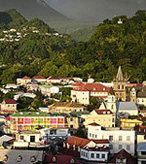

Tax on property income in Dominica

Tax Rate on Rental Income |

|||

| Monthly Income | $1,500 | $6,000 | $12,000 |

| Tax Rate | 5.7% | 26.0% | 30.5% |

| Click here to see a worked example | |||

| Source: Global Property Guide research |

|||

INDIVIDUAL TAXATION

Nonresidents are taxed on their Dominican-sourced income. The income of a husband and wife are assessed separately.

INCOME TAX

Income earned by nonresidents is taxed at progressive rates.

INCOME TAX |

|

| TAXABLE INCOME, XCD (US$) | TAX RATE |

| Up to 30,000 (US$11,100) | 0% |

| 30,000 - 50,000 (US$18,501) | 15% |

| 50,000 - 80,000 (US$29,602) | 25% on band over US$7,407 |

| Over 80,000 (US$29,602) | 35% on all income over US$29,602 |

| Source: Global Property Guide | |

RENTAL INCOME

Rental income from residential properties is taxed at progressive income tax rates. Municipal taxes, maintenance costs, and accountancy fees incurred in the preparation of an income tax return are deductible.

Rental income from residential properties is taxed at progressive income tax rates. Municipal taxes, maintenance costs, and accountancy fees incurred in the preparation of an income tax return are deductible.

CAPITAL GAINS

There is no capital gains tax in Dominica.

Stamp Duty on Property Transfers

Sales of properties are liable for stamp duties levied at 6.5% of the sales price or the market value of the property - 2.5% is payable by the seller and 4% is payable by the buyer.

PROPERTY TAX

MUNICIPAL TAX

There are no real property taxes in Dominica but there are municipal taxes levied on properties located in the cities of Roseau and Canefield. The tax rate is 1.25% levied on the assessed value of the property.

CORPORATE TAXATION

INCOME TAX

Income and capital gains earned by companies are taxed at a flat rate of 25%. Income-generating expenses are deductible when calculating taxable income.