Singapore's Residential Property Market Analysis 2025

The Singaporean private housing market continues to demonstrate resilience, supported by sustained demand and a strong pipeline of new project launches, which have helped to underpin home prices and rents despite heightened economic uncertainty.

This extended overview from Global Property Guide covers key aspects of the Singaporean housing market and takes a closer look at its most recent developments and long-term trends.

Table of Contents

- Housing Market Snapshot

- Supply Highlights

- Demand Highlights

- Rental Market

- Mortgage Market

- Socio-Economic Context

Housing Market Snapshot

The private housing market in Singapore continues to demonstrate resilience, supported by sustained demand and a strong pipeline of new project launches, which have helped to underpin home prices. In the third quarter of 2025, the Urban Redevelopment Authority's (URA) Property Price Index for all private residential properties increased by 0.89% quarter-on-quarter and 5.08% year-on-year.

Singapore's house price annual change:

Note: Singapore House Price Index: Private Residential Properties (2009 = 100).

Data Source: Urban Redevelopment Authority.

Landed properties (privately owned standalone terrace houses, semi-detached houses, bungalows, and shophouses) led the quarterly price gains with a 1.41% rise and a 3.95% increase on an annual basis. "As interest rates continue to moderate, high-net-worth individuals seeking capital preservation may continue to invest in luxury landed properties <…> We expect buying appetite for luxury homes to continue into 2026," stated the report from OrangeTee.

Prices for non-landed private homes (strata-titled private condominiums) rose by 0.82% quarter-on-quarter and 5.57% year-on-year, supported by firm demand across various market segments. The Core Central Region (CCR) recorded the strongest performance, with prices increasing by 1.68% quarter-on-quarter and 8.28% year-on-year, driven in part by notable new launches such as The Robertson Opus, UpperHouse at Orchard Boulevard, and River Green.

Knight Frank's analysis, however, indicates that while recent CCR launches have renewed activity in prime districts, price appreciation in the CCR over the past five years has trailed that of the Rest of Central Region (RCR) and Outside Central Region (OCR). From Q3 2020 to Q3 2025, cumulative growth in the CCR's non-landed price index was 27%, compared with 47% in the RCR and 46% in the OCR. "With a narrowing price gap between the prime locations versus the rest of the island, value opportunities could emerge for the observant homebuyer," the report noted.

Property Price Index of Private Residential Properties, quarterly vs annual movement:

| Quarterly Movement (QoQ), Q3 2025 vs Q2 2025 |

Annual Movement (YoY), Q3 2025 vs Q3 2024 |

|

| All properties (whole island) | 0.89% | 5.08% |

| Landed properties (whole-island) | 1.41% | 3.95% |

| Non-landed properties (whole island) | 0.82% | 5.57% |

| Core Central Region (CCR) | 1.68% | 8.28% |

| Rest of Central Region (RCR) | 0.31% | 3.92% |

| Outside Central Region (OCR) | 0.80% | 5.58% |

| Data Source: URA. | ||

The CCR continued to register the highest average price of new homes sold (including landed and non-landed properties but excluding executive condominiums), with new sales averaging SGD 3,208 (USD 2,499) per square foot. This was followed by the RCR at SGD 2,695 (USD 2,099) and the OCR at SGD 2,154 (USD 1,678).

| Average Sale Price, Q3 2025, (SGD, per sqf) |

Average Sale Price, Q3 2025, (USD, per sqf) |

YoY, % | |

| Core Central Region (CCR) | |||

| New Sale | SGD 3,208 | USD 2,499 | -0.22% |

| Resale | SGD 2,261 | USD 1,761 | 3.67% |

| Sub Sale | SGD 2,955 | USD 2,302 | 1.90% |

| Rest of Central Region (RCR) | |||

| New Sale | SGD 2,695 | USD 2,099 | 3.81% |

| Resale | SGD 1,942 | USD 1,513 | 4.24% |

| Sub Sale | SGD 2,252 | USD 1,754 | 2.32% |

| Outside Central Region (OCR) | |||

| New Sale | SGD 2,154 | USD 1,678 | 1.56% |

| Resale | SGD 1,573 | USD 1,225 | 5.64% |

| Sub Sale | SGD 2,001 | USD 1,559 | 5.76% |

| Data Sources: URA, Realion (OrangeTee & ETC) Research. | |||

Looking ahead, market analysts expect private home prices to continue trending upward, supported by healthy demand and the supply of upcoming launches. "The upward revision of Singapore's 2025 GDP forecast, along with the low-interest rate environment, has boosted consumer confidence, supporting homebuying activity," commented ERA. Forecasts by CBRE, Knight Frank, OrangeTee, and PropNex place 2025 price growth in the range of 3% to 5%.

In the public housing market, the Housing and Development Board (HDB) Resale Price Index rose by 0.39% quarter-on-quarter and 5.60% year-on-year in Q3 2025, contributing to a narrowing price gap between public and private housing. HDB plays a central role in Singapore's housing landscape, developing and managing residential estates to ensure affordability for citizens. Ownership is restricted to Singaporeans and eligible permanent residents, with a minimum occupation period of five years before resale. As of 2024, HDB flats accommodated 77.4% of resident households, according to the Singapore Department of Statistics (DOS).

Supply Highlights:

Strong Market Fundamentals Support Steady Expansion in New Supply

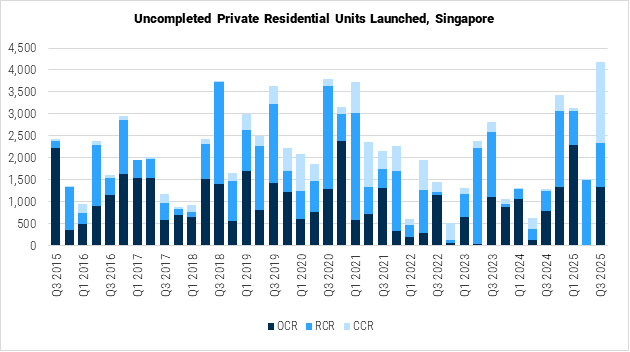

Reflecting sustained buyer demand underpinned by stable employment conditions and continued household formation, housing supply in Singapore has expanded steadily. The URA reports 4,191 private residential units launched during Q3 2025, marking a substantial year-on-year increase of 226.40%. Over the first nine months of the year, developers launched a total of 8,850 units, up 174.67% compared to the same period in 2024.

Data Source: URA.

Of the units launched in the first three quarters of 2025, 41% were located in the Outside Central Region (OCR), followed by the Rest of Central Region (RCR) at 37% and the Core Central Region (CCR) at 22%. The CCR recorded the most pronounced year-on-year expansion, with launches rising more than 523%, supported by a series of major new projects, including The Robertson Opus, UPPERHOUSE at Orchard Boulevard, River Green, and the soft-launched W Residences Marina View.

Uncompleted private residential units launched by the submarket:

| Units Launched, Q1-Q3 2025 |

YoY, % | |

| CCR | 1,952 | 523.64% |

| RCR | 3,257 | 246.12% |

| OCR | 3,641 | 85.01% |

| Total | 8,850 | 174.67% |

| Data Source: URA. | ||

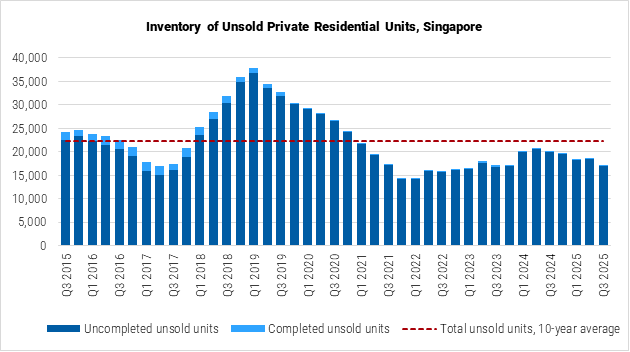

Total unsold inventory of private residential units (excluding executive condominiums) declined by 7.74% quarter-on-quarter to 17,209 units in Q3 2025. Of this, 17,029 units were from uncompleted projects with planning approvals in place. On a year-on-year basis, unsold inventory fell by 14.48% and remains below the ten-year annual average of 22,349 units, as well as significantly below the peak of 37,799 units recorded in Q1 2019.

Data Source: URA.

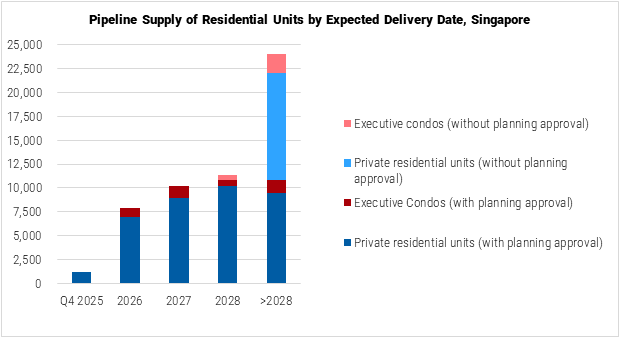

The URA data further indicates that approximately 54,000 private residential units, including executive condominiums, are currently in the pipeline for future sale, spanning both approved developments and those pending approval. Several noteworthy projects are expected to launch before year-end, including Penrith, Zyon Grand, The Sen, Skye and Holland, and Faber Residence, underscoring developers' continued responsiveness to market dynamics and sustained buyer interest. "Developers are likely to expedite their launches and ride on the current wave of positive sales momentum", noted OrangeTee Research.

Note: Total number of units to be delivered within the projects, including both sold and unsold units.

Data Source: URA.

Demand Highlights:

Structural Demand and Competitive Launches Propel Residential Sales

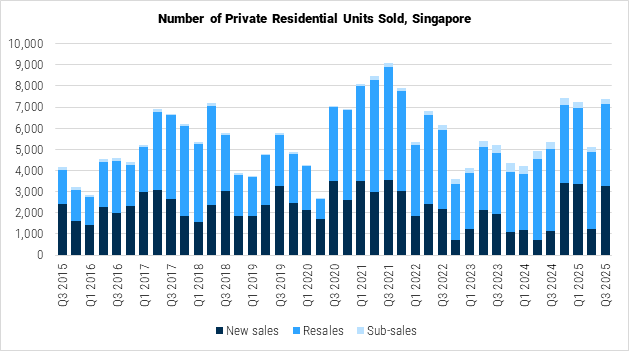

Private residential sales activity in Singapore continues to strengthen. According to the URA data, 7,404 residential units (excluding executive condominiums) were transacted in Q3 2025, marking a robust 37.83% increase year-on-year. This brings total sales for the first three quarters of the year to 19,793 units, up 36.34% from the same period in 2024.

Experts from Knight Frank attribute the market's resilience to Singapore's strong employment landscape and healthy household balance sheets, even amid global economic uncertainty. "Most residents remain employed, and strong domestic savings provide households with financial flexibility, sustaining demand even as global economic and geopolitical pressures persist," the latest market overview noted.

Data Source: URA.

New home sales were particularly strong, with 3,288 new private units sold in Q3 2025, representing a 183% year-on-year surge. The increase corresponded with a larger pipeline of newly launched projects, steady buyer demand, and a supportive low-interest-rate environment. "Three projects sold above 85% on their launch day, namely Lyndenwoods (94%), River Green (88%), and Springleaf Residence (92%). This can be attributed to pent-up demand as they are in areas that either saw the first-ever launch, or first in a long time in their respective estate," experts from ERA commented.

The resale segment also held firm despite heightened competition from new launches. A total of 3,881 resale transactions were recorded in Q3 2025, reflecting a slight 0.54% increase from a year earlier. Sub-sales remained the smallest segment, with 235 units sold in the quarter, a 33.24% year-on-year decline largely due to a smaller pool of recent private home completions.

Regionally, the Outside Central Region (OCR) continued to dominate sales, accounting for more than half of all private home transactions. The Rest of Central Region (RCR) contributed 34%, while the Core Central Region (CCR) accounted for the remaining 16%.

Number of residential units sold by submarket:

| New Sales, Q1-Q3 2025 |

YoY, % | Resales, Q1-Q3 2025 |

YoY, % | Sub-sales, Q1-Q3 2025 |

YoY, % | |

| CCR | 1,139 | 372.61% | 2,025 | 8.75% | 76 | 85.37% |

| RCR | 2,937 | 243.11% | 3,315 | 12.18% | 382 | -14.35% |

| OCR | 3,799 | 94.62% | 5,753 | 3.96% | 367 | -41.75% |

| Total | 7,875 | 158.28% | 11,093 | 7.17% | 825 | -26.14% |

| Data Source: URA. | ||||||

Foreign buyer participation remained subdued following successive Additional Buyer's Stamp Duty (ABSD) hikes, particularly the April 2023 revision that raised the rate for foreign buyers to 60%. "In lieu of foreign buyers that have stayed away from the private home market due to the 60% ABSD rate, wealthy Singaporeans and Permanent Residents (PRs) have been on the prowl for investment opportunities in Singapore's prime residential areas," noted Knight Frank.

Dynamics of ABSD rates for residential properties:

| Rates before Jul 6, 2018 | ABSD 1, Rates on or after Jul 6, 2018 |

ABSD 2, Rates on or after Dec 16, 2021 |

ABSD 3, Rates on or after Apr 27, 2023 |

|

| Singapore Citizens | 1st property: 0% 2nd property: 7% 3rd + property: 10% |

1st property: 0% 2nd property: 12% 3rd + property: 15% |

1st property: 0% 2nd property: 17% 3rd + property: 25% |

1st property: 0% 2nd property: 20% 3rd + property: 30% |

| Singapore Permanent Residents (PRs) | 1st property: 5% 2nd + property: 10% |

1st property: 5% 2nd + property: 15% |

1st property: 5% 2nd property: 25% 3rd + property: 30% |

1st property: 5% 2nd property: 30% 3rd + property: 35% |

| Foreign Residents | 15% | 20% | 30% | 60% |

| Data Source: IRAS. | ||||

Looking ahead, CBRE Research has revised its forecast for 2025, now projecting new home sales to reach between 9,000 and 10,000 units. "While the bulk of major projects have already been launched, there are still a few anticipated launches in Q4 2025 <…> With robust performance reported at said launches, CBRE Research now forecasts that full year 2025 new home sales could reach a 4-year high <…> since 13,027 units were sold in 2021," analysts commented.

PropNex similarly expects new private home sales to fall within the 9,000 to 10,000 range, with resale transactions forecast at 14,000 to 15,000 units next year. The agency cites moderating interest rates, a healthy pipeline of upcoming launches, and ongoing demand from first-time homebuyers and HDB upgraders as key supporting factors. However, it notes that broader macroeconomic risks, including US trade policy tensions, remain the primary downside consideration.

Rental Market:

Rents Continue to Rise Moderately

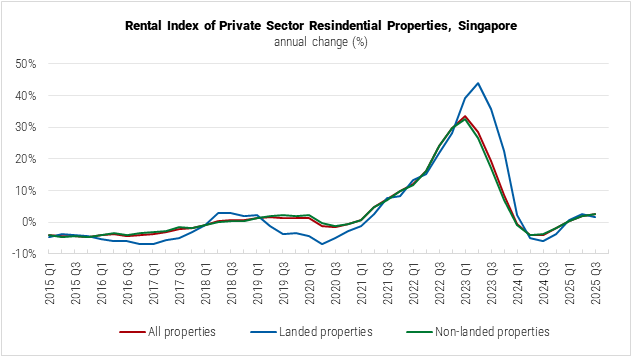

Following a sharp downturn in the private rental inflation trend in 2024, when the Rental Index of Private Sector Residential Properties from the URA demonstrated annual declines for three consecutive quarters, the market now shows signs of stabilization, with the index movement back in positive territory since early 2025.

Singapore's rent price index:

Note: Singapore Rent Index Of Residential Properties Index / Quarterly (2009=100), % change 1 yr

Data Source: Statistics Singapore.

In Q3 2025, the island-wide private rental index recorded a 2.4% year-on-year growth, with the index for landed properties increasing by 1.6% and the index for non-landed properties by 2.7%. The regional dynamic for non-landed properties varied only marginally, with the index posting a slightly stronger annual increase in the CCR (2.7%) than in the OCR (2.6%) and the RCR (2.5%).

Data Source: URA.

Rental Index of Private Sector Residential Properties, quarterly and annual movement:

| Quarterly Movement (QoQ), Q3 2025 vs Q2 2025 |

Annual Movement (YoY), Q3 2025 vs Q3 2024 |

|

| All properties (whole island) | 1.2% | 2.4% |

| Landed properties (whole island) | 2.4% | 1.6% |

| Non-landed properties (whole island) | 1.1% | 2.7% |

| Core Central Region (CCR) | -0.5% | 2.7% |

| Rest of Central Region (RCR) | 1.8% | 2.5% |

| Outside Central Region (OCR) | 2.5% | 2.6% |

| Data Source: URA. | ||

In nominal terms, the research carried out by Global Property Guide in July 2025 showed the average advertised rent for residential units in Singapore standing at USD 2,740 for 1-bedroom units, USD 3,520 for 2-bedroom units, and USD 4,930 for 3-bedroom units. The corresponding gross rental yields averaged 3.36% (slightly up from 3.41% previously reported in November 2024), with only marginal variation among the monitored submarkets. Yields slightly above the national average were observed in Hougang / Punggol / Sengkang (3.60%) and Alexandra / Commonwealth (3.51%).

The rents in the high-end segment of non-landed private residential projects tracked by Savills rose for the third consecutive quarter (albeit less notably than in previous periods), reaching SGD 5.99 (USD 4.67) per square foot in Q2 2025.

Overall, commenting on recent developments, analysts from Savills note that across market segments, the median rents of small-sized units, particularly studio and one-bedroom apartments, have come under downward pressure. Slower rental growth may be attributed to increased competition among landlords amid ample new supply, as well as softening demand from foreign professionals, dampened by tariff-related hiring uncertainties and labor-substitutive effects from the adoption of generative artificial intelligence.

At the same time, Savills believes rents may still be able to weather through 2025 and stay sideways for the whole of this year. "Notwithstanding business uncertainties, rents are holding up because newly completed and let out apartments carry a premium over the rest," said Alan Cheong from Savills Research.

CBRE experts offer a slightly more optimistic assessment of the market's prospects, based on improved occupancy statistics despite increased unit completions in Q3 2025 compared to the previous quarter: "We maintain our forecast for island-wide rents to grow 1-3% in 2025, barring a significant pullback in demand."

Mortgage Market:

Interest Rates at 3-Year Low, Market Activity Grows

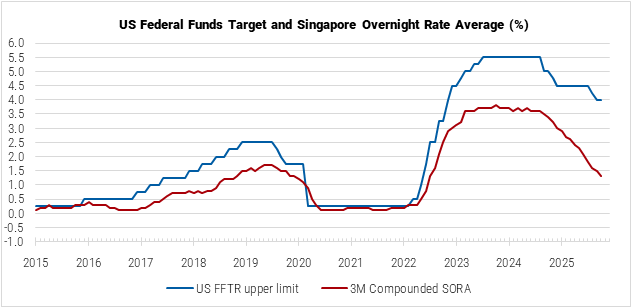

Unlike most central banks, the Monetary Authority of Singapore (MAS) does not conduct monetary policy by adjusting domestic interest rates; rather, it uses the Singapore dollar nominal effective exchange rate (S$NEER), based on a weighted basket of currencies from major trading partners, as its primary intervention tool.

This approach causes Singapore's interest rates to be greatly influenced by global markets and, more specifically, by the US market. The Singapore Overnight Rate Average (SORA), which, since 2019, has been gradually replacing the Singapore Inter-Bank Offered Rate (SIBOR) as the main lending benchmark and basis for new floating-rate mortgages, tends to move in tandem with the US Federal Funds Target Range (FFTR), typically trending below it.

Along with the gradual monetary policy relaxation by the US Federal Reserve, SORA has been on a downward trajectory since the fall of 2024, with the 3-month Compounded SORA most recently reported by the MAS at 1.3% in October 2025.

Banks in Singapore typically offer floating-rate mortgages with interest calculated as 1-month or 3-month Compounded SORA plus bank spread of up to 1% and fixed-rate mortgages with a 1- to 3-year lock-in period (after which the rate switches to SORA plus bank spread). Thus, a consistent decline in SORA over the recent months led to interest rates on home loans also falling to a 3-year low.

According to the information on individual loan products accumulated by Redbrick Mortgage Advisory, at the time of research in November 2025, fixed-rate mortgages were offered by banks at best rates of between 1.55% and 2.40% during the locked period, while best-offer net interest on floating-rate mortgages ranged from 1.65% to 2.30% during the locked period. At the same time, the Housing and Development Board (HDB) concessionary loan rate remains somewhat higher at 2.60%, which prompts many HDB homeowners to refinance their mortgages with cheaper bank loans, as outlined in a recent article in The Straits Times.

Data Sources: MAS, FRED.

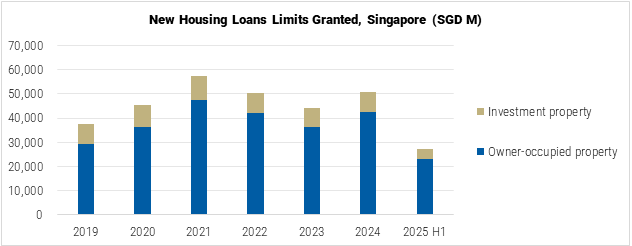

With interest rates falling, lending activity in Singapore notably picked up after two years of annual declines in new housing loans granted. Based on figures published by the MAS, the combined value of loan limits granted for owner-occupied and investment properties in 2024 expanded by 15.3%, compared to 2023, not yet reaching the highs observed in 2021 but already exceeding the 2022 levels.

This upward trend continued in H1 2025, with limits granted reaching SGD 23.0 billion (USD 17.4 billion) for owner-occupied properties and SGD 4.3 billion (USD 3.2 billion) for investment properties - a 17.1% year-on-year increase in their combined value.

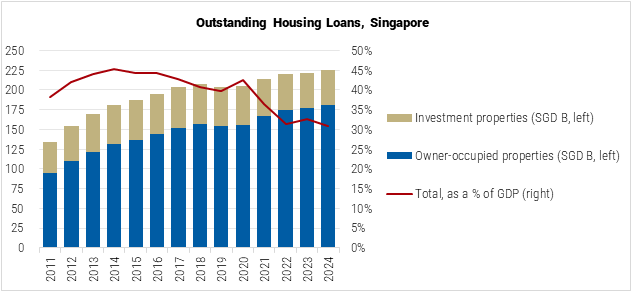

Data Source: MAS.

In parallel, the total amount of outstanding housing loans in Singapore returned to more pronounced growth, having increased by 1.7% in 2024 after a slowdown to just 0.8% in 2023. The overall market expansion was driven by owner-occupied properties (+2.2% year-on-year), while the investment properties segment shrank by 0.3% year-on-year. As of H1 2025, the combined housing loan stock stood at SGD 230.6 billion (USD 174.2 billion), over 80% of that amount represented by loans on owner-occupied properties and about 20% by loans on investment properties.

Sized against the Singaporean economy, the residential mortgage market was equivalent to an estimated 30.9% of GDP at current prices in 2024, down from 32.7% in the previous year and 45.3% a decade ago in 2014. Based on the latest reporting from the DOS, mortgages represent 72.7% of total household debt, of which 61.1% are loans from financial institutions and 11.6% loans from the HDB, which provides loan options with lower downpayment and higher loan-to-value ratio to qualifying Singaporean nationals.

Data Sources: MAS, DOS.

Socio-Economic Context:

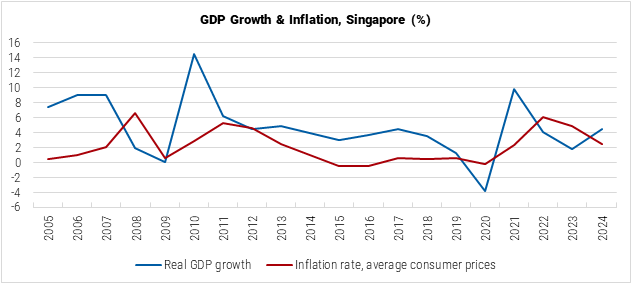

Growth Resilient, Expected to Moderate

After a strong 4.4% expansion in 2024, Singapore's economy has demonstrated resilience amid global uncertainties in the three quarters of 2025, cushioned by a construction boom, generous fiscal support, and falling interest rates. Nonetheless, the country's real GDP growth is expected to moderate in 2025 and beyond as activity in trade-related sectors normalizes and the impact of tariffs unfolds further. "The Singapore economy has expanded at an above-trend rate this year, but GDP growth is expected to step down in 2026 as tariff effects start to bite," summarized the latest macroeconomic review from the MAS. The current forecast from the International Monetary Fund (IMF) expects growth to slow to 2.2% in 2025 and 1.8% in 2026.

In parallel, consumer price index (CPI) inflation in Singapore continued to ease, dropping from an annual level of 4.8% in 2023 to 2.4% in 2024 and, most recently, registered at just 0.7% in September 2025. The MAS review noted that in recent months inflation slowed for most goods and services, reflecting fresh government subsidies for long-term care services, as well as subdued imported and moderating domestic cost pressures. At the same time, some of the factors dampening inflation are expected to diminish in the quarters ahead, allowing the MAS to forecast that core inflation will trough in the near term and rise gradually thereafter, averaging around 0.5% for 2025 as a whole and come in between 0.5-1.5% for 2026. This projection is in line with the IMF forecast, which places the indicator at 0.9% for 2025 and 1.3% for 2026.

Data Source: IMF.

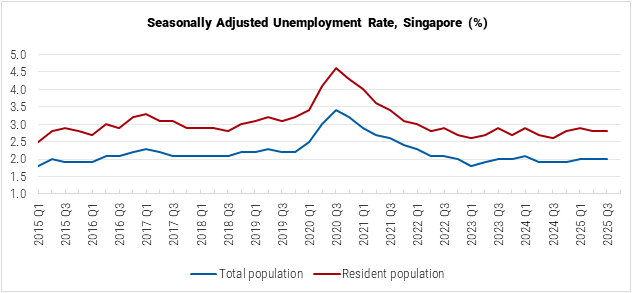

In the Singaporean labor market, the latest MAS review notes faster-than-expected employment gains amid a stronger pace of hiring in construction, travel-related services, and modern services. Other indicators (such as vacancies to unemployed persons ratio, job vacancy rate, and market turnover indicators), however, point to a softer market.

Beyond the tariff-related corporate inaction and deferment of decisions for plans to expand in the region, experts point to the increasing adoption of generative artificial intelligence as a factor affecting the labor market in Singapore. "How this may pan out is still unclear, but given recent announcements by large tech companies that AI is replacing a significant number of coders, the demand for foreign tech workers here is likely to be softer moving forward," Savills commented earlier this year.

The total seasonally adjusted unemployment rate in Singapore was most recently reported at 2.0% in Q3 2025. Resident unemployment (including Singaporean citizens and permanent residents) continued to trend slightly higher at 2.8% during the same period. As of mid-year 2024 (most recent available figures), citizens and permanent residents made up about 61% of the total labor force in the country, with the remaining 39% represented by non-resident foreign workers.

Data Source: DOS.

In general, while uncertainty around economic outlook has receded somewhat with the conclusion of some trade deals between the US and various countries, the outlook for the Singaporean economy remains cautious, as its external-facing industries, such as manufacturing, continue to face risks of renewed trade conflict and disruption.

"Further increases to effective tariff rates, including from product-specific duties, could impact the performance of Singapore's externally-oriented sectors, while still-elevated global policy uncertainty could also weigh more heavily on hiring and investments with a lag," the MAS summarized in the October 2025 macroeconomic review. "An abrupt correction in the AI investment boom and the associated exuberance of financial markets is another downside risk to the growth outlook."

At the same time, the economy's fundamental strengths, including high fiscal reserves, budget surpluses, positive net international investment position, and a favorable business environment, are expected to mitigate its vulnerability to external shocks. In April 2025, Fitch Ratings affirmed Singapore's 'AAA' standing with a stable outlook.

Sources:

- Monetary Authority of Singapore (MAS)

- Statistics: https://www.mas.gov.sg/

- Monetary Policy Framework: https://www.mas.gov.sg/

- Monthly Statistical Bulletin: https://www.mas.gov.sg/

- Macroeconomic Review, October 2025: https://www.mas.gov.sg/

- Singapore Department of Statistics (DOS)

- National Accounts: https://www.singstat.gov.sg/

- Prices and Price Indices: https://www.singstat.gov.sg/

- Labor, Employment, Wages & Productivity: https://www.singstat.gov.sg/

- Household Sector Balance Sheet: https://www.singstat.gov.sg/

- Statistics on Resident Households: https://www.singstat.gov.sg/

- Urban Development Authority (URA)

- Release of 3rd Quarter Real Estate Statistics: https://www.ura.gov.sg/

- Housing and Development Board (HDB)

- Resale Statistics: https://www.hdb.gov.sg/

- Flat and Grant Eligibility: https://www.hdb.gov.sg/

- Rental Statistics: https://www.hdb.gov.sg/

- Inland Revenue Authority of Singapore (IRAS)

- Additional Buyer's Stamp Duty (ABSD): https://www.iras.gov.sg/

- International Monetary Fund (IMF)

- Country Overview: Singapore: https://www.imf.org/

- 2025 Article IV Staff Report: https://www.imf.org/

- Federal Reserve Economic Data (FRED)

- Federal Funds Target Range - Upper Limit: https://fred.stlouisfed.org/

- Knight Frank

- Singapore Residential Market Update - Q3 2025: https://www.knightfrank.com.hk/

- Singapore Residential Market Update - Q1 2025: https://www.knightfrank.com/

- Savills

- Singapore Residential Leasing Q2 2025: https://pdf.savills.asia/

- CBRE

- Commentary on URA Q3 2025 Statistics - Office, Retail, and Residential: https://www.cbre.com.sg/

- Redbrick Mortgage Advisory

- What is the Best Home Loan in Singapore in 2025: https://www.redbrick.sg/

- PropNex

- Q3 2025 Residential Report: https://www.propnex.com/

- OrangeTee

- Private Residential Sales & Rental Q3 2025: https://www.orangetee.com/

- Private Residential Trends Q3 2024: https://www.orangetee.com/

- ERA Real Estate

- 3Q 2025 URA Real Estate Statistics: https://www.era.com.sg/

- Fitch Ratings

- Fitch Affirms Singapore at 'AAA'; Outlook Stable: https://www.fitchratings.com/

- The Straits Times

- More HDB Flat Owners Refinancing to Cheaper Bank Loans as Interest Rates Drop to 3-Year Low: https://www.straitstimes.com/

- S'pore Households Should Stay Prudent in Making Big Financial Commitments, Including Property: MAS: https://www.straitstimes.com/

- Singapore Economy Beats Forecasts With 2.9% Growth in Third Quarter Despite US Tariffs: https://www.straitstimes.com/