Property Investment in Macau: Foreigner’s Guide

The island nation of Mauritius, set in the Indian Ocean just east of Madagascar, is gaining attention not only as a tourist and expat paradise. With its white sandy beaches, strong legal, financial, and political systems, and cultural blend of African, Indian, and Creole heritages, Mauritius offers an appealing lifestyle that goes well beyond vacation living. Government schemes have opened doors for foreign buyers looking for property investments, as well as those interested in making Mauritius their new permanent home.

This guide will take you through the basic steps and important things to consider when buying property in Mauritius as a foreign first-time buyer.

12 Things to Know Before Buying a Property in Macau

- Can Foreigners Buy Property in Macau

- Best Cities and Regions to Invest

- Square Meter / Square Foot Prices

- Median Asking Prices

- Rental Yields and Rents

- Market Performance (Past and Present)

- Landlord and Tenant Laws

- Property Related Taxes

- Buying (and Selling) Costs

- Short-Term Rental Regulations

- Mortgage and Financing Options

- How to Buy Property in Macau: Step-by-Step

1) Can Foreigners Buy Property in Macau?

Yes, foreigners can buy property in Macau. In fact, Macau is the only Chinese territory where foreigners can purchase both structures as well as some land (freehold property), although most land is still leased from the government (leasehold).

2) Best Regions and Cities to Invest

Macau offers a unique and dynamic real estate landscape shaped by its rich cultural heritage, booming tourism industry, and proximity to major economic centers in the Greater Bay Area.

Macau Peninsula

As the historical and administrative heart of the city, the Macau Peninsula remains one of the most sought-after areas for real estate investment. It combines dense urban living with close proximity to key landmarks, casinos, and business districts. The area continues to see redevelopment of older buildings into modern apartments and mixed-use complexes. With limited land availability and high demand for both residential and commercial properties, the peninsula offers strong potential for value appreciation and stable rental yields.

Taipa

Taipa has transformed from a quiet island village into a modern urban center that bridges old Macau and the glitzy Cotai Strip. The area is home to several international schools, shopping malls, and residential towers that attract professionals and expatriates. Its mix of convenience and lifestyle appeal makes it particularly attractive for long-term rental investments. Neighborhoods such as Taipa Central and Ocean Gardens are known for their high-quality developments and strong market stability, supported by excellent connectivity to Macau’s major commercial and entertainment zones.

Cotai

Positioned between Taipa and Coloane, Cotai is the epicenter of Macau’s economic growth and global tourism appeal. The district hosts some of the world’s largest integrated resorts, luxury hotels, and entertainment complexes. With ongoing expansion and infrastructure upgrades, Cotai continues to draw significant foreign investment. Residential and serviced apartment projects in the area benefit from steady demand from professionals and high-income tenants working in hospitality and gaming. As Macau diversifies its economy beyond gaming, Cotai stands as a strategic hub for both commercial and residential real estate growth.

Coloane

Known for its natural beauty and tranquil atmosphere, Coloane provides a striking contrast to Macau’s dense urban core. The area’s low-rise villas, ocean-view apartments, and resort-style communities appeal to buyers seeking exclusivity and serenity. With scenic beaches, golf courses, and access to hiking trails, Coloane has become a preferred location for luxury property investment. As the government continues to promote environmental preservation and high-end tourism, the district offers promising opportunities for investors focused on sustainable and premium real estate.

3) Square Meter / Square Foot Prices

Although Macau’s prices per square meter are half that of its Hong Kong neighbor, they are still some of the highest across Asia.

- Macau - $10,064 sq. meter

4) Median Asking Prices

Investors can expect to pay high dollar amounts for property in Macau, which has some of the loftiest asking prices in Asia. Notably, the average cost almost doubles when purchasing a two-bedroom versus a one-bedroom apartment.

- 1-Bedroom - $537,000

5) Rental Yields and Rents

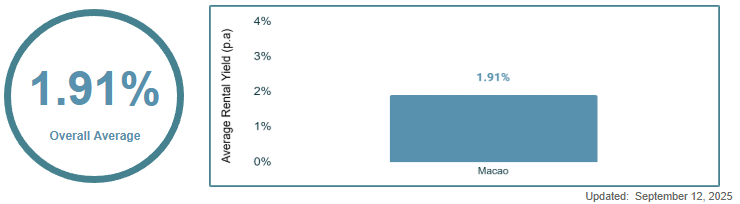

Despite Macau’s purchase prices being some of the highest in Asia, rental yields are rated as very poor. In fact, they were the lowest in Asia as of September 12, 2025, averaging at just 1.91%.

Three-bedroom properties fared the best at 2.36% – likely due to the low number of units available. Two-bedrooms fared the worst at just 1.53%.

Macau's rent price index:

Data Source: DSEC.

6) Market Performance (Past and Present)

After Portugal gave Macau to China in 1999, the Chinese government ended the existing casino monopoly and granted licenses to several new gaming operators, including major companies from Las Vegas and Australia. This sparked massive foreign investment and the rapid development of lavish casino resorts. By 2007, Macau’s gambling revenue had surpassed that of Las Vegas, making it the world’s largest gaming market, with revenues peaking in 2014 at around $45 billion.

As the city’s wealth grew, property prices skyrocketed. Many affluent mainland Chinese investors viewed Macau real estate as a safe and profitable asset, particularly amid low local interest rates. The housing market reached record highs by late 2018. However, many apartments were used less as homes and more as a place to park gambling profits. This prompted China’s anti-corruption campaign, which sharply reduced the high-roller VIP gambling that had fueled Macau’s boom. The real estate market cooled as a result and has not recovered.

From 2020 to 2022, the pandemic brought tourism to a near standstill, causing Macau’s property sector to collapse. Although the market has begun to slowly move upward, it still remains far below its peak.

Macau's house price annual change:

Data Source: Statistics and Census Service.

7) Landlord and Tenant Laws

Global Property Guide considers Macau laws to be slightly Pro-Landlord between landlord and tenant. While the laws are generally balanced, landlords have more power when it comes to rent prices, payment collection, and eviction rights. Additionally, new laws that were passed in March 2025 make it much easier for landlords to evict for nonpayment without the assistance of an attorney. Tenants do have rights, however, especially when it comes to lease terms.

8) Property Related Taxes

Macau’s tax structure is relatively simple. Foreign property owners are taxed only on income gained in Macau, and rental income is governed under the property tax system, meaning there is no separate income tax.

Rental income is taxed at a flat 8% after a 10% deduction for maintenance, repairs, and other property-related costs. Foreign-owned property that is not rented out (i.e., self use) is taxed at a flat 6% of the official property assessment value, after a 10% deduction.

9) Buying (and Selling) Costs

In 2024, Macau changed its laws, significantly reducing stamp duty (transfer taxes) for foreign property investors. Instead of buyers paying a 10% stamp duty tax, buyers now pay the same amount as citizens.

When buying property, a stamp duty and a small surcharge are added to the purchase price. The amount varies, ranging from 1.05% for properties up to MOP 2 million (approx. $249,000 USD), 2.10% for properties costing 2 to 4 million MOP (approx. $249,000 to $499,000), and 3.15% for properties costing more than 4 million MOP (approx. $499,001+ USD).

Macau does not impose a capital gains tax when property is sold, making ongoing tax exposure fairly limited compared to many other markets.

Here's a full breakdown:

| Transaction Costs | ||

| Who Pays? | ||

| State duty | 1.05% - 3.15% | buyer |

| Legal Fees | 0.20% | buyer |

| Notary Fees | 1.60% | buyer |

| Real Estate Agent Fee | 2.00% | buyer/seller split |

| Costs Paid by Buyer | 3.85% - 5.95% | |

| Costs Paid by Seller | 1.00% | |

| ROUNDTRIP TRANSACTION COSTS | 4.85% - 6.95% | |

| Source: Global Property Guide, PWC | ||

10) Short-Term Rental Regulations

In 2022, Macau passed an amendment banning short-term accommodations for individuals staying on the island for less than 90 days. Most short-term guests must stay in hotels or other approved resorts. However, there are exceptions for guests who are related to the property owner, and for those who are visiting Macau for work, study, academic, sporting, charitable, religious, or cultural activities.

11) Mortgage and Financing Options

Many, but not all, residential properties are eligible for mortgage loans by foreign investors in Macau. (Commercial and industrial mortgages are harder to obtain.) Some Macau properties may be ineligible for funding due to their age, location, or poor craftsmanship, as there has been a government crackdown on building and construction safety since 2021.

For those properties that do qualify, expect to pay around 30% out of pocket. The loan amount will be based on the bank’s valuation, which is often less than the actual purchase price.

Mortgage loan terms range from five to 30 years, and banks consider not only the buyer’s income and assets, but also their age.

12) How to Buy Property in Macau: Step-by-Step

- Research Pricing, Yields, and Legal Restrictions: Before beginning a property search in Macau, it is important to understand the market and legal restrictions. In Macau, almost all the land is owned by the government, which then leases it out for up to 25 years with potential for renewal. Since 2022, Macau’s short-term rental laws have limited potential for AirBNB-type investments, requiring most tourists to stay in approved hotel-type establishments. Additionally, Macau’s property prices are some of the highest in Asia, but its rental yields are the lowest as of September 2025.

- Research Long-Term Market Changes: Macau’s real estate market flourished prior to the pandemic, but much of that success was due to corruption by high-stakes gamblers. Since 2020, the real estate market has struggled, partly due to the loss of gambling revenue during the pandemic, but also due to crackdowns on corruption and poor building construction. Historically, most guests come from either the mainland or Hong Kong, often only making day trips to the island. Macau is campaigning to increase overnight stays and open new markets to attract more visitors. How well this will impact the real estate market is yet to be seen.

- Research and Find Property: Popular real estate websites include Anjuke.com and Fang.com, which both include properties in Macau. However, these and other sites can be somewhat difficult to navigate. Because all paperwork will be in Chinese or Portuguese, it is important to work with a trusted bilingual, licensed real estate agent. Your agent can also help you locate available properties.

- Research Local Taxation and Landlord Laws: Property owners are taxed annually on income earned in Macau, either at a flat 8% on rental income or a flat 6% on the official assessment for self-use property, both minus 10% for deductions. This income tax is paid as property taxes; there is no separate income tax for property. Landlords cannot lease property for less than 90 days (i.e., short-term rentals) unless the guest is a member of the landlord’s family, or is visiting the island specifically for work, study, academic, sporting, charitable, religious, or cultural activities.

- Hire a Bilingual Macau Lawyer/Notary: Macau requires that property transfers be performed before a notary and then registered. Again, all paperwork is in Chinese or Portuguese, so hiring a local bilingual lawyer and/or notary is essential. They will run any title checks, draft and verify the deed, and handle filings.

- Sign a Promissory Agreement: Expect to provide a down payment of approximately 2%-10% at the time of the offer. Payments must be made by check and are paid in Hong Kong dollars. Make sure your account has the money, as bouncing a check in Macau is a serious offense that can lead to imprisonment. Buyers will also have to pay stamp duty within 30 days of the signing of the provisional or purchase agreement, not at closing. If the buyer backs out of the deal, they will lose their deposit and the stamp duty. If the seller backs out, they will not only have to refund the deposit and stamp duty, but they must also pay a punitive fine equivalent to the down payment. Additionally, whichever party backs out of the deal must also pay the agent’s commission.

- Secure Financing: Macau-based banks may offer mortgage loans to foreigners, but require higher down payments. The amount that can be borrowed is based on whichever is lower – the purchase price or the bank’s valuation of the property. (It is usually the latter.) The bank may also require a valuation payment, which is often later waived once the bank loan is confirmed.

- Conduct Due Diligence: The buyer’s attorney will run due diligence to ensure the title – or “busca” in Portuguese – is clean with no legal disputes.

- Obtain a Structural Inspection: Given the history of poorly-constructed buildings in Macau, having the property structurally inspected is recommended, especially if it was built before the government’s crackdown in 2021.

- Sign and Register Final Paperwork: The buyer’s attorney will verbally translate all paperwork at the time of signing, but a written translation – which is highly recommended – should also be available for an additional fee. A notary will draft a public deed of sale and purchase in either Chinese or Portuguese. Both parties – or their representatives – must sign the paperwork in front of the notary. The sale is complete once the property is submitted to the Macau Land Registry.

Timeline: 2-6 months.

Need Help?

Buying property in a foreign country can feel overwhelming, but we're here to help.

At Global Property Guide, we offer:

- Data-backed insights on property prices, rental yields, and taxes

- Country-specific legal and tax guidance through our partner network

- Pre-screened investment properties, including income-generating Airbnb units

- 1-on-1 consultations with real estate experts focused on international buyers

- Step-by-step buyer support, from due diligence to closing

Whether you're looking for your first investment in Macau or expanding your international portfolio, we can help you make smart, secure decisions.

Contact our team or book a free consultation to get started.