 2024, and floor area dropped slightly by 0.3% to 87,811 sqm.

- Seven-room dwellings: dwelling completions were up by 27.2% y-o-y to 103 units, and floor area increased by 26.2% to 29,817 sqm.

- Eight or more-room dwellings: the number of dwellings completed increased by 31.3% y-o-y to 42 units in 2024, while the total floor area surged by 22.8% to 14,183 sqm.

Despite this, construction activity remains below the previous peak seen before the Global Financial Crisis of 2008-9.

"Development activity has never recovered from the last recession. From 2004 to 2008, on average, 22,000 apartments were built p.a.," said Colliers International.

Croatia's total dwelling stock reached 2,336,485 units, with a total useful floor area of 195.36 million sqm in 2024, according to figures from CBS.

Recent residential developments and projects in the pipeline

Recent years have seen a steady pipeline of upscale residential developments across Croatia, particularly in major urban centres and select coastal locations, reflecting sustained domestic demand, rising foreign interest, and gradually improving residential construction activity.

- VMD Park Kneževa - a high-end 125-unit apartment complex in Zagreb, completed in 2022. The project remains a benchmark for premium urban living, with estimated selling prices of around €5,000 per sq. m.

- VMD Kvart Heinzelova-Darwinova - a large residential complex offering more than 400 apartments in Zagreb. The project has been delivered in phases since 2022, with prices generally ranging between €2,600 and €3,000 per sq. m.

- Project Bužanova-Štrigina - an upscale residential development by Alfastan comprising 69 apartments, completed in 2023. Selling prices typically range from €3,200 to €3,700 per sq. m., reflecting strong demand for centrally located, high-quality housing.

- Vrtovi svjetla - a residential complex developed on the former TEŽ industrial site in the Sigečica area of Zagreb. The first phase of 163 apartments was completed in 2022, with prices starting at approximately €2,600 per sq. m. The entire project, which will deliver around 463 residential units, is expected to be completed by late 2024.

- Regent Sveta Klara - a modern residential project in the southern part of Zagreb, currently under construction, with completion expected in 2025-2026. The development targets mid- to upper-market buyers and emphasizes energy-efficient design and contemporary layouts.

- Regent Borovje Project - a residential development in eastern Zagreb, scheduled for completion in 2025. The project offers modern apartments aimed at owner-occupiers and long-term investors, benefiting from the improving infrastructure in the area.

- Jarun Gardens - a high-end residential development near Lake Jarun in Zagreb, planned for delivery in 2026. The project targets the premium segment, offering larger units, private outdoor spaces, and proximity to one of the city's most desirable recreational areas.

- Granešina Residential Project - a contemporary residential scheme in Gornja Dubrava, with construction progressing since 2024 and completion expected in 2026. The project focuses on affordable-to-mid upscale housing with energy-efficient standards.

- Zagrebački Manhattan - a large-scale mixed-use urban redevelopment project proposed in Zagreb, incorporating residential towers alongside commercial and retail components. The project remains in the planning and permitting phase as of 2025 and, if realized, would significantly expand high-density residential supply in the capital.

- Lukoran Resort - an upscale residential and tourism development located on Ugljan Island, set on approximately 7.7 hectares of prime seaside land. Scheduled for completion in 2025, the project will comprise 126 residential units, including villas, townhouses, and apartments, complemented by a beach club and marina.

- Prim Bay Resort - a large-scale mixed-use development located in a secluded bay near Primošten, within close proximity to Split. Planned for phased delivery in 2025-2026, the project will include a 250-room hotel, 141 branded residences, and a comprehensive range of leisure amenities, including beach bars, restaurants, wellness facilities, and sports and entertainment areas.

- Čiovo Bay Residences - a luxury residential development on Čiovo Island, currently under development, offering sea-view apartments and villas primarily targeting foreign buyers. Initial phases are expected to be completed between 2025 and 2026.

- Green Oasis Poreč - an eco-oriented residential development in Poreč, currently in the construction phase. The project integrates sustainable building solutions and is expected to be delivered in stages through 2025.

Rental Market:

Moderate rental yields, but very limited rental market

Croatia has moderate gross rental yields, averaging 4.42% in Q4 2025, slightly down from 4.45% in Q2 2025, 4.91% in Q4 2024, and 4.78% in Q2 2023, based on recent research conducted by the Global Property Guide.

Croatia's rent price index:

Note: Croatia's Rent Price Index, % change 1 yr

Data Source: Croatian Bureau of Statistics.

By major city:

- In Zagreb, Croatia's capital, gross rental yields for apartments ranged from 3.37% to 6.3% in Q4 2025, with a city average of 4.72%.

- In Rijeka, apartment rental yields ranged from 3.84% to 5.04%, with a city average of 4.28% in Q4 2025.

- In Split, apartment rental yields are relatively lower, ranging from 3.01% to 4.66% in Q4 2025, with a city average of 3.61%.

- In Osijek, gross rental yields for apartments ranged from 4.69% to 5.27%, with a city average of 5.08%.

Most Croatians are owner-occupiers. About 91% of Croatian households are currently living in an owner-occupied home or apartment, far higher than the eurozone average of less than 70%, according to Eurostat figures.

The country's long-term rental market is very small. Most long-term rental properties are in Zagreb, Dubrovnik, and Split. In Zagreb, the demand for rental properties partly comes from students studying at the University of Zagreb, as in Split, where the greatest demand is in the city center and around the university campus.

The Adriatic coast is the core of short-term demand, concentrating on short-term holiday rentals for foreigners and tourists.

Mortgage Market:

Mortgage interest rates declining

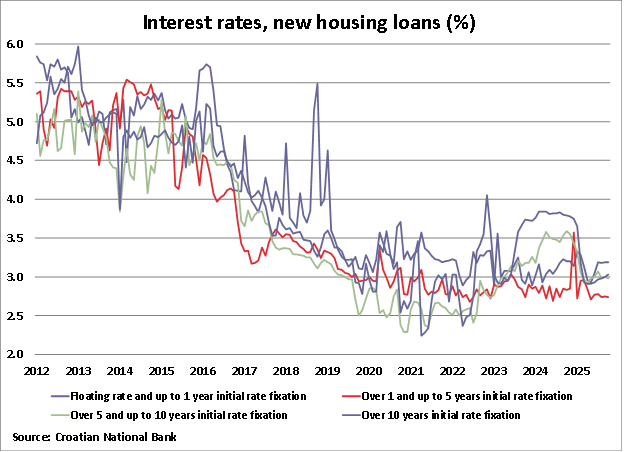

In October 2025, the average interest rate for new housing loans in Croatia was 3.03%, down from 3.73% in the previous year and 3.6% two years ago, according to the Croatian National Bank (CNB), the country's central bank. However, it remains higher than the average interest rate for new housing loans of just 2.89% in January 2023 when the euro was newly adopted as its official currency.

Croatia's mortgage loan interest rates:

Note: Annualised agreed rate (AAR) / Narrowly defined effective rate (NDER) (R)

Data Source: ECB.

By initial rate fixation (IRF), in October 2025:

- Floating rate and IRF of up to 1 year: 3.19%, slightly down from 3.2% in October 2024 and lower than the 2.91% recorded in the same month two years ago.

- IRF over 1 and up to 5 years: 2.74%, slightly lower than the 2.83% in the same period last year but at par with the 2.74% registered two years ago.

- IRF over 5 years and up to 10 years: 2.98%, down from 3.59% in October 2024 and from 3.18% in October 2023.

- IRF over 10 years: 3.03%, down from 3.79% in the same period last year and from 3.74% two years earlier.

Only about 2.4% of all new housing loans in the first ten months of 2025 are floating rate (or with interest rate fixation (IRF) of up to 1 year), 2.1% have an IRF between 1 and 5 years, and 3.7% have an IRF between 5 and 10 years. The remaining 91.8% of all new housing loans have an IRF of more than 10 years.

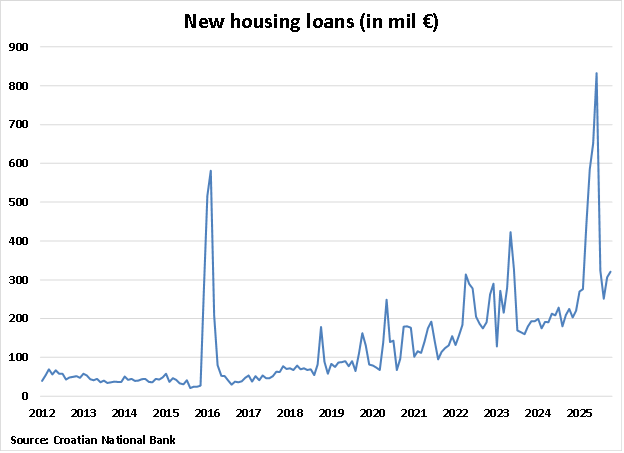

New housing loans rising strongly again, outstanding loans continue to increase

Croatia's residential mortgage loans are now growing strongly again, amidst gradually declining interest rates. In the first ten months of 2025, the value of new housing loans drawn amounted to €4.26 billion, up by a whopping 110.8% from €2.02 billion in the same period last year, according to CNB figures.

New housing loans by IRF, in the first ten months of 2025:

- Floating rate and IRF of up to 1 year: €103.9 million, up by a huge 37.6% as compared to the same period last year.

- IRF of over 1 and up to 5 years: €88.4 million, up by 11% from a year earlier.

- IRF of over 5 years and up to 10 years: €155.5 million, up by a whopping 56% as compared to a year earlier.

- IRF of over 10 years: €3.91 billion, up by a huge 121.6% from the previous year.

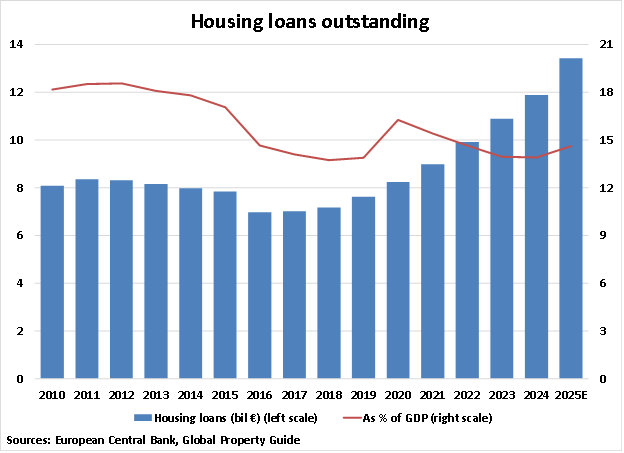

As a result, outstanding housing loans in the country continue to increase. As of October 2025, the total outstanding housing loans reached a record of €13.43 billion, up strongly by 14.8% as compared to a year earlier, following year-on-year growth of 9.1% in 2024, 9.8% in 2023, 10.3% in 2022, 9% in 2021, and 8.2% in 2020.

Outstanding housing loans have been continuously growing since 2017. But prior to this, the mortgage market contracted by an annual average of 3.5% from 2012 to 2016, before stabilizing in 2017.

The mortgage market has developed significantly in recent years, as the old large state-owned banks have been privatized, commercial banks have been restructured, and Austrian, Italian, and German banks have entered the market. There was a significant increase in building societies' share of loans, from 1% in 2003 to 5% recently.

Yet the size of the residential mortgage market of Croatia remains small, equivalent to about 14.6% of GDP in 2025.

Since Croatia joined the eurozone early last year, nearly all housing loans in the country have been converted to euros.

Socio-Economic Context:

Croatia's economy continues to expand, albeit at slower pace

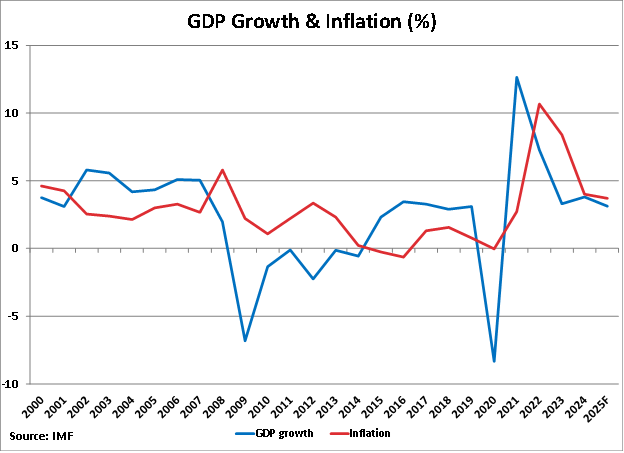

Croatia's economy recorded a moderate real GDP growth rate of 3.8% during 2024, following annual expansions of 3.3% in 2023, 7.3% in 2022, and 12.6% in 2021. The country's economic growth last year remains among the highest levels in the euro area.

"The economy has continued to grow rapidly, still among the highest in the euro area, but imbalances are emerging. The increases in fiscal deficit driven by spending during strong economic growth have exacerbated demand pressures, contributing to higher inflation and current account deficits. Credit growth has been rapid, and housing prices have increased strongly," said the IMF in its 2025 Article IV Consultation.

In the third quarter of 2025, economic growth slowed sharply to 2.3% as compared to a year earlier, following year-on-year growth of 3.6% in Q2 and 3.3% in Q1, according to figures released by the Croatian Bureau of Statistics. In fact, it is the lowest expansion recorded since Q3 2023. Over the same period:

- Household consumption increased by 1.9% y-o-y in Q3 2025, a deceleration from the previous quarter's 4% growth.

- Gross fixed capital formation grew by 7.5% y-o-y, up from the previous quarter's 4.9% growth.

- Government spending also increased by 3.8% y-o-y, slightly up from the previous quarter's 3.3% growth.

- Net external trade had a negative impact on GDP, as exports fell by 1.1% y-o-y in Q3 2025, while imports increased by 2.4%.

On a seasonally-adjusted quarterly basis, the country's real GDP increased by a miniscule 0.3% in Q3 2025, following a 0.9% growth in the previous quarter.

With this, the European Commission expects Croatia's economy to expand by 3.2% this year, and gradually slow to 2.9% in 2026 and to 2.5% in 2027. The IMF is a bit more conservative, projecting a real GDP growth rate of 3.1% for Croatia this year, before slowing to 2.7% this year and 2.6% in 2027.

"After growing by 3.8% in 2024, Croatia's real GDP growth is forecast to gradually slow down but remain robust throughout the forecast period, supported by strong domestic demand," said the European Commission. "In 2025, GDP is projected to grow by 3.2%, as private consumption is underpinned by increases in real wages and employment."

"Economic growth is forecast to ease to 2.9% in 2026 and 2.5% in 2027, driven by a slowdown in consumption as improvements in real disposable income moderate," added the Commission.

During the global financial crisis, Croatia's economy lost more than 12% of its GDP from 2009 to 2014, Europe's second-biggest contraction after Greece. Since the beginning of 2014, Croatia has been in the European Commission's Excessive Deficit Procedure (EDP) due to its high budget deficits and public debt.

Croatia's economy began to turn around in 2015 and gained momentum in 2016, expanding by 2.6% and 3.6%, respectively. The country exited the EDP in June 2017. The economy grew by an annual average of 3.3% from 2017 to 2019, before contracting by a huge 8.3% in 2020 due to the Covid-19 pandemic.

The Croatian economy bounced back strongly in 2021, registering a real GDP growth rate of 12.6%, fully offsetting the pandemic-induced contraction of 8.3% in the prior year. Then in 2022, Croatia recorded another impressive growth of 7.3%, as economic activity totally returned to pre-pandemic levels.

The country registered a budget deficit equivalent to about 2.4% of GDP in 2024, followed by a shortfall of 0.8% of GDP in 2023 and a nearly balanced budget in 2022. Despite the shortfall increase last year, Croatia's budget remains within the Maastricht threshold of a 3% deficit.

Croatia's budget deficit is projected to widen further to about 2.9% of GDP this year, largely due to strong growth in social benefits, especially pension outlays, and lingering fiscal pressures from the expanded 2024 wage bill.

"The general government deficit has steadily increased since 2023 and is close to 3 percent of GDP this year, primarily due to higher wage bills and social benefits," said the IMF. "Taking into account the government's 2026 budget plan and existing policies, we project the deficit to remain at about 2.9 percent of GDP in 2026. Given the expected higher financing by EU grants, which is deficit neutral, the budget plan implies little withdrawal of fiscal stimulus next year."

Despite this, the public debt is projected to fall to around 56.2% of GDP this year, down from 57.7% of GDP in 2024, 61.8% in 2023, 68.5% in 2022, 78.2% in 2021, and 86.5% in 2020. In fact, public debt is already far lower than the 70.9% of GDP recorded before the pandemic in 2019.

In March 2025, Fitch Ratings affirmed Croatia's long-term foreign-currency issuer default rating at 'A-', with a stable outlook. This followed upgrades in September 2024 and July 2022 after the Council of the European Union officially confirmed Croatia's accession to the euro area on January 1, 2023.

"Croatia's ratings reflect its credible policy framework supported by its EU and eurozone membership, a record of fiscal discipline and commitment to EU fiscal rules, and robust economic growth," said Fitch Ratings.

Then in September 2025, S&P Global Ratings also affirmed its 'A-' long-term and 'A-2' short-term sovereign credit ratings on Croatia, with a positive outlook. Earlier, in September 2024, Moody's upgraded the Government of Croatia's long-term issuer and senior unsecured ratings to A3 from Baa2, and the outlook has been changed to stable from positive.

Inflationary pressures have edged higher but remain manageable. In November 2025, the overall inflation stood at 3.8%, up from 3.6% in the previous month and 2.8% in the same month last year.

Nationwide inflation averaged just 1.2% in 2010-2021 before accelerating to 10.7% in 2022 and 8.4% in 2023. Inflation eased to an average of 4% last year.

The European Commission expects inflation to settle at an average of 4.3% this year, before falling to 2.8% next year.

The labor market remains tight. The registered nationwide unemployment rate was 4.5% in November 2025, up from 4.2% in the previous month but still lower than the 5% recorded a year earlier, according to CBS.

"Labour shortages remain significant despite increased numbers of non-EU workers immigrating to Croatia. The unemployment rate is set to reach new lows of 4.7% in 2025, 4.5% in 2026 and 4.6% in 2027, mirroring the tight labour market," said the European Commission. "As labour demand gradually stabilises and employment growth slows, nominal and real wage increases are projected to ease."

The country's jobless rate averaged 17.4% from 2000 to 2017 before gradually falling to single-digit figures in the past seven years.

Sources:

- Prices of Sold New Dwellings, First Half-Year of 2025 (Croatian Bureau of Statistics): https://podaci.dzs.hr/

- Prices of New Dwellings Sold, Second Half-Year of 2024 (Croatian Bureau of Statistics): https://podaci.dzs.hr/

- Market Snapshot Croatia H1 2025 (Colliers International): https://www.colliers.com/

- 2024 Overview and 2025 Outlook Croatia (Colliers International): https://www.colliers.com/

- 2023 Overview and 2024 Outlook Croatia (Colliers International): https://www.colliers.com/

- Croatia to join euro area on 1 January 2023 (European Central Bank): https://www.ecb.europa.eu/

- Building Permits Issued, October 2025 (Central Bureau of Statistics): https://podaci.dzs.hr/

- Construction (Croatian Bureau of Statistics): https://web.dzs.hr/

- Gross rental yields in Croatia: Zagreb and 3 other cities (Global Property Guide): https://www.globalpropertyguide.com/

- Croatia Home Ownership Rate (Trading Economics): https://tradingeconomics.com/

- Interest rates (Croatian National Bank): https://www.hnb.hr/

- Economic forecast for Croatia (European Central Bank): https://economy-finance.ec.europa.eu/

- IMF Executive Board Concludes 2025 Article IV Consultation with the Republic of Croatia (International Monetary Fund): https://www.imf.org/

- Republic of Croatia: Staff Concluding Statement of the 2025 Article IV Mission (International Monetary Fund): https://www.imf.org/

- Republic of Croatia (International Monetary Fund): https://www.imf.org/

- Croatia GDP Growth Slows in Q3 (Trading Economics): https://tradingeconomics.com/

- Croatia Government Debt to GDP (Trading Economics): https://tradingeconomics.com/

- Fitch Affirms Croatia at 'A-'; Outlook Stable (Fitch Ratings): https://www.fitchratings.com/

- Croatia 'A-/A-2' Ratings Affirmed; Outlook Positive (S&P Global): https://www.spglobal.com/

- Moody's Ratings upgrades Croatia's ratings to A3, changes outlook to stable from positive (Moody's Ratings): https://ratings.moodys.com/