Covid-19 is a dramatically worrying pandemic. But provided a pandemic is short, it tends to have only temporary effects on housing markets. For instance before Hong Kong's 2013 SARS epidemic, property prices were already declining as a result of an intense real estate cycle, and the decline was only mildly accelerated by the epidemic. The onset of SARS in Hong Kong coincided with a 72% reduction in transaction volumes for 44 housing estates but only a 1.6% decrease in house prices versus the pre-SARS trend, according to Grace Wong writing in the Journal of Urban Economics. After the epidemic was over, real estate transactions reverted to normal volumes.

According to a summary by US portal Zillow:

· Housing transactions fell by around 33% in Hong Kong as customers avoided human contact, but snapped back to normal as soon as the epidemic was over.

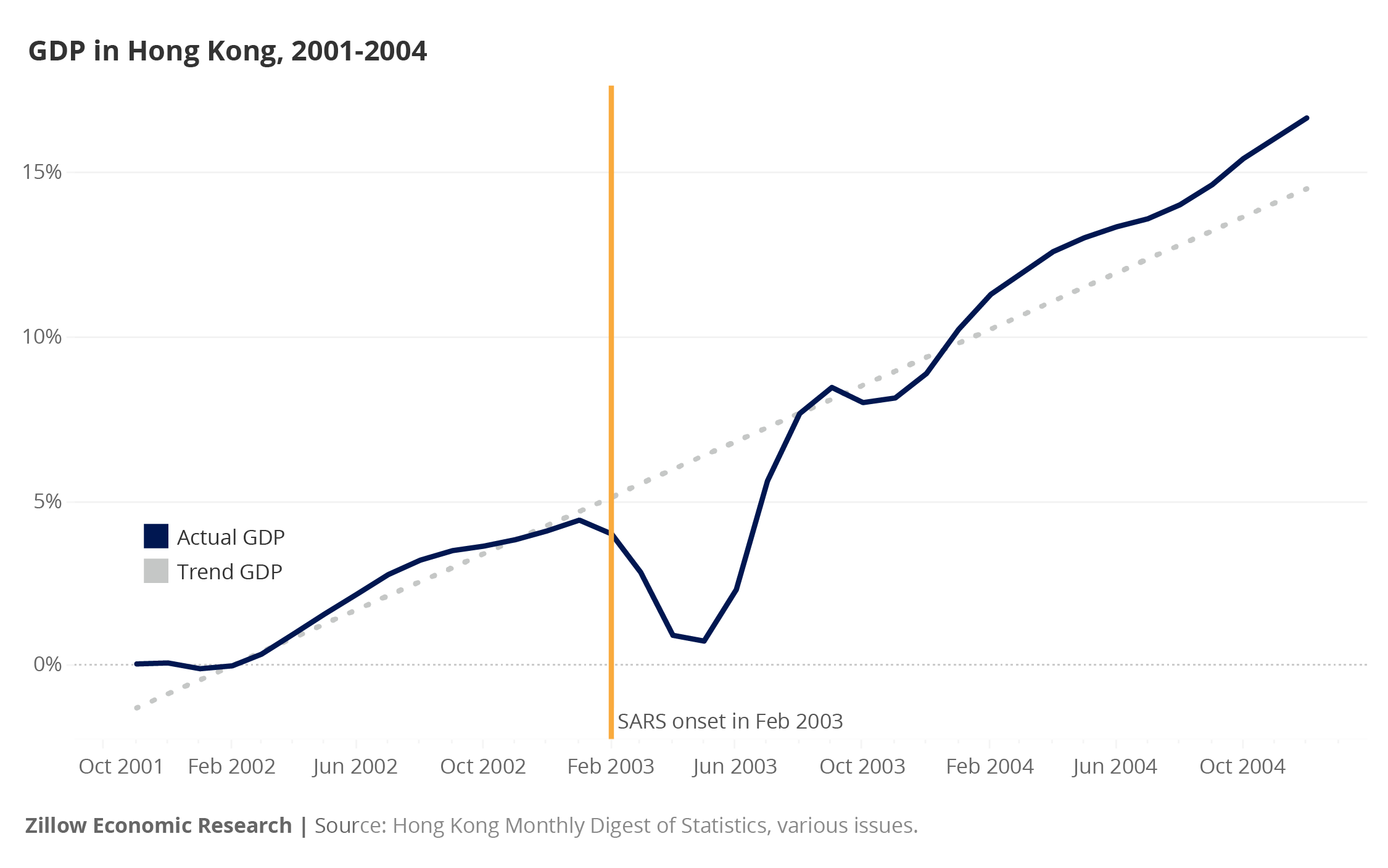

· During epidemics such as the 1918 influenza or the 2003 SARS outbreaks, economic activity fell sharply during the epidemic (a 5-10% temporary hit to GDP or industrial production over the course of the epidemic) but quickly reverted to normal once the epidemic was over, again according to Zillow's research.

· This pattern differs from a standard recession, which is a situation in which economic activity falls for 6-18 months and then recovers more slowly.

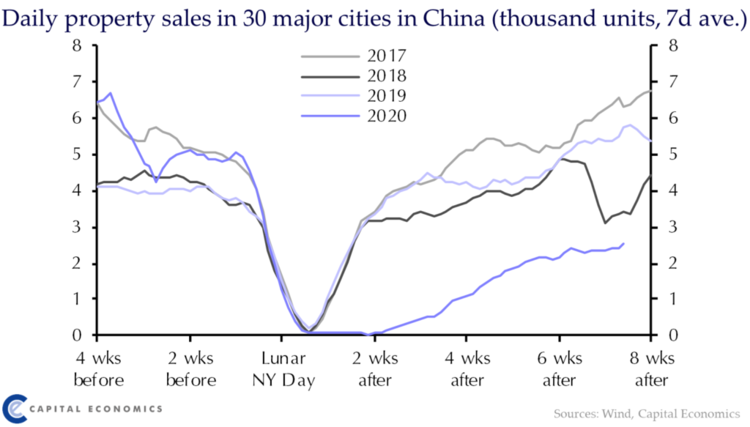

In China housing transactions initially totally ceased during the Covid-19 pandemic, but seem now to be recovering somewhat.

Source: Capital Economics

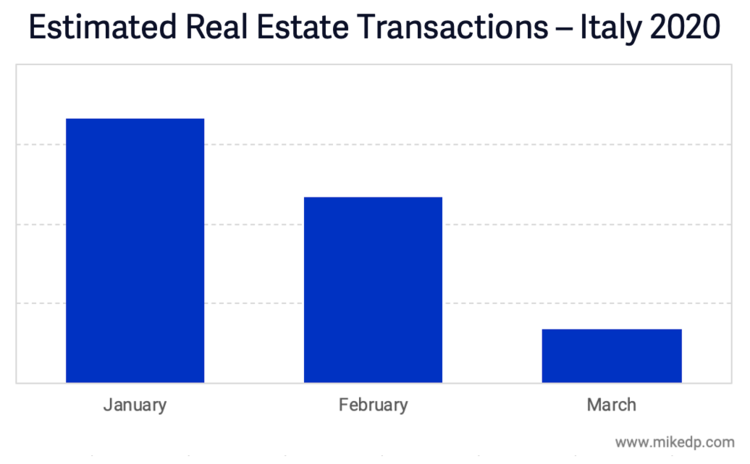

The decline in transactions is just beginning in most other countries:

Source: Mike DelPrete

The following chart emphasizes that the impact on GDP of a temporary virus is short-term:

On the other hand....

However the Covid-19 epidemic seems fundamentally different from SARS, in that while it had a similar beginning, it isn't clear that it will have an end soon.

How big an impact would a prolonged epidemic have?

The US Congressional Budget Office (2006), basing itself on a variety of studies, has summarized much of the pandemic literature. It estimates that the loss caused by a severe flu epidemic (similar to 1918) of about 4.25% of annual GDP.

This estimate is based on a wide range of research studies. Theoretically-based studies tend to forecast large losses, typically at 5% of GDP for a severe pandemic. Empirical studies find smaller effects, at 0.5% to 2.5% of GDP variously for the 1918 flu pandemic, Hong Kong's SARS outbreak, and localised pandemics.

A loss of around 4.5% of GDP is the mid point of the estimates.

Yet there is a niggling doubt about whether previous studies quite envisaged the immense economic impact (e.g.) of a prolonged requirement for social distancing, if this turns out to be necessary, or of the various ways in which the current episode is simply different from previous pandemics.

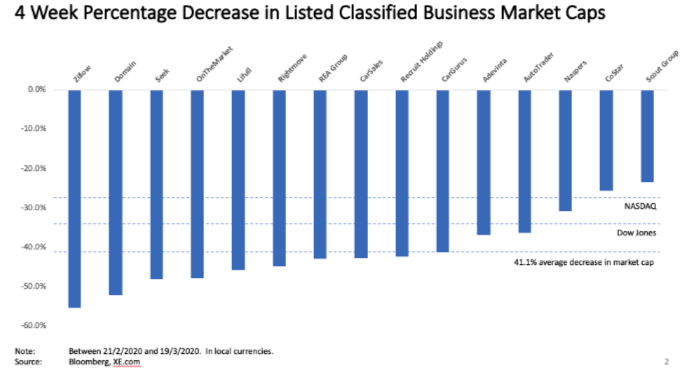

Starting February 19th the world saw a dramatic collapse in stock prices, with Nasdaq falling 27% and the Dow Jones 35%, apparently reaching bottom on 23 March.

Almost all economic recessions are anticipated by stock price collapses. The size of this collapse suggests that the marketplace anticipates a deep recession, not a "quick snap-back" to normality. So it would seem that the market itself believes that the Covid-19 episode is different from previous flu and SARS epidemics.

The stock price of listed marketplaces - i.e., online facilitators of real-world transactions - fell most, with real estate markets faring particularly badly. Over USD 90 billion (or 38%) in value was wiped off the market caps of the top 15 global listed marketplaces. The worst affected was the US real estate giant Zillow, which lost over 55% of its value, with shares falling from a high of US$65 to US$29.

This reflects the dramatic collapse in real estate transactions, with brokers in affected countries like Italy seeing transactions down 80%, and brokers and portals both slashing fees.

Markets are clearly anticipating a long hiatus in real estate transaction volumes, and a substantial recession - which other things being equal, will lead to a decline in house prices.

It is notable that many European countries have responded to the current pandemic by Keynesian spending stimuli. Like war economies, which typically ramp up to full employment to deal with the new requirements, there has been a fresh deployment of doctors, building hospitals, the extra use of the police and the army, spending on state-subsidised research, and other forms of stimulus spending, not to mention people volunteering to distribute supplies to the vulnerable. So it is possible that the coronavirus restrictions will be compensated for by the Keynesian stimulus of increased state spending.

Yet our base case scenario following such a huge disruption must be a GDP decline, i.e. a decline in economic activity, given that large portions of the economy are out of action. Many economic activities such as manufacturing, supply chain logistics, retail, service industries and entertainment are suffering. Airlines, buses, trains, taxi-drivers, restaurants, theatres, barbers, have closed or downscaled. Hotels are empty. Hospital wards for elective operations are empty. Football, hockey, basketball, golf, horse racing, major city marathons, and the Olympics have been cancelled. Universities will have to rethink their modus operandi - it may no longer make sense for students to pay large sums for social interaction, when distance learning is just as efficient. Will going to the doctor make sense, if telemedicine can replace visits? Even religion is getting into the act, with pastors broadcasting their sermons online from empty churches.

So the biggest impact of Covid-19 on real estate is likely to be a change in economic activity, if social distancing persists. Tourist, beach and holiday centres will suffer calamitously, at least short-term. Overseas purchases of residential property will largely cease, at least temporarily. Airbnb will be badly impacted. City-centre housing prices will decline in European cities in locations where travellers form a significant part of market demand. The real estate agency model in which an individual accompanies a potential purchaser to a house is temporarily dead. Activity will move online. Virtual tours will partly replace real tours.

How long will social distancing last? According to Tomas Pueyo's Coronavirus: The Hammer and the Dance, the initial response to Covid-19 requires a hammer, characterized by a few weeks of intense lockdown and disruption. Following the hammer comes a "dance," or roughly 18 months of trying to keep the reproductive value of the virus low, while meanwhile waiting for a vaccine. Pueyo emphasizes that we don't yet know what countermeasures provide the most benefit while offering the least disruption.

China is already relaxing social distancing, while Korea has mitigated the need by multiplying testing. But the initial period of strict social distancing may need to be followed by re-enacting the strict measures again at a later date, as the virus re-asserts itself. Travel and tourism hubs, city centres, holiday resorts, are likely to be severely affected for some time, not least because national authorities are likely to vigilantly monitor inbound travel.

As Dr. Neil Ferguson of UCL (whose paper recently persuaded the UK to abandon 'mass immunity' in favour of social distancing) recently told the New York Times, “We don’t have a clear exit strategy... We’re going to have to suppress this virus — frankly, indefinitely — until we have a vaccine... It’s a difficult position for the world to be in.” Dr. Ferguson apparently believes that a vaccine to contain the virus is still likely some 17 months away. However he also feels that an anti-viral is closer on the horizon and will help lower the death rate.

What if tests can speedily be developed to take blood samples at airports and deliver the results in 15 minutes? All this is uncertain, as we are still developing fight-back measures. But in countries with efficient governments, such as Singapore, the bounce-back could be rather speedy.

The further we look into the future, the less we can assess the likely impact of Covid-19!

However it seems likely that for at least a year, certain real estate markets, and certain economic activities, will be highly affected.

Sources:

- USD 90 Billion in Listed Marketplaces' Value Destroyed in Just 4 Weeks (Property Portal Watch): https://www.onlinemarketplaces.com/articles/32245-usd-90-billion-in-listed-marketplaces-value-destroyed-in-just-4-weeks

- Coronavirus: the Hammer and the Dance (Tomas Pueyo, Medium): https://medium.com/@tomaspueyo/coronavirus-the-hammer-and-the-dance-be9337092b56

- Impact of non-pharmaceutical interventions (NPIs) to reduce COVID-19 mortality and healthcare demand (Neil M Ferguson et al): file:///C:/Users/Owner/AppData/Local/Temp/Imperial-College-COVID19-NPI-modelling-16-03-2020-1.pdf

- Information from past pandemics, and what we can learn: a literature review (Zillow): https://www.zillow.com/research/pandemic-literature-review-26643/

- How real estate portals are reacting to Covid-19 (Mike DelPrete): https://www.mikedp.com/articles/2020/3/24/how-real-estate-portals-are-reacting-to-covid-19

- Survival of the fittest: the real estate pandemic guide (Mike DelPrete): https://www.mikedp.com/articles/2020/3/21/survival-of-the-fittestnbspthe-real-estate-pandemic-survival-guide

- Coronavirus likely to accelerate a business environment revolution (Asia Sentinel): https://mail.google.com/mail/u/0/#inbox/WhctKJVqssTbGCFlTNQwshdPtzGRcxPjZQkWKbWFVpdbLmQhxSCfFwJnsvwCTHZLxNTsjSq

- Second wave of infections makes repeat surge of disease 'inevitable', scientists warn (The Independent): https://www.independent.co.uk/news/health/coronavirus-second-wave-surge-hong-kong-china-uk-cases-a9420876.html

- White House takes new line after dire increase in death toll (New York Times): https://www.nytimes.com/2020/03/16/us/coronavirus-fatality-rate-white-house.html

- Act fast and do whatever it takes, say leading economists (World Economic Forum): https://www.weforum.org/agenda/2020/03/covid-19-economic-crisis-recession-economists?fbclid=IwAR1awWjHRuRNEEvJIVIn1rihWyXdssebDVCnZ41lvAMrOQ_d6HNanVQAq68